The division of debts on loans under a divorce is one of the subtle nuances of communication between former spouses. If life does not work out, people are forced to deal with the complexities of the emotional and psychological plan. As a rule, divorce proceedings are preceded by unpleasant, conflict situations, and some even have nervous breakdowns. The last thing that people who find themselves in a difficult life situation want to share debts. Yes, only if there are any, you will have to do it, moreover, following the law.

Relevance of the issue

What is surprising, many people are surprised by the need to work not only with property. The divorce section of the loan seems to some a completely unthinkable thing. And that’s true, everyone knows that a diverging couple only shares what they have gained by being together. But after all, debt obligations drawn up during the period of marriage are also joint ownership. If it’s time to get divorced, you’ll have to separate them thoroughly. After a divorce, one of the two may refuse to pay the obligations, and this gives rise to additional misunderstanding. Others, in principle, do not understand (or pretend that they do not understand) what is at stake.

The division of a loan between spouses after a divorce is necessary if during the marriage such an agreement was concluded with the bank, according to which both people are debtors. There is a possibility of being co-borrowers not only on a loan program, but also when applying for a loan from an individual. In some cases, the agreement is drawn up in such a way that only one of the two acts as the borrower, and the second is the guarantor. The listed circumstances require spouses to participate equally in the payment of debts - the law requires the recovery of exactly half the amount from each.

Case Nuances

According to jurisprudence, a divorce loan section is necessary if only one of the former spouses acts as a debtor, while there is evidence that the funds were spent for the benefit and needs of the family. In practice, this is the situation most often encountered. One of the family takes equipment on credit, receives funds from the bank for the purchase of housing, a car, for a vacation trip. Although the second may not appear at all in the arrangement, the debt in court is still recognized as common. Judicial practice testifies that just such situations more often become conflicting.

The wording of the law suggests that this or that waste be spent on the needs of the family, while the very understanding of this phrase is different for different people. In order to be able to prove that the funds received under the credit program were expended in this way, the definition and interpretation of the term were written in the laws. The division of the loan during the divorce of the spouses occurs if the funds were spent on material, spiritual needs, satisfied on a fee. In court, any debt is considered to be spent specifically for the needs of this kind, and usually the authority shares all obligations in the same proportions as the shares of the property acquired together.

And I have nothing to do with it!

During the division of the loan when divorcing spouses, one of the parties most interested in the results is the lender. In addition, of course, compliance with applicable law and the correct assessment of the expenditure of funds received under the credit program in the interests of the person in whose name the debt obligations are executed. But a person who was previously married, while not mentioned in the agreement, usually proves that the money was not spent on family needs, which means that no one has any right to demand anything from him.

In the general case, in judicial practice, the division of a loan after a divorce is rarely a serious problem, since it is quite easy to prove that the funds went to the family and home. Often, the official purpose of the loan program is enough for the court to decide - for example, if the family received money for the vacation. Since debt obligations are always accompanied by the execution of additional documentation, to which the court also has access, it is not difficult to check and clarify how exactly the funds were used up in reality. For example, if tickets or vouchers for both spouses were purchased for a holiday loan, we can safely say that the funds went for family needs. An alternative is the appearance of some property that the couple could not afford before, but bought after one of them concluded an agreement with the bank. The more the object is worth, the less the total income was, the easier it will be to find out the situation. In order to simplify the proceedings, it is reasonable to immediately request income certificates at the workplaces of both participants in the process. Witnesses who have a good knowledge of the financial situation of the family may come to the rescue.

but on the other hand

Much more problematic is the position of someone who is interested in proving when dividing property after a divorce: the loan was not spent on the needs of the family. In such a situation, the interested party should give reasonably impressive justification that the spouses did not need the amount received from the bank, and financial opportunities were spent anywhere, but not on life together in its various aspects. To prove his position, an interested participant in a lawsuit can bring a statement of income, if there is a bank account - an extract from him. If there are other documents and opportunities to confirm their stable financial position, it is reasonable to resort to them.

Such a statement about the division of a loan after a divorce is often executed if during the marriage one of the spouses secretly issued debt obligations at the bank and spent the received funds on their needs. For example, a person could go on a busy trip on a trip - alone or with a friend, a friend. If it is possible to prove just such circumstances, the court recognizes the debt obligations as personal, and the second participant in the process does not have to pay anything.

