It is impossible to predict everything that can happen to us, but when you travel abroad, you need to think about insurance. This topic is always relevant. The issue of health and life insurance is especially acute for people who spend more than one month a year abroad. This article introduces you to Tripinsurance. According to reviews, this service is very popular with tourists.

A few years ago, Russian insurers ceased to cooperate with ISOS due to the increase in the cost of services. Today, investing in a profitable program at affordable rates is not as easy as it might seem at first glance, which is why amid the inaction of once popular companies, the topic of online travel insurance is interesting. In this case, as was already easy to guess, we will talk about the Tripinshurans service.

What is Tripinsurance?

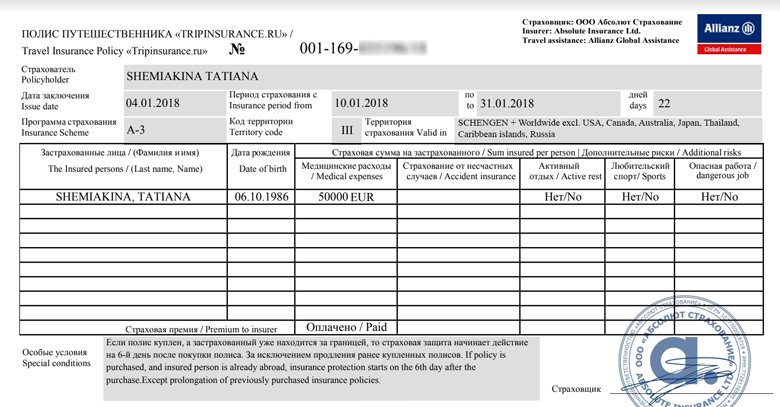

If you pick up the insurance policy, it is easy to notice that on this document the insurer does not indicate Tripinshurans, but Absolute Insurance LLC. Therefore, Tripinsurance is neither an assistance nor an insurance company. What does she do?

Tripinsurance insurance company is the creator of travel insurance products developed on the basis of the insurance company. The policies of this company are serviced by a reputable assistant and have excellent online support. This offer is unique, since Absolute Insurance does not implement such policies.

A few words about assistance

This is the official service provider for the Mondial Assistance service company. To evaluate any travel policy, a combination of two components is important: insurance and assistance. The latter is a kind of service company that provides direct assistance to customers in the event of an insured event. Assistance solves problems on the spot: goes to medical institutions, communicates with doctors, orders an interpreter, etc. If the assistant does not have agreements concluded with local medical institutions, the tourist will have to pay for his treatment on his own, collecting all the certificates, receipts, receipts . The client will be able to reimburse costs only at home, by contacting his insurance company with transfers of foreign payments.

The main advantage of Tripinsurance programs is cooperation with Mondial Assistance, which belongs to the Allianz Global Assistance (AGA International) group and has its own call center. Today, the company, which has 34 representative offices around the world, is recognized as one of the best services in the field of travel insurance. It works on the same principles as ISOS. Insurance abroad with decent assistance is a guarantee of really prompt receipt of the necessary medical care as part of the reimbursement of the insurance amount.

What is the difference from other service companies

Tripinsurance insurance is the best option for those planning a trip to Europe. Those who have had to deal with medical care in these countries know that doctors only go to their homes in the most emergency cases. For example, in France, Italy or Germany, even with a fever of +39 ° C, you need to rely only on yourself and get to the medical facility yourself. However, Allianz has a number of contracts with hospitals in the predominant number of European regions. In addition, the treatment is fully covered by insurance, you will not have to pay for it from your own pocket. Meanwhile, in Europe there are places where these rules do not apply (for example, the Baltic countries, Finland, Sweden).

In which countries can I use insurance?

Tripinschurans has no proposals for specific territories. Even if a specific country is indicated in the policy, this does not mean that you can rely on insurance only in this region. When choosing a product from Tripinsurance, consider the following:

- "Schengen" - the action applies only to the countries of the Schengen agreement.

- "Thailand" - insurance will cover costs in any territory, with the exception of Russia, Canada, the United States, Japan, Australia and the Caribbean.

- “The whole world except Thailand” - the policy is suitable for traveling anywhere in the world, except Thailand and the area, which is located within 90 km from the place of residence.

