Each entrepreneur, concluding an international commercial agreement, came across the rules of Incoterms, 2010 (this is the latest edition), which regulate the payment of transport costs, the transfer of risks from seller to buyer and the actual transfer of goods. In this article, we will give a brief description of each term, define the features and consider in detail the distribution of areas of responsibility in the case of delivery under CIF conditions.

Delivery conditions

The Incoterms Rules 2010 contains four groups of terms:

- E - point of transfer of goods - warehouse of the manufacturer / seller. Loading is carried out by the buyer. There is only one term EXW in this group.

- F - the buyer pays for the services of the carrier, and the seller delivers the goods to the terminal of the carrier.

- C - the seller pays for the services of the main carrier. This group includes the CIF delivery terms we are considering.

- D - transfer of goods in the territory of the buyer. Delivery at the seller’s expense.

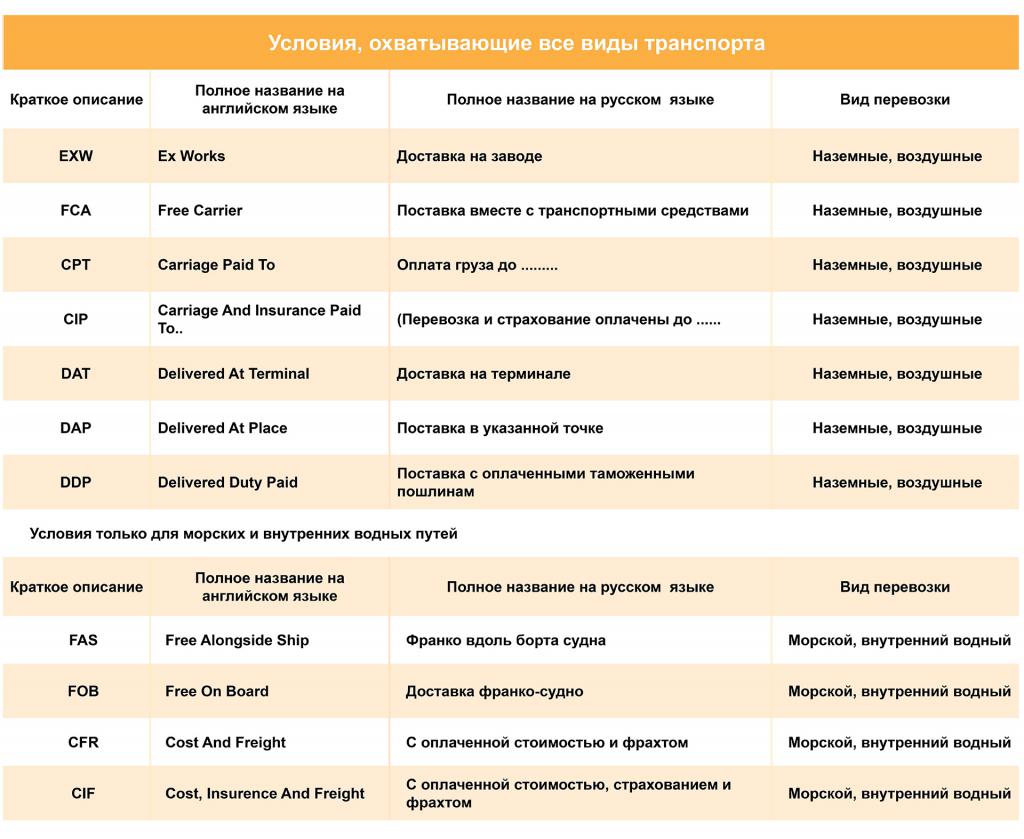

The rules of Incoterms, 2010 contain eleven terms on the terms of delivery, seven of which apply to any transport, and four only to sea.

Briefly consider all the terms:

EXW (ex works) - ex-warehouse. This is the most favorite term for exporters, because the buyer is solely responsible for transporting from the manufacturer’s warehouse and for completing export formalities.

FCA (free carrier) - free carrier. The buyer hires a carrier that has terminals in the country of departure. The seller’s task is to arrange export and deliver the goods to the specified terminal.

CPT (carriage pad to) - delivery paid to such an item. This term imposes payment of freight to the point of arrival on the seller. After that, the buyer picks up the goods from the arrival point and performs customs clearance. Under these conditions, the buyer covers product insurance.

CIP (carriage and insurance paid to ....) - delivery and insurance paid to. A term similar to the terms of CPT, but with the difference that insurance is paid by the seller.

DAT (delivered at terminal) - delivery to the terminal. You can confuse the terms DAT and CPT. The significant difference is that under DAT conditions, the seller delivers the goods at his own expense, bears insurance costs to the customs post of the country of destination. Further, responsibility passes to the buyer.

DAP (delivered at place) - delivery to destination, according to the contract. Group D means the seller’s liability and risks to the indicated place. Customs fees and taxes are paid by the buyer.

DDP (delivery duty paid) - delivery and taxes paid. This is the most favorite term for buyers, because under these conditions the seller is responsible for the entire delivery process from his warehouse to the customer’s warehouse. In this case, the buyer does not bear any transport or customs costs.