Life and its vicissitudes

Very often, ex-spouses apply to the court, because a loan was previously issued for the acquisition of real estate (still married). Division in a divorce involves a fair separation of all obligations and acquired property. In most cases, in such a situation, one of the two continues to pay money following the debt program, so the banking structure does not need to contact the law enforcement agency. The second person, previously married, is required by law to pay his share. A spouse solely settling with a financial company has the right to receive part of the money spent on the program back.

If the debt obligations in the bank were executed for the purchase of an apartment, it automatically turns into a common material asset of the married (or former in such relations). Usually, when dividing a mortgage loan during a divorce, the court proceeds from the fact that everyone is entitled to half of the home. If it has not yet been shared, first a statement is filed in court, in which they ask to share the jointly acquired assets. The next stage of the one who wants to achieve justice is to appeal with the aim of eliminating the unjustified enrichment of the former elect. If you manage to prove your right, partially mortgage payments already made after the divorce can be received back. To do this, you will have to provide documentation confirming exactly who paid for the obligations. If all official papers for each deposit have been preserved, there will be no particular problems.

The relationship is over

When applying for a divorce with a loan section, it is necessary to take into account several subtleties and details of the legislation governing marital relations in our country. The laws stipulate separate situations in which one of the two has the right not to pay on debt obligations received while still in marriage. If the relationship between the couple has actually already been terminated, only after that the person who is still remaining on the papers with the spouse has issued a loan, the second one is considered not to be involved in this and is not responsible.

If it is possible to prove that the loan was issued, while the spouses did not have a life together, if they did not conduct a common household, then the obligation to pay is assigned only to the one who issued the debt. This nuance of the loan section after the divorce is mentioned in article 38 of the UK, and more precisely, in its fourth part. The debt is recognized as separate only by the court. A person who has not received loans is required to prove in court that by the time the debt was formalized, no family relationship had already existed. To prove their position, they usually resort to testimony, although in some cases other evidence may be useful - they can be recommended by the attorney conducting the case.

Do I need to understand this?

Although it seems otherwise that their questions will never be raised, in practice it turns out that many people face the loan section after a divorce. Not everyone is able to acquire property completely at their own expense, and at the stage of purchasing a product, product, service, many still do not even assume that family relations may soon collapse. It is known from judicial practice that more often people borrow large amounts, which makes the issue of compensation extremely important and significant for both participants in the process. In order to assess your rights, obligations and opportunities in advance, it is wise to familiarize yourself with the collections of laws governing civil and family legal relationships. These documents explain in as much detail as possible what and how a law-abiding citizen of our country should and must do.

By studying the 39th article of the code governing relations between spouses, you can find out that the section of the loan for divorce (consumer, mortgage and any other) is due to the fact that a debt obligation is also a person’s property. By default, when dividing the acquired between spouses, the court divides everything equally. The law enforcement structure has the right to deviate from this standard, regulated by article 45 of the same collection of laws on family relations. In many respects, the choice of shares depends on whether the money borrowed was spent on the purchase of real estate, whether they went on a movable. This takes into account the extent to which the spouse's property share can cover obligations. If there is a possibility of coverage, it is considered that the obligations under the debt agreement are fulfilled by a person.

Subtleties and conditions

As you can learn, by studying a variety of cases, practices, documents about the hearings (as well as the samples presented in the material), the division of the loan after the divorce in most cases occurs in equal parts. The court makes such a decision if people maintained official relations. Usually it does not matter if there is a minor child in the family, although exceptional situations are rarely possible. The second part of the 45th article, included in the collection of laws regulating family relations, obliges to divide debt obligations between spouses in half. At the same time, it is necessary to have confirmation of the fact that the money was used for family needs, that the property bought for them went to the benefit of everyone.