- “Russia” is a special insurance product that can be used in Russia, the CIS countries and the Crimea, but not within a radius of 90 km from the city of residence.

- “The whole world” - the policy will operate on the territory of any state except the home region.

- “Almost the whole world” - the ability to choose the territory of insurance coverage yourself, excluding certain countries.

The insurance is suitable for travelers who plan their trip in detail. But for those who need to insure themselves formally, exclusively for applying for a visa, it is better to look for other options, since Tripinshurans does not have such offers, and those available are expensive.

Insurance policies have standard expiration dates. The document may be valid for a certain period specified by the buyer, or one calendar year. There is a significant limitation in such Tripinsurance: the maximum duration of one trip should not last more than three months, while the number of trips and tours is not limited.

Single trip insurance products

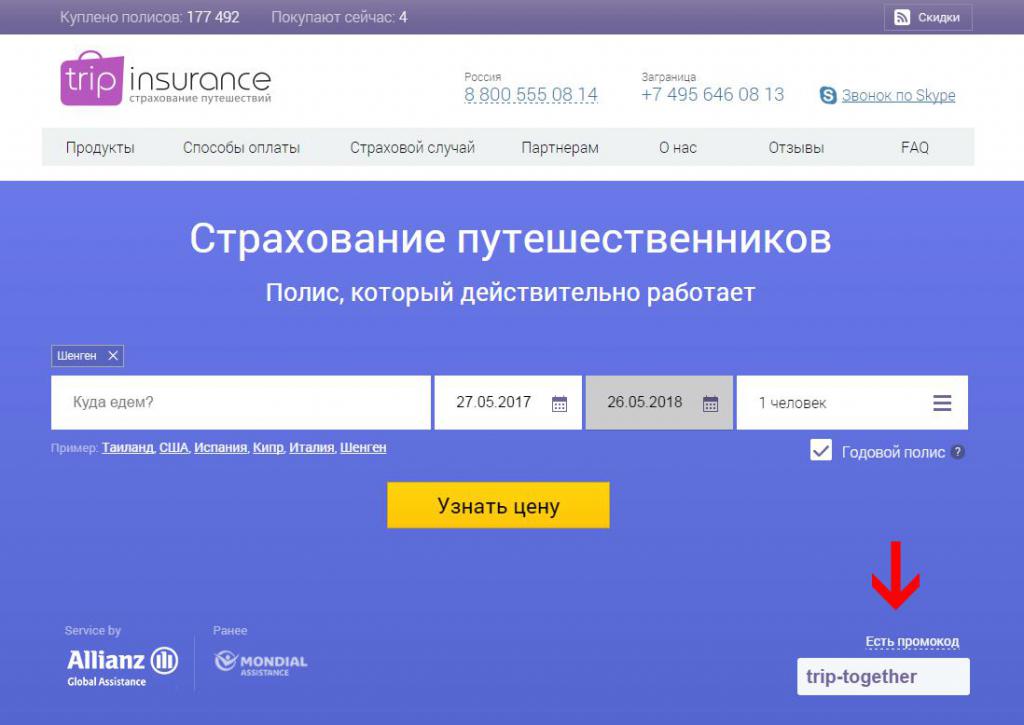

Annual and one-time Tripinsurance policies can only be purchased on the company's website. You cannot find them on the well-known portal for travelers “Cherekhap”. Insurance is not sold in the offices of Absolute Insurance. You can choose a program suitable for yourself in one of two ways: on the official tripinsurance.ru website or on third-party sites that link to the official website. An electronic service will allow you to choose one of three tariffs:

- Base Basic minimum rate with a minimum insurance coverage of 35,000 €. This package also implies the possibility of providing emergency dental care in the amount of 200 €. This is the best option for compulsory insurance, for example, in order to obtain a Schengen visa. But, as already noted, for formal insurance it is better to use cheaper options on the same Cherehap service. For example, a policy from Tinkoff Insurance will cost almost half the price.

- Standart. The provision of extended medical care and the provision of bonuses. The amount of coverage upon the occurrence of an insured event is € 50,000, and as additional services it is worth noting legal support, payment for air tickets for early return home and reimbursement of expenses for delayed flights.

- Million. The maximum coverage is € 1 million. The Million package is the same Standart plus liability insurance and baggage.

