In the financial market, there is such a thing as a PAMM account. Many investors create investment portfolios for themselves and make a profit. How can I make money with such an account?

What is a PAMM account?

A trader who has become a manager opens a certain type of account and invests there own money. Such investments are called manager's capital. And then he creates an offer, and on certain conditions, willing investors can invest their money in this manager's PAMM account.

Thus, it turns out that the manager trades not only at his own expense, but also at the money of investors who, at a certain percentage indicated in the offer (offer conditions), transferred his own funds to him for management. As a result, the manager risks not only the funds of his investors, but also his own. On the other hand, the manager receives a percentage of the income for completing transactions and managing the funds of investors, that is, a PAMM account. Everyone who wants to earn, therefore, chooses for himself such a manager who suits him according to certain parameters. The investor himself sets the selection criteria and limits his risks.

PAMM accounts as an opportunity to earn money

PAMM accounts: is this a divorce, or is there no deception about it? To answer this question you need to familiarize yourself with the conditions of earnings and see how it all works. To better understand whether these types of investments are a hoax, that is, PAMM accounts - a divorce or a real opportunity to earn money, consider an example.

Suppose a manager opens a PAMM account with certain conditions that he offers to his investors. Further, he conducts trade on it. Investors observe through monitoring their work, and according to its results they determine for themselves whether it is worth trusting their funds to this manager. The received data suits them, and they invest in the PAMM account of this manager. And the latter continues to trade, but not only with his own funds, but also with the money of investors. His PAMM-account is increasing due to investments, and trading continues. If the manager’s own funds are 300, and investor funds (one or more) $ 200, then the total amount is already $ 500, and the manager controls this money.

The more successful his trading, the higher the manager’s rating, which means that more people will invest in his PAMM account. As the account grows, the funds on it increase, which means the profit for all participants, which is distributed in proportion to their investments. According to the terms of the offer, at the end of the term (usually once a month), all investors pay a manager a reward for successful transactions. At will, they can continue cooperation.

Calculation of an investment PAMM account

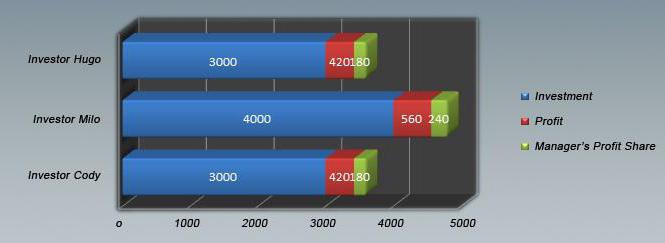

To better understand: PAMM accounts - divorce or not, consider the following example. The initial amount is 500 dollars, of which 300 dollars, funds of the manager and 200 - investor money. According to the results: $ 1,500, a profit of 200%.

So, as a result of trading on a PAMM account:

- Manager: investments of 300 dollars, the result of 980 dollars. That is, 300 is the initial contribution and plus 200% of the profit, plus the percentage of remuneration from investors, in this case - 20% of their profit.

- First investor: investments of $ 100, result 260. Two hundred dollars - profit and minus the percentage of remuneration to the manager, 20%.

- The second investor: investments of $ 60, only 156. One hundred and twenty dollars - profit and minus 20% for the manager.

- Third investor: investments of $ 40, result 104. Eighty dollars - profit and minus 20%.

As a result, everyone was satisfied and profitable. The investment scheme is clear, and now everyone can independently decide whether PAMM accounts are really divorce or not.

PAMM Account Insurance

What are the risks, and in general - are they? The fact is that all investors have several types of insurance. If you consider a PAMM-account a fraud, then this is far from the case. There are brokers who insure PAMM accounts. This is the first type of preservation of invested funds. And the second can be called conditional insurance. Most likely, this minimizes losses, that is, losses. Under the terms of the offer, the investor can limit his losses on his own. What does it mean? The investor determines the level or any specific amount that he agrees to lose, but no more. For example, an investor determines that losses on his investments cannot be more than 20%. Or a certain amount, for example, from an investment of $ 100, losses can not be more than $ 20.