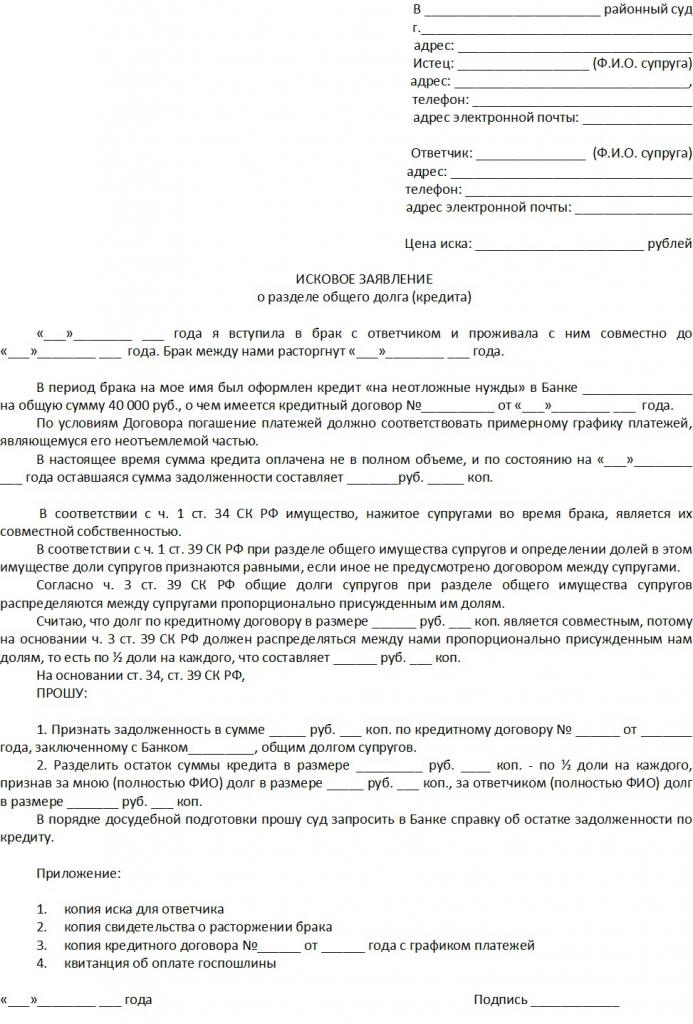

In the classic version, the registration of a divorce takes place at the registry office, but there may be exceptional situations in which a section of the loan is filed in court after the divorce. A claim may be sent by one of the spouses. Most often they turn to such an instance if the family has a child under the age of eighteen, if the property provoked quarrels between the spouses. In addition, the court comes to the rescue if one of the spouses refuses to agree to the divorce proceedings. Under the agreed conditions, the court retains the right to determine which shares of the loan to which of the former family members need to be paid. For example, as a result of the process, one can get 40% of the property, along with it - 40% of the debts, the second will get 60% of both.

Accuracy is the key to justice

Studying the samples of documents devoted to the section of the loan during divorce, the cases cited above, the experience of participants in the meetings, and the stories of lawyers, we can conclude that usually the court is quite responsible in analyzing all documents. Only after studying the available facts, they decide in favor of a particular person, satisfy his application or refuse it. The court is obliged to analyze the evidence provided by both parties, the testimonies of witnesses, information extracted from official documentation. One of the parties may not agree with the final decision made by the court. She still has the right to file an appeal. To consider it, you need to draw up the document correctly, within the time specified by law. Many recommend in this situation to seek the help of a lawyer - this will increase the chances of reviewing the case in favor of the dissent.

Far from always there is a need for lengthy and tedious, difficult psychological court hearings - an amicable settlement can be concluded. The division of loans during divorce does not cause problems and conflicts for everyone, often former family members easily come to an understanding, which is recorded in a written agreement. This document prescribes the conditions for the division of all accumulated property. You can enter the division into equal shares, you can stop at a different format if it suits both parties. In the current legislation there are no requirements for the obligations undertaken by the spouses, no specific shares are stipulated: if adults decide on their own to agree, if each of them agrees with the contents of the document, it is considered valid. To confirm acceptance of the conditions, it is necessary to sign an official paper.

About the subtleties

If the section of the loan during the divorce is executed in the form of an agreement signed by the parties, while the trial has not been initiated, both parties are obligated to notify the interested person who provided the loan that the marriage has been completed. The lender, having received such information, amends the agreement with the borrower. Usually they are drawn up in the form of an additional agreement. In some cases, they may propose to draw up a new arrangement in which they fix in detail the obligations and rights of each interested person participating in the transaction.

Marriage contract

Sometimes the division of the loan in case of a divorce is carried out in the conditions of a pre-concluded marriage contract. Paragraphs of this document are the basic rules for the division of acquired by spouses, including debt obligations. Currently, the marriage contract, drawn up in accordance with the law, is recognized as an absolute legal documentation, therefore, its provisions become an official requirement for the divorce proceedings.