Annual policies

These are ideal travel insurance plans that are planned for one year. They have a more favorable cost and are suitable for those who go abroad more than twice a year.

All year-long insurances can be divided into two groups - 365DAYS and Multitrip. In the first case, as already mentioned, there is a restriction - one trip should not exceed a three-month period, in the second - you can stay abroad all year round, but the amount of insurance coverage will be much less, and the fare will be much higher. Both tariffs are valid for a calendar year.

Many interpret the 90-day limit differently. This does not mean that you can stay outside the Russian Federation for three months and no more. The restriction implies that the maximum number of days abroad can be 360 per year. This means that after 90 days the insurance ceases to function, and in order to activate it again, you need to return to Russia, then you can leave again. Thus, the “counter” is reset, and the next 90 days begin to count. If you just cross the border of another state, Tripinsurance will consider this a continuation of the trip. Other insurers work on the same principle with respect to annual programs.

It is important that in all tariffs calculated for a year, the same package of services is presented. They differ only in the size of insurance coverage.

Active rest on insurance from Tripinshurans

Cooperation with any insurance company, including Tripinsurance, has a number of features. For example, health insurance can be waived without loss for three days from the date of purchase of the policy. There are other subtleties. They are clearly spelled out in the contract, but many citizens neglect the need to carefully read the document. Next, we pay attention to the most important points.

The first thing that falls under any travel insurance contract is the protection of risks during outdoor activities. Few travelers know that basic policies cover damage when visiting the water park, doing beach sports, tennis, golf, snorkeling and cross-country skiing. By default, even bike insurance is included in any program. However, it implies the presence of rights of the appropriate category and helmet on the head, as well as the absence of alcohol in the blood.

If the vacationer does not plan to go hunting or fishing, to ride a jet ski or downhill skiing, surfing, snowboarding or engage in other extreme sports, then there is no need for insurance for outdoor activities. A checkmark opposite this item significantly increases the price of insurance, sometimes up to two times.

Other nuances

Tripinshurans health insurance covers children and adults under 80 years old. However, few know that the insurance coefficient increases by 2-3 times for babies under three years of age and older people over 70 years of age.

Citizenship does not play any role, since travel is insured, which includes traveling abroad to a country of citizenship. In this case, a permanent place of residence or stay does not matter. In addition, you can purchase a policy not only before the planned departure, but also directly on the trip. Most insurers do not offer the opportunity to purchase policies upon departure. According to reviews, Tripinsurance is one of the few companies that do not prohibit taking out insurance abroad. The only thing to consider in the event of such a transaction is that the policy will take effect only six days after the purchase.

Liability insurance is available in one-time Million and 365 DAYS packages. Tripinschurans will cover the damage if the insured person breaks an expensive item in a hotel or causes material damage to another person. In order to obtain reimbursement, there must be a court decision on the conviction of the company's client.

As for jellyfish burns, injections about sea urchins and other “exotic” injuries, they are paid by the insurer only if they really threaten the life of the victim. Dengue fever treatment abroad is covered.

If a Doctor on Call service is available at a particular medical institution, Tripinshurans assistance always provides it to the insured person. In addition to this service, Doctor Online is popular among tourists. The application allows you to ask your doctor a question in real time and get recommendations.

Travel insurance not only covers the costs of emergency transportation, but also pays for a taxi to visit the doctor. Even bipatrides (persons with dual citizenship) can take advantage of the company’s services, they provide emergency vaccination for insurance. It turns out that the agreement also spelled out assistance in the event of a terrorist act, which is not found in any insurance company.

What is not covered by Tripinsurance

The insurance company does not insure against the risks of exacerbation of chronic and skin diseases, as well as sunburn. As with other insurance companies, oncological pathologies and mental disorders do not fall under the contract. In the case of an exacerbation, which is a life-threatening condition, the patient will be helped within 1000 y. e. He will have to deal with the rest of the consequences of relapse on his own. This item is especially important for allergy sufferers who are traveling to exotic countries with unusual climate and vegetation for the first time.

Tripinsurance policy will not be a profitable solution for pregnant women - it will cover the costs of medical services provided for up to 11 weeks. Next, the woman will have to pay for everything on her own.