Risks of investing in PAMM accounts

There are risks for the investor, and PAMM accounts, whether or not they are divorced, are to be decided independently by everyone who invests in such an account. In the example that was given above, we considered the case when the investment brought income. But with unsuccessful trading, all participants may receive losses. No one is completely safe from losses, for that he is also in the financial market, which always has great risks. Any investor can limit them, but it is completely impossible to exclude.

If we take the definition of a PAMM account, a divorce (word) in relation to it will be unjustified. Before opening this type of investment, everyone who wants to invest is immediately warned of the risks. In addition, it is also worth considering the following: monitoring is, of course, good; you can track the manager’s trade and choose the best one for yourself. However, previous work on such an account does not guarantee future profitability. Suppose a manager receives a stable income of 40% for several months, but this does not mean that in the future it will be the same. Next month, he may receive a loss. Such risks can only be limited, but they cannot be avoided in any way for a PAMM account. How risky this is, each investor has to decide on his own.

Passive income

Probably any person wants to have earnings in the form of passive income. Of course, this is convenient: you can do any business and constantly receive additional money. Some people distribute their investments in such a way that they live only at their expense. Someone makes money on various Internet projects, while someone invests in a bank and lives on interest. Each in his own way decides what type of investment he should do.

Forex PAMM Accounts - Divorce For Lazy People, Or Is It Still A Type Of Passive Income? Usually, people who do not want to figure out something, learn something, but simply look for “magic money”, at which no effort is needed, are at a loss. In any financial field you need to have basic knowledge. If a person does not know anything about the system with which he wants to earn money, it is very easy to deceive him. Therefore, before investing somewhere, you need to find out what it really is and how it works.

How not to be deceived with a PAMM account?

If a person wants to have income in the form of investing in a PAMM account, for this he needs to learn more about this type of activity. PAMM accounts: divorce or real money? It all depends on what kind of investment portfolio those who wish to receive passive income will choose for themselves.

How to do it right?

- First of all, you need to monitor all PAMM accounts that seem most suitable. You need to look at the yield, preferably not less than 1 year. The schedule for increasing profits should increase evenly. There should not be any sudden changes and jumps.

- Further, it is necessary to determine the risk threshold, that is, the amount that the investor agrees to lose in case of unsuccessful trading.

- You also need to view the rating: the higher it is, the better.

The main parameters of the PAMM account:

- profitability (expressed as a percentage);

- working period (how long does it exist, in months);

- profit uniformity (you need to look at the chart);

- rating.

Is it worth investing in PAMM accounts?

If the investor does a good preparatory work, in this case the PAMM account can be a good additional income. But only subject to the mandatory conditions that have been described above. The better and more thoroughly an investor conducts an economic analysis, the greater the chances of making money. It is necessary to learn all the subtleties and nuances on this issue, you can even undergo special training. There are various courses and programs for teaching investment.

If a person wants to earn money on Forex PAMM-accounts, one needs to take specialized investment courses on PAMM-accounts. It is on them that you can learn to choose the right portfolio for yourself. The investment portfolio includes several PAMM accounts. You can learn how to properly distribute your funds and what methods to work with them at such courses. Only after completing the training can you invest in PAMM accounts.

Reviews

There is an opinion that PAMM accounts are a divorce. So say people who have lost their money on this type of investment. It is quite possible to get a loss on a PAMM account, since the risks are really high. However, not everything is so bad. There is a fairly large percentage of people who earn on this. The opinion of specialists boils down to the fact that it is possible to obtain passive income on PAMM accounts, only you need to choose the right investment portfolio for this. And you also need to undergo special training. Having fulfilled all the conditions, the investor will have a chance to receive passive income from opening a PAMM account.