The Ministry of Finance of Russia follows a policy of increasing the duration of borrowed funds. The activities of the state apparatus are aimed at expanding the list of financial instruments with which borrowing is carried out. As part of this policy, in June 1995, OFZs were issued. These are federal loan bonds, but with a variable coupon.

What is OFZ?

Federal loan bonds, or OFZs, are one of the types of securities in Russia issued by the Ministry of Finance. In fact, bonds have a standard format, their only feature is that the reliability of securities is provided by the state itself. Assets are traded on the Moscow Exchange. Bonds can be purchased through any broker. OFZ bonds can be purchased and stored by both residents of Russia and foreign citizens. The price for one bond is 1000 rubles. Depending on the paper format, its profitability is determined, which is comparable with modern deposit programs. The main purpose of these securities is to attract capital to the country's budget.

The next stage of market development

In Russia, OFZ is exclusively the issue of the Ministry of Finance. In fact, these are bonds whose high level of reliability is ensured by the Russian state. Trading in OFZs is held on the Moscow Exchange. Assets can be purchased through any broker. OFZ buyers and holders can be both Russian and foreign legal entities and individuals. For one bond, buyers give 1000 rubles. The yield on a trading instrument is comparable to the yield on a bank deposit. The issuance of updated bonds in 1995 marked the stage of market development when it is ready to accept debt obligations with a duration of more than a year. Bidders have also enriched experience in order to operate with new sophisticated tools. Regulatory documents and technological base were prepared very quickly. In the technological aspect, the placement of bonds, their circulation and redemption are similar to the processes associated with T-bills.

Coupon Variable Income Bonds

OFZ is one of the types of securities that are presented in several formats. Papers with unknown coupon income of variable type (OFZ-PK) are popular. Documents give their owners the right to receive interest income from time to time. The frequency of payments may be two or four times during the year. The size of each of OFZ-PK coupons is announced immediately before the start of the coupon period, it depends on the current yield of the issue of T-bills, which have an almost identical period of payment with coupons. It is allowed to receive a discount if the bonds of the federal loan (OFZ) have a placement price on the primary or secondary market less than the cost of their repayment, including at par. OFZs are securities with a par value of 1,000 rubles with a validity period of 1 year to 5 years.

OFZ-PD, OFZ-FD and OFZ-AD: general concept

OFZ-AD, OFZ-FD and OFZ-PD are bonds that belong to the category of securities with known coupon profit. The sizes of securities are announced by the issuer before they are issued, and their holders have every right to receive systematic interest income. As with the previous category of bonds, a discount is provided on identical conditions. Depending on the type of asset, its circulation period can vary from 1 year to 30 years. The nominal value, with the exception of OFZ-FD, is 1000 rubles. For PD, the denomination can vary from 10 to 1000 rubles. The form of issue is documentary. Storage of a printed asset is a prerequisite for its repayment in the future.

Release Features

Each bond issue is characterized by the presence of a state registration code, which is similar in structure to the GKO code. The exception is only the second category, indicating the type of security. Each OFZ issue, the yield on which corresponds to the majority of deposit programs, is accompanied by the issuance of the Global Certificate, presented in two copies, which are stored in the depository of the Ministry of Finance. Coupon income is the main difference between bonds and T-bills.

OFZ market with floating coupon income

The placement of OFZs with a floating rate on the Russian stock market was a testament to the expansion of the scope of debt obligations with a variable interest rate. The breakthrough is due to the fact that all bonds of this type in the world provide an opportunity to reduce interest rate risk, which may be due to significant fluctuations in interest rates characteristic of long-term investments. The probability of losses of the investor, who fears their increase, and the borrower, who does not want to reduce them, is reduced.

In the world back in 1996, bonds with a variable rate occupied about 46% of the market. In Russia, OFZ-PD's popularity is constantly growing. This suggests that the market is undergoing dramatic changes. Coupon income becomes apparent not only at the time of payment, but also at the conclusion of contracts in the secondary market. When concluding a transaction, the buyer must not only pay the par value of the bond, he needs to pay coupon income, which must correspond to the time the seller spent the asset. Like all securities, OFZ-PK is taxed in the manner prescribed by law.

The participation of foreign investors in the bond market

The GKO-OFZ market is open to foreign investors. The chairmen of the Ministry of Finance of the Russian Federation and representatives of the Central Bank of the Russian Federation have expanded the possibilities of Western investors in the direction of investing in domestic securities. The domestic segment is attractive for foreign market participants because the purchase of securities with a validity period of more than one year opens up certain prospects. So, payment for acquired assets can be made in rubles and directly from the investment account. The opportunity is opened for the further conversion of ruble profits into foreign currency units with the reparation of profits, respectively. GKO-OFZ is a great opportunity to fully diversify risks in the investment portfolio. At the stage of market formation, dealers and investors were given the opportunity to carry out not only speculative, but also arbitrage transactions.

Bond market rates

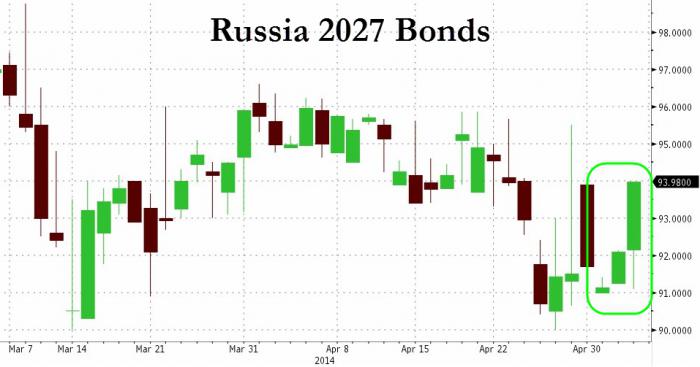

OFZ market rates are constant and variable. Fixed or fixed rates are set for each coupon period of each individual issue. The variable rate is formed taking into account official data characterizing the level of inflation. The OFZ rate depends to a large extent on the key rate of the Central Bank. The difference between the indicators is only a few points. After the spring rate cuts below 13%, market participants continue to expect a decrease in the indicator. This is evidenced by a low demand for debt obligations. So, in an April deposit auction in the amount of 110 billion rubles with a rate of 12.5%, it was possible to place only 75 billion at a rate of 13.02%. As for bonds, the market set their yield at 10.72%. Demand is three times higher than the available supply. The closed financial communication channels as a result of sanctions from Europe did not affect the situation. Western investors interested in the rate continue to actively participate in the auction.

What are the plans of the Russian government?

For the Russian government, the OFZ market is a great opportunity to cover the budget deficit through a loan . In the future, it is planned to issue securities worth 250 billion rubles, with a net attraction of 112 billion rubles. To date, since the beginning of the year, bonds worth 93.3 billion rubles have already been sold with a net attraction of minus 12.9 billion rubles. Among the estimated volume of securities, assets worth 150 billion rubles will have a term of up to five years, and 80 billion rubles will be issued with a term of 5 to 10 years. A total of 20 billion rubles will be issued securities with a rotation period of more than 10 years. Most of the securities in the future will have a floating rate. According to experts, the March bonds issued by the Central Bank of the Russian Federation were too overvalued, and in this regard, all bidders expect their value to decline by the end of spring. The weakening ruble continues to exert dominant pressure on bonds.