According to dictionaries and reference books, value added tax (VAT) is a form of withdrawal to the state budget of a part of the cost of goods, work or services, which is created at all stages of the production process of goods, works and services and is paid to the budget as it is sold. Therefore, you need to know how to fill out a VAT return.

What is VAT?

If in simple words to tell the average person about what VAT is, it will look something like this: this is the type of tax given by the producer to the state for creating (or selling the product created by others) from which it will then receive a profit in excess of the cost of its production .

In other words, the tax is calculated from the difference between the sale price of the product and the amount of funds invested in its purchase (or manufacture). It should be noted that the seller still compensates himself for the amount of VAT, laying it in the final cost of the goods.

Who and how should file VAT reports

The tax law in article 174.1 of the Code on Fees and Taxes states that this tax must be declared:

- persons who are not payers of a given tax (for more details, see article 173, paragraph 5);

- individuals and legal entities, if they pay VAT;

- defined by one hundred and sixty-first article of tax agents.

Knowing how to fill out a VAT return, one should adhere to the rule that enterprises that do not bear the burden of paying taxes but provide invoices to their customers must declare the tax value.

Article 80 of the Code establishes that a tax return can be filed in the form of a statement on the full amount of profit, its origin, expenses incurred, taxable object, benefits, accrued VAT amount and other documented information by which tax calculation is determined.

All reporting documents with relevant information are submitted by VAT payers at their actual place of registration for a period up to the 20th calendar day of the month following the taxable period.

The amendments to Article 174 that have entered into force from the first day of the current year oblige all tax payers (regardless of the number of personnel) to submit a declaration of the appropriate format using telecommunication channels through the appropriate document management operator.

Reporting Key Points

The VAT declaration is currently being filled in unchanged - according to the official order of the Ministry of Finance No. 104n of October 15, 2009. But in the letter of the Federal SN (October 17, 2013 No. ED-4-3 / 18585 “On filling out tax returns submitted to the tax authorities”), it was recommended that from the beginning of the first month of the year OKTMO be replaced in place of OKATO.

If the VAT declaration form is filled out properly, the company is guaranteed a tax return. That is why it is important to understand how to fill out a VAT return correctly, and to be able to use the structural plan for preparing a reporting document.

The article details how to fill out the VAT tax return. Its form contains certain points.

The main sections of the tax reporting document

Title sheet form:

- Section one - the full size of the amount of tax that is transferred to the state budget.

- The second section - deductions, according to information from tax agents, transferred to the state treasury.

- Section 3 of the VAT return calculates the amounts deducted at a rate of 0%.

- Adj. 1 for the third section - the amount of tax paid, which appeared as a result of recovery.

- Adj. 2 for the third section - the calculation of the amount of VAT for the provision of services, trade in various products, renewal of the rights of owners, VAT (residences of other countries whose activities pass through organized missions).

- In the fourth section, you need to calculate VAT, based on transactions with a commercial nature, for which the zero rate is confirmed.

- The fifth section - calculates the costs of commercially targeted activities with an agreed rate of added value.

- Sixth section - VAT is calculated in respect of actions of a commercial type without official confirmation.

- Section 7 of the VAT declaration relates to commercial activities that are not included in the taxation of VAT, which are not recognized by entities paying taxes, or to processes that are carried out outside the territory of the Russian Federation.

This year, the corresponding filling out of the VAT return implies the obligatory presence of a registered title page. If the practice of a particular representative of an entrepreneurial organization includes actions that are indicated in regulatory documents, then the remaining sections are included in the reporting document according to the structure.

The instructions for completion indicate that VAT payers should accept sales books, purchase books, and accounting registers as the basis for preparing the declaration (tax accounting is possible).

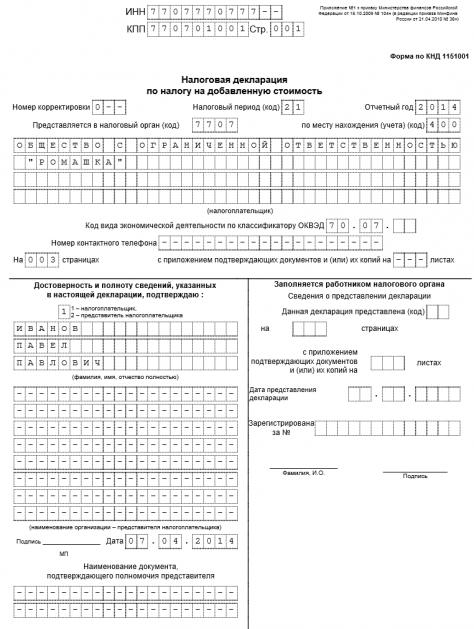

Example: 2014 VAT return

The tax reporting document under discussion begins to draw up a cover sheet. Evidence of registration with the tax authorities indicates that information about the checkpoint and tax identification number is entered first.

The item “Adjustment number” implies a code of delivery of the type of document (in the case of initial submission - 0, an updated document - 1). The codes in the VAT return include a code containing information on the procedure for filling out the declaration during the tax period.

The column “Reporting year” should contain information about the year in which the VAT return is submitted. The form must be numbered, indicating on it the number of the corresponding service that accepts reporting. In this case, indicate the code in the value of 400, it indicates that the taxpayer is registered in the same place where the document is submitted.

Based on the classifier of