New York is one of the twenty most influential and major cities in the world. The degree of development of this metropolis can be judged by the standard of living, population density, as well as by the huge impact on the financial markets of the whole world. New York is the oldest and largest financial center of the North American currency market. It houses the world's largest and most important US stock exchange, the NYSE, which is considered to be a symbol of the financial strength of the United States of America.

NYSE Prerequisites

Until the end of the 18th century, the profession of a broker as such did not exist. Dealers of that time were more interested in commodity transactions than in securities. Sales operations were carried out in hotel rooms and in coffee shops along Wall Street. Securities speculation (CB) became the leading activity of brokers only after bonds guaranteed by the US government were issued on the market in 1790. Dealers interested in goods and brokers for the sale of securities began to separate their activities. Most often, securities transactions occurred under a plane tree growing on Wall Street, near house number 68. Auctioneers and dealers sought to monopolize all transactions for the sale of securities, inflated commissions, as a result of which all transactions of purchase and sale of bonds and shares guaranteed by the state became unprofitable.

NYSE Getting Started

The first attempt to change things was the meeting of leading brokers in the lobby of the Corre's Hotel. In the end, on May 17, 1792, the most respected brokers signed the famous "Plane plane agreement." The text of the agreement was short, the goals transparent. In the initial auction, transactions were conducted for three types of state securities and for shares of two banks. Brokers were allowed to sell securities only to each other, with commissions accounting for a fixed 0.25% of the transaction value. This agreement was the birth certificate of the New York Stock Exchange.

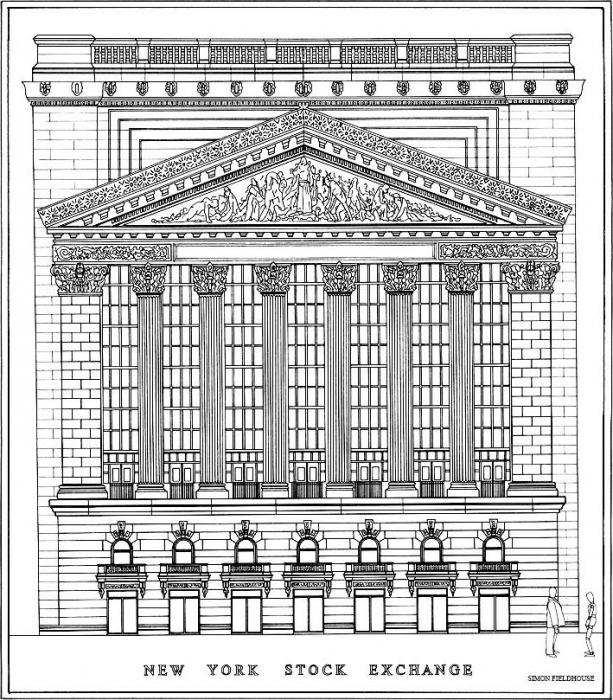

NYSE building

At the beginning of their work, brokers rented a room for two hundred dollars. This is the first room occupied by the New York Stock Exchange. The address of this financial institution was listed as Wall Street, 40. In the 19th century, the exchange burned several times, changed its address. Over two centuries, its profits increased so much that in 1903 the administration was able to design and build a stock exchange building. The architect was George Post. Initially, the NYSE was a Greek temple-like house with an elaborate pediment and six columns on the facade. The total amount of work amounted to $ 4 million. Later, another 22 floors were added, which housed new trading floors of the financial mechanism, which New York is proud of. The stock exchange, whose address is Wall Street 11, is known to any American and city visitor. The room performed its functions until 1978. After that, the New York Stock Exchange NYSE moved to other addresses, and the building itself became a US national property.

An interesting story is the appearance of the national flag on the main pediment of the exchange building. Because of the onset of the Great Depression, many bankrupt stockholders committed suicide by throwing themselves out of the windows of a building. After that, the administration installed iron bars on the windows. To a solid financial institution did not look like a prison, it was decided to close these bars with the US national flag.

The NYSE is currently closed to visitors, but New Yorkers are eager to take pictures of the old building at the intersection of Broad Street and Wall Street, which housed the New York Stock Exchange. Photos of this house are known to tourists from all over the world.

NYSE in the twentieth century

During its existence, the New York Stock Exchange has experienced many ups and downs. Trading on it was suspended several times, for example, in October 1929 due to the start of the Great Depression in October 1987, when the Dow Jones index experienced its deepest decline. October 2012 was also unsuccessful, when the exchange stopped its work due to the approach of Hurricane Sandy. Currently, its activities are regulated and controlled by a special body - the State Commission on Securities and Exchange. It was the New York Stock Exchange that developed and implemented the Dow Jones Index, which is the most important parameter of the Central Bank quotation.

NYSE today

Since 1975, the New York Stock Exchange received the status of a non-profit organization, the assets of which were owned by 1366 private individuals. Places on the exchange could be sold and bought. To date, the cost of a member of this corporation is about $ 3 million. The youngest broker in the history of the exchange is thirty-year-old William J. O'Neill. It was he who created the US Central Bank's daily database. This happened in the 60s of the twentieth century.

The New York Stock Exchange differs from other exchanges in that it is very meticulous about companies that submit their securities to transactions. These firms must comply with the listing conditions . These conditions are one of the most severe among other stock exchanges in the world. Listed companies are considered the most reliable. Currently, 2800 world-class companies meet NYSE listing conditions, and only 450 of them are registered outside the United States. In the slang of brokers, such firms are called “blue chips”.

How does the NYSE work?

An established financial mechanism that determines the value of various companies in every corner of the world every minute is what the New York Stock Exchange is today. The office hours from 9:30 to 16:00 (New York). The work of the exchange is carried out by specialized specialists Specialists. NYSE employees are responsible for stock trading and liquidity support. The specialist serves as an intermediary in transactions between buyers and sellers, and launches sales processes. In case of violation of the balance between supply and demand, the specialist has the right to use the firm’s money to maintain the value of the Central Bank. In addition, exchange specialists maintain an open book - a feed of quotes of various securities in real time, execute orders and orders of holders and buyers of securities.

In addition to specialists, such brokers take part in the work of the exchange:

- persons representing companies from the list of Listed companies;

- Persons representing mutual and pension non-governmental funds Institutional investors;

- persons who individually invest securities;

- Independent brokers who place orders of their clients;

- Representatives of brokerage houses and bidders on behalf of some NYSE Member Brokerage firms;

- floor brokers Floor Brokers. These are specialists who trade in the shares entrusted to them. Currently, there are twenty posts on the floor of the exchange, each of which has up to thirty sectors. One broker holds about thirty stocks. As a rule, a broker on the floor is a specialist who has a huge experience working on the exchange.

The current activities of the NYSE are international in nature. The economies of many countries, including large ones such as China and Russia, depend on the successful work of the NYSE. The competitiveness of any country, its role in global processes directly depends on the success and profitability of the leading companies in this country. And the activities of the NYSE, like other stock exchanges in the world, are aimed specifically at developing the global economy as a whole, without dividing companies and shares across continents and states.