Is it necessary to change the TIN when changing a residence permit? This question excites many citizens. Yes, permanent residence rarely changes. But what if this happened? TIN is directly related to tax services. So, if you use an invalid number, you can run into trouble. So you have to thoroughly study this issue. Maybe, in fact, you do not need to deal with additional paperwork?

Definition TIN

Is it necessary to change the TIN when changing a residence permit? Before making final conclusions, it’s worthwhile to figure out which document we will generally be dealing with. Often in the very definition of a particular concept, answers to certain questions are already hidden. So, the TIN is the taxpayer number, and it’s individual. Assigned to all citizens in Russia, as well as organizations that must transfer taxes to the state fund.

All taxpayers have such a combination of numbers, but some are unaware of it at all. An INN is issued at the place of registration. And, more precisely, in the IFTS of your area. Accordingly, registration has some role, but plays upon receipt of this document. What to do if you change your residence permit? Is it necessary to change the TIN? And what documents will be required in this case?

Once and forever

Frankly, the question is not so complicated in fact. After all, if you are thinking about whether you need to change the TIN when changing your residence registration, reflect on what we are dealing with. It has already been said that this is nothing more than a number that is assigned so that taxes can be transferred. Is it really necessary to change it in some situations?

Not at all. Indeed, in Russia, when changing a surname or name, this document does not change. And, therefore, the new place of residence also does not affect the need for replacement. As practice shows, only if you have lost a document, you will need to restore it. Or rather, get a duplicate. And nothing more. Therefore, if you think about whether you need to change the TIN when changing your registration, then the answer will be negative. You should not even rack your brains over this topic.

Change Actions

But, in general, do you need to do something when you change the place of registration? In principle, no. After all, such a document is required exclusively for tax services. But in Russia they are all interconnected. And when a person moves to another place of residence, all information about him is transmitted automatically. Including TIN. The tax office of your former district will report a move to the office that is tied to your place of residence. Your personal data will be automatically replaced.

It turns out that the TIN at the place of registration is not tied. This number is issued to a citizen once. And for life. Under no circumstances does it change. Moreover, changing the place of registration does not require any additional actions or notifications from you, with rare exceptions.

Exception to the rule

Is it necessary to change the TIN when changing a residence permit? Not. And if you are an individual, then you do not even need to inform the tax authorities of your new place of residence on your own. As already mentioned, there are exceptions to the rules. Or rather, it is one. You should speak on your own about changing a residence permit only when you are an individual entrepreneur. But at the same time your TIN will not change. The tax service will require you to fill out a special application in which you will need to indicate a new location for your registration. There is nothing difficult about this.

How to declare about yourself? Find the tax authorities at the place of your new registration and come there with a passport, as well as an IP registration certificate . TIN and SNILS also take with you. Next, ask for an application form for notification of a change of residence. Fill it out, attach copies of your documents and leave it in tax.

Get the number

Since it is not necessary to change the TIN under any circumstances, it’s worth at least studying how to get this paper initially. In fact, it’s not so difficult. True, keep in mind that a TIN without a residence permit is unlikely to be accepted. Therefore, you will have to worry about registration in advance. Fortunately, the process is not burdened with any difficulties and paperwork. If you are already 14 years old, you only need a passport, as well as an application for a TIN. But for citizens who have not yet reached the desired age level, it will be much more difficult. Indeed, to obtain a TIN, you need the presence of legal representatives.

What exactly is needed in this situation? Citizens who have not reached the age of 14 can receive a TIN only in the presence of their parents. In addition, it is the legal representatives who must write the corresponding statement. A passport (copy) from the parent, a child’s birth certificate, information on the registration of a minor is attached to it. Further, you contact the tax authorities at the place of your registration and submit documents for processing. After about 2 weeks (sometimes after a month, but this is rare), you can get a TIN certificate.

Through the Internet

In principle, nothing complicated. Only modern citizens have special opportunities. If the registration has changed, do I need to change the TIN? Not. Moreover, you don’t even have to report anywhere when you move. Except when you are an individual entrepreneur.

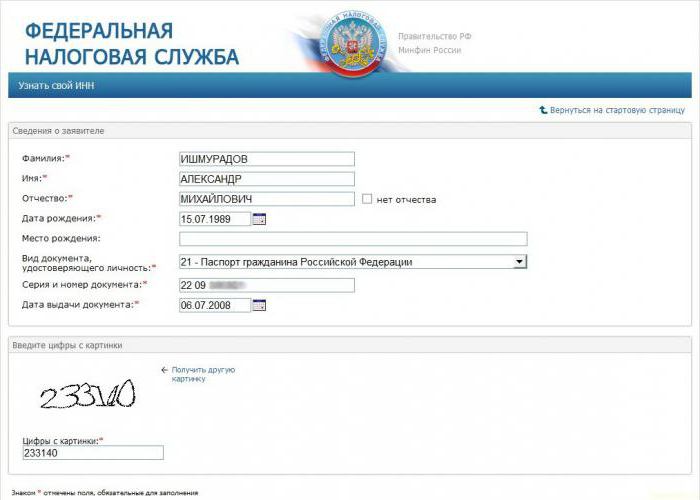

In addition to a personal appeal to the tax authorities, you can use the Internet to obtain a TIN certificate. You have the full right to submit an application through the State Services portal, having an account there. Usually there is no problem with this. Or the official website of the Federal Tax Service will help. The second option is more suitable, because for the first you may need a TIN. And if you do not know him, you will have to abandon the State Services portal.

To get started, get yourself an account on the website of the Federal Tax Service and go through authorization there. Next, fill out the electronic application form of the established form for issuing the TIN certificate, if necessary, provide copies of your documents with an electronic digital signature. And then just wait a while. You will be able to receive a certificate in electronic format (download directly from your “My Account” on the website of the Federal Tax Service), personally pick it up at the tax office at your place of residence or by mail (an extremely rare case).

conclusions

Is it necessary to change the TIN when changing a residence permit? Not. Remember, this document is issued once and for life. Even a change of residence does not affect this. With rare exceptions.

Obtaining a TIN certificate also does not cause any trouble. Nevertheless, without a document you can live for the time being. You should not rush to get it. As a rule, the TIN must be obtained at the time of your first official employment. And nothing more. No fines for the absence of a document are not allowed. After all, you have the right to receive it when you consider it necessary, if you are not officially getting a job.