Since auto insurance has risen in price, insurance companies (IC) information about KBM has suddenly “disappeared”. Today this situation is quite common. Moreover, to explain why this bonus cannot be used, SK managers find it difficult. We’ll try to figure out how to restore the KBM and save our own money.

The first and perhaps main question: “Why?”

Why is the Neat Driving Benefit not applicable? Most often, the insurance company answers as follows:

- If you had to change your driver’s license, then the data in the program disappears, and new ones appear, like with a driver who has just received the right (a KBM which simply cannot be). The same answer will be in case of a change in the name of the driver. The reason for this is the default. Although in reality the driver is obliged to inform his insurance company about the change of document or personal data. Therefore, the insurance history starts from scratch.

- If any of the acquaintances or relatives introduced the applicant to the policy, and they made a mistake in the UK. For example, they introduced a third, initial class of coefficient. And with subsequent CTP extensions, the real class earned by the driver is not taken into account, naturally, by mistake.

- The data was transferred to the Russian Union of Auto Insurers (RSA) , but the bonus malus is not accrued due to typos (in the full name, passport data, year of birth, etc.).

- The insurance company did not transfer information about the insured to RSA. There may be several reasons. One of the frequent ones is the termination of activities of the UK.

- There was an interruption in the insurance period, so the bonus malus data is reset.

- If several drivers are indicated in the policy, then the KBM with the lowest class will be taken to calculate insurance.

- There is simply no data on the driver. It sounds wild, but insurers just hide the data on the MSC.

Independent investigation

A reduction factor is not calculated in case of:

- guilty pleas in DPT;

- reaching a maximum in the bonus malus system equal to 50% (or 13th grade), because there is nowhere to reduce further;

- non-completion of the insurance period (5% is accrued for each accident-free year, but at the end of the term);

- non-renewal of the end of the CTP insurance policy (if the contract was not extended for 12 months or more, then the KMB must be increased again, that is, from scratch).

A reduction factor will not be restored if:

- During one of the insurance periods, the policy was open to an unlimited number of drivers. This is the case when the coefficient is assigned to the vehicle, and not to a specific person.

- The insurance conditions have changed: from a limited number of drivers to an unlimited one, or a new vehicle has been purchased for which new insurance has been issued. In this case, according to the law, the discount is reset.

- The driver did not appear in any insurance policy during the year. A discount for non-accidents is accrued annually and is valid for the continuation of the next year. As soon as the cycle is interrupted, the KBM is reset.

You can also check

Before you restore the KBM, you need to find out what it is. The accrued points can be found on various portals. For instance:

- on the official websites of insurance companies in special bookmarks;

- on portals with an OSAGO online calculator, most often they are not tied to a specific IC;

- on the PCA website, because it is here that data about all policyholders flows, and requests from any site that provides a bonus check service come here.

PCA portal: check bonus-malus coefficient

Before restoring a KBM for free or for a fee, you must verify your data with the data of the Union of Auto Insurers. To do this, you need passport data and driver's licenses of all persons inscribed in the insurance. Each of those inscribed in OSAGO is checked separately.

Consider the algorithm of work:

- in the window "driver" we put a daw "individual";

- for each of the list in the policy, F. I. O. is entered, date of birth, series and number of the driver’s license (if there was a replacement of the document, or personal data in the “special marks” window changed);

- in the window "the date of commencement of the validity / addition of the driver" we indicate: if the policy is valid, then the first day after the expiration of the contract is entered; if there is no valid insurance, then we set the date of opening a new policy (at the request of the insured);

- After checking the entered data, we enter the verification code, after which a verification table appears, over which the effective coefficient is written.

Is it worth it to restore?

Naturally, yes. And the reasons are quite significant:

- the discount (reduction in insurance costs) increases every year subject to accident-free driving;

- upon restoration of the KBM, the amount of the overpayment shall be returned to the policyholder.

To restore the MTPL OSB on the basis of the SAR, you can use electronic services. A minimum of time will be spent on the procedure, but the savings will be significant.