FAS (free alongside ship). This term, like all subsequent ones, refers only to maritime transport. The cargo is delivered to the loading port of the buyer, which is responsible for transshipment and further transportation.

FOB (free on board). The seller not only delivers the buyer to the sea transport, but also transloads it.

CFR (cost and freight). The seller pays for the delivery to the specified point. Buyer pays insurance and shipping charges.

- CIF (cost, insurance and freight). These conditions are similar to the previous ones. The main difference between the CIF and CFR conditions is that insurance is added to the seller’s expenses (in addition to delivery).

What CIF Means: Decryption

The terms of CIF Incoterms, 2010 belong to group C. This means that the goods are delivered at the seller’s expense. This term applies only to shipping by sea. In English, the term cost, insurance and freight is translated as "cost, insurance and delivery."

Delivery of goods (in accordance with CIF)

Under the terms of delivery of CIF Incoterms, 2010, it is assumed that the seller delivers the goods to the specified port of the buyer at his own expense. At the same time, he chooses the carrier on his own. The seller incurs the costs of loading, export clearance, insurance and delivery of goods.

Responsibility of the Parties

To understand the CIF term in detail and to understand the intricacies of the contract on the terms of CIF, you must have clear answers to the following questions:

- Which counterparty is responsible for the delivery of goods?

- Which counterparty is responsible for customs procedures both in the country of departure and destination?

- At what point does the seller’s obligation to deliver goods end?

- When the responsibility for the goods passes from the manufacturer to the acquirer?

- How long does the seller deliver the goods to the buyer?

Seller Responsibility subject to CIF

The seller finds a carrier and concludes a contract for the supply of goods by sea. Shipping costs are agreed between the seller and the carrier.

The seller draws up the goods for export: pays all export payments and delivers the goods to the port of departure. He also pays for all expenses associated with loading and transshipment of goods, draws up an insurance policy for cargo and pays for insurance of goods for the period of delivery.

Responsibility for the goods passes from the seller to the carrier at the port of departure.

Buyer Responsibility subject to CIF

The buyer provides all the necessary documentation for the import of goods into the country of destination, organizes the unloading of goods at the point of arrival, is responsible for customs clearance of goods and payment of payments and taxes on imports in the country of destination.

After inspection of the cargo, he also signs supporting documents attesting to the fulfillment of obligations by the seller.

In addition, the buyer organizes the delivery of goods to their warehouses and pays for the products, in accordance with the terms of the commercial agreement.

Transfer of responsibility for goods from producer to buyer

You must understand the clear difference between the transfer of ownership and the transfer of responsibility for the goods.

The temporary point of transfer of ownership is negotiated between counterparties in a foreign trade contract. The goods can become the property of the buyer both during loading the goods on the ship, and upon receipt of the goods at the port of arrival in the case of a letter of credit. At what point the cargo will become the property of the buyer, depends on the contractual relations of partners and terms of payment.

Under CIF conditions, responsibility for the cargo, as well as its integrity and completeness, passes from the seller to the carrier after loading the goods onto the ship. For this, a standard insurance policy is issued (100% of the cost of the goods plus 10%) for the entire cargo. Upon request, the buyer has the right to increase the insurance amount and insure additional risks, but at his own expense.

What is included in the price of goods under CIF

The cost of the goods indicated in the foreign trade agreement, which is supplied on the terms of CIF, includes the following costs:

- By packing the goods and applying the corresponding markings.

- On loading and delivery of goods to the point of departure.

- By customs clearance in the country of export.

- For loading goods on a ship.

- Upon delivery to the point of arrival.

- Freight insurance.

Legal features of the contract on the terms of CIF

Terms of delivery are specified in the same paragraph with the obligatory indication of the latest version of Incoterms (for example, Incoterms, 2010).

Also, in this clause it is necessary to indicate “Destination Port” and “Point at Destination Port”.

In addition to the obligations and rights of counterparties, along with the payment terms, the moment of transfer of ownership is clearly stated.

CIF conditions assume that at the indicated time, the buyer will arrange for prompt unloading from the vessel. Based on an agreement between seller and buyer, landed is added to the CIF term. In this case, the cargo is not only delivered to a specific port, but also unloaded.

The contract necessarily states that the buyer is the beneficiary of the insurance policy, so that in case of damage to the goods he could contact the insurance company on his own.

Features of the declaration of goods on CIF

The customs value of the goods according to the first basic method consists of the cost of the goods themselves, the costs of their delivery, insurance, loading and other costs payable or paid by the buyer.

What features of determining the customs value can be identified by considering the delivery on the terms of CIF Incoterms, 2010? As you know, under CIF conditions, the cost of goods already includes the costs of delivery and insurance of the goods. Customs value, payments and taxes will be calculated based on the invoice value of the goods.

But the customs value should not include expenses incurred in the territory of the Customs Union, that is, transportation costs and insurance costs from the point of arrival to the territory of the Customs Union to the actual destination.

Therefore, when declaring goods, the costs from the point of arrival to the point of destination are deducted from the invoice value (provided that there is documentary evidence from the carrier).