The insurance does not pay for search and rescue work, so those who plan to engage in trekking, climbing or other forms of entertainment in a forest or mountainous area should take this fact into account. As for the protection of the risks of damage or loss of personal belongings, they are included in the Million and 365 DAYS tariff plans. However, their effect does not extend to what baggage insurance is usually bought for - fur and jewelry, laptops, video cameras, computer equipment, mobile phones and other expensive items.

Opinion of people

If you are going to go abroad, you must buy an insurance policy. Another question is which insurer? Judging by reviews of Tripinsurance, this company is quite popular with Russians. It is also interesting that this insurance company has a constructive approach to criticism, which is addressed to it. So, for example, on the forum of the official site, people sometimes leave negative reviews about the services of assistance. Representatives of the company regard the user's comment as a signal to action. In the near future, the administration understands the situation and fixes the problems.

First of all, it is worth noting why people turn to this company. If you believe the reviews about Tripinsurance, then most of all customers appreciate the company:

- prompt resolution of issues and difficulties associated with paperwork;

- professionalism of consultants who always competently answer any questions asked about the products offered;

- worthy service company.

The gap in the ratio of positive and negative responses is quite large, and the number of positive comments wins. Thus, the choice of insurance policy should be guided by the number of dissatisfied reviews - if there are too many of them, it is better to refuse the purchase in favor of a more favorable and reliable offer.

Among the customers who urge them not to get involved in buying travel insurance online are mostly those who suffered from their own negligence. Before buying, you must definitely specify all the terms of the contract.

Insurance payments and indemnities

Most users recommend purchasing Tripinsurance to travel to Schengen countries. There is a wide range of services and proven assistance. The only negative is the relatively high price. In addition, there is always the opportunity to apply for a policy while traveling, but keep in mind that it will be valid on the sixth day, not earlier - this way the company prevents fraud with the purchase of the program after the occurrence of an insured event in the coverage area.

The principle of insurance itself is that in case of injury or a dangerous disease, all medical expenses are covered by the company. If the insurance territory is limited, then in those countries where payment for services related to the occurrence of an insured event is technically impossible, the victim pays the money. Upon arrival in Russia, all expenses are compensated to him. But still, the company seeks to expand its insurance coverage. Otherwise, why then will you need a policy if you have to pay for all medical services from your wallet?

Tripinsurance works well in resort areas, countries in Europe, USA, Latin America. According to the principle of self-payment and compensation, only tourists from distant countries and states that are subject to a special political regime (Syria, North Korea, Iran, Iraq) are served.

In most countries, the insurance company works according to the standard mechanism: Tripinshurans sends a letter of guarantee to an assistant or directly to a medical institution abroad. According to reviews of Tripinsurance, to receive medical care at a medical institution, you do not need to make a cash deposit or leave a passport as a deposit, and in China, most clinics are accepted at all for free.

If you still had to pay for the treatment with your own money, it is not necessary to visit the Tripinsurance office. You can inform the company’s representatives about the cost of the service by phone, and send confirmation copies by e-mail as confirmation. If after checking the documents the company is happy with everything, it is necessary to send the original documents by registered mail. This is quite an important point, since other insurance companies have a requirement of personal presence in the office.

If the insured event occurred in one country, treatment was also started in it, but after some time the insured traveled to the territory of another state, the subsequent treatment with the current policy will be covered under the same insurance case. If the insurance has expired during the hospitalization, Tripinerance continues to pay for the stay in the clinic. If the victim after the end of the policy will need to be re-admitted without being in the hospital, he will have to pay for medical services himself.

Customer interaction

Based on the traveler’s reviews of Tripinsurance, far from all are satisfied with the remote customer support organization. Communication with the company can be carried out by phone, email or skype. You can buy insurance only on the official website of the insurance company.

In real time, you can contact the Vinsky forum - the most popular platform for public discussions and customer appeals. Representatives of Tripinschurans respond in detail to all comments. Some users write directly from a hospital or hotel.

So that the purchase of medical policies for travelers does not put a heavy burden on the wallet, the company has a loyal discount program. Tripinsurance actively supports regular customers, helping them save up to 20% of the cost of a particular offer.

In addition, the company carefully monitors the quality of medical care in partner clinics. Thanks to the study of customer reviews and the current rating system, timely measures are taken to select medical facilities. If there are more than two negative comments about a particular clinic, Tripinshurans ceases to cooperate with it.