Sample Application

Before restoring the KBM in the database, we draw up a statement. In writing, it must contain:

- name of organization: insurance company, RSA, Central Bank;

- Applicant's full name, registration address, contact numbers;

- petition for entering data into the database of the Union of Motor Insurers;

- details of the current policy;

- grounds for changing the accrued KBM (certificates from insurance companies, contracts of previous insurance periods, etc.);

- list of attached documents and photocopies;

- applicant's signature and date.

Insurance companies

The law obliged all UKs to accept applications with the request to restore the KBM both electronically and in writing. On official sites there is a special tab with a form for contacting. It can be filled online, or you can download, print and send it by Russian Post. But both in electronic and in paper form, it is necessary to attach policies for previous insurance periods (or a certificate of absence of payments).

A written statement is made in duplicate. The company records it in the journal of incoming documents. If the secretary refuses to accept the application, it is sent by registered mail with a mandatory notice of delivery. After ten working days, you can check the data on the MSC in the PCA database. If there are no changes, you must file a complaint with the Central Bank of the Russian Federation or the Union of Auto Insurers.

Military Insurance Company

To restore the KBM in the VSK, you must contact the specially created service "Checking the correct application of the KBM." With its help, a statement is drawn up to verify the correctness of applying the bonus-malus coefficient in the base of the Union of Auto Insurers. Further, the system automatically connects to the SAR and performs a check of the KBM at the settlement date. The result of the verification is sent by e-mail. If the insurer considers the coefficient incorrect, it can leave a complaint on the VSK official website, which must be considered within five business days.

Rosgosstrakh

First you need to find out on what day the discount was reset. You can find out only by choosing the date and preferably on the official website of the company. You can then file a complaint. In the “Feedback” tab, fill in the proposed windows: status of the person, nature of the appeal, etc. Next, you need to attach a photo (scan) of the current OSAGO insurance, a driver’s license (both sides) and a vehicle certificate (also on both sides).

Now the body of the statement. In order to restore the KBM in Rosgosstrakh, you need to describe the situation in detail, indicating the date of reset. Within a day, a notification about the consideration of the case and (almost always) the return of the coefficient comes to the indicated electronic mailbox. The letter also gives recommendations on how to return an excessively paid insurance premium.

How to recover KBM: SAR

Often, insurance companies are confident in their sinlessness. And if the policyholder does not agree with the coefficient assigned to him, then you need to apply only to the Russian Union of Auto Insurers.

Actions may be as follows:

- Go to the official PCA portal and leave a request for the restoration of MSC on-line.

- Send a written complaint by Russian Post or electronic. The form can be found in the public domain. The body of the application must contain: personal data of the insured and each person entered; if there was a change in a driver’s license, you must specify information about the previous (previous); the reason why the KBM seems to be incorrectly accrued; a decrypted signature that simultaneously certifies the document and consent to the processing of data, and the date.

- A copy of the driver’s license (if OSAGO is limited) and a copy of the passport with a residence permit (if the policy is unlimited) should be attached to any of the selected options . The absence of these documents will not allow to restore the MSC in the SAR. For this is the reason for the refusal to consider the appeal. Scans are attached to the electronic complaint.

- As an addition, scans confirming the arguments can be attached. These include certificates proving trouble-free (until 2014), insurance policies of previous years (they contain information on accrued KBM) and even a certificate-extract from the traffic police about the absence of accidents. The negative answer to the appeal to the insurance company can also be included here.

In case of loss of policies for previous years, in order to restore a KBM on the basis of the SAR for free, you must contact the insurance company conducting the case for a certificate confirming the absence of payments. A document must be issued within five business days. If, nevertheless, it was possible to confirm a data error in the Russian Union of Auto Insurers, then the bonus malus will be restored and recounted. The answer on paper comes through the Russian Post, in electronic form - by e-mail.

Interesting nuances

Before restoring the KBM in the SAR database, you need to know that the data here are collected only about the agreements concluded since the beginning of 2011. In addition, the Union is not empowered to make any changes to its bases. This can only be done by an insurance company with which a contract is concluded (prolonged).