Already at the stage of concluding an agreement, all possible conflict and problem situations that may arise in the future should be foreseen - this will help to eliminate disagreements at the stage of divorce. It should be stated in the documentation in which format the property will be divided, how in case of a divorce, loan obligations should be divided, what is the format for paying alimony. All items must be agreed with both marriages. The law obliges us to use strictly phrases with unambiguous interpretations, so that in the event of a divorce, there would be no difficulty in determining the rights and obligations, capabilities of each person concerned.

Important to understand

Regardless of what the starting conditions are, a divorce loan section is an individual process that requires a specific approach, taking into account the specific features of the current case. The court, if it was decided to turn to it, is obliged to treat its clients in this way, taking into account when revealing justice all the factors of the situation, the circumstances in which the case developed.

Many people believe that if you need a loan section during a divorce, you should use the services of an experienced lawyer. . , , , , , , . , , .

–

. – , . , . , , . , , , . , , . , – , , .

If an agreement has already been concluded on mortgage lending, it is unprofitable and inconvenient for the banking structure to make adjustments to it. For this reason, sometimes the court does not have any real opportunity to divide the home bought in a mortgage between the divorcing. Renewal of the loan program for one person is also accompanied by significant difficulties. Lawyers in this situation recommend even before the divorce to pay off obligations to the bank. The best option is the sale of property.

Is it an option to sell?

If the banking structure gives official permission for this, the spouses have the opportunity to sell the property at the current market price. The funds received with this should go to the calculation of the mortgage program. If there is too little finance, it will not be possible to repay the loan in full; obligations to repay it to a financial institution are divided between the spouses in half. If the money received during the sale of real estate turned out to be more than what was required to be paid to the bank, the balance must be divided between the parties. They are divided, as a rule, in equal proportions.

Alternative approach

One of the divorced can redeem the share of the second person in an immovable property. At the same time, he turns into the sovereign owner, fully responsible for the settlement with the bank. If it was decided to focus on this particular option of closing mortgage obligations, you should first specify in detail how much has already been paid on the mortgage program. At the conclusion of the contract, one person refuses the share, the second becomes the sole tenant, along with this he is obligated to pay half of the financial amounts that were transferred to the bank by the spouses on the mortgage program.

Often, divorcing people would like to formalize the deal in this format, but neither side has sufficient funds to acquire a share of the second person. A bank may come to the rescue. The financial structure allows you to use the apartment as a collateral object, which allows an interested divorced person to get a loan. From it, a person pays the necessary amount to a former life partner, turning into a single borrower. However, in reality this approach is not applied too often. Many banking institutions that issue loans do not agree on additional obligations in conjunction with mortgages, especially if the property that is in their possession should be a pledge. If there is reason to believe that a person will not be able to cope with debt obligations, will not be able to pay off in advance, the loan managers will surely refuse.

Together and next: since we started, we’ll continue

One of the options for calculating the mortgage program in the event of a divorce is the joint payment of funds. If there are no special conditions, property and debt obligations are divided between former spouses in equal shares. At the same time, the spouses can be in good enough relations to live within the same house for a while. Under certain conditions, the relationship between them is worse, while both are still ready to fulfill obligations under the loan program, which they entered into as a family. Both of these options allow the calculation of mortgage debt in the same mode as during marriage - no special changes and adjustments need to be made. Each of the former family members once a month transfers the required amount to the bank, following the provisions of the loan agreement. This continues until the obligations are fully covered. After completing the calculations, each of the former spouses will own half of the home.

Features and Solutions

If one of the former family members is ready to pay his share of the loan, and the second does not have such opportunities, you can conclude an agreement according to which the obligations for settlement with the bank are borne by one person. He also has the right to recover from the second person half the funds that he will transfer to a financial organization. Having finished paying off debts, this person will have the right to acquire his share from the former life partner. An alternative is to repay the debt to the one who settled with the bank. In the first case, the dwelling will have one owner, in the second - two owners with equal shares.

What to stop at?

As experts say, when planning a divorce proceedings and court proceedings or concluding an amicable agreement, you should first familiarize yourself with the laws, court practice, documents (including samples). The loan section after the divorce is subject to generally accepted rules, while taking into account the nuances of the case. If the problem is rather complicated, it is recommended to seek the help of a qualified lawyer.