Experts recommend starting the recovery of the coefficient by identifying errors. You will have to work with policies for previous insurance periods. Moreover, the KBM document is not indicated, therefore, it will have to be calculated in manual mode. It should be borne in mind that from year to year the coefficients for car insurance change. You can learn them from the Bank of Russia Instructions for the year of the policy.

To restore the CBM coefficient, it is better to start the check with the latest insurance. Most often, the error lies precisely in it, less often in previous periods. If the policy is valid, then in two or three days everything will be fixed (after an independent check of the UK). If the insurance period has already ended, then a return of the coefficient is also possible. The bonus malus will not be restored only in the event of the liquidation of the insurance company that issued the policy. For only she has the right to do so. The Union of Auto Insurers is not authorized to amend the database.

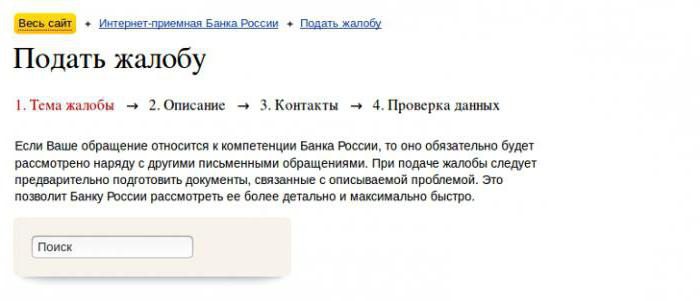

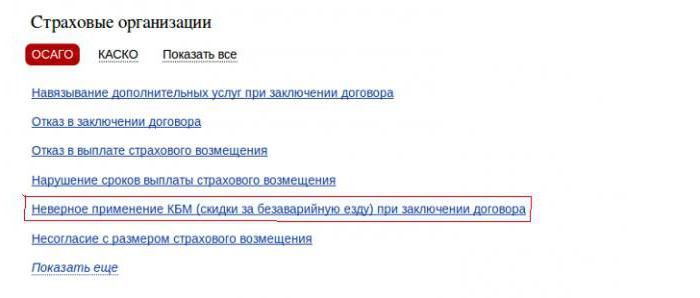

Or the central bank

In order to restore KBM for free, you can also complain to the website of the Central Bank of Russia. On his portal there is a special Internet reception. This method is considered the most reliable. Everything is made out through a special form. It is located in the "Insurance Organizations" section. The “CTP” tab defines the topic of the complaint “Incorrect use of the KBM at the conclusion of the contract”. After filling out the form, you must attach the scans of the policy that has completed its action, or a certificate of the absence of payments. All stages of the application are reflected in letters to the email address of the applicant. Work with each appeal should not exceed 30 days. The Central Bank considers applications for policies from the expiration of which no more than a year has passed.

Third Party Services

Today there are many Internet portals that promise: "We will restore the KBM in the PCA database." They also offer to return excessively paid funds. They provide services both on a paid basis and on a free basis, and in the shortest possible time. Recommending a site is quite difficult. It is advisable to carefully read the reviews or comments of those who have already used their services before starting work on such services.

The scheme of action on such portals is approximately the following.

- Before you restore the KBM, you need to check it. It is possible without registration, but if there are several drivers, then you will have to work in your personal account.

- All necessary data is entered in the proposed form. To check the current discount in the column "date" select "today". Next comes the last name, first name, patronymic (the register does not matter), date of birth, series of driver’s license, its number. Click the button "Show KBM".

- Most often, the discount is checked automatically for all previous insurance periods.

- If the coefficient value is incorrect, then the portal is asked to leave contact information. During the working day, consultants contact the applicant to clarify all the nuances. And in a day, at the most in five, MSC will be restored.

Epilogue: refund of excessively paid funds

The restored coefficient gives this the full right. We are preparing a statement. We indicate in it:

- name and details of the insurer;

- passport details of the applicant, including registration;

- a request to return funds to the specified bank account;

- the basis for the return of funds (official paper on the amendment of the KBM).

Insurance companies have 14 days to do this.

Post scriptum

In order to avoid zeroing or decreasing the coefficient, auto lawyers recommend checking its value on the PCA portal once a year. And it is necessary to do this before concluding a new insurance contract or before entering your data into other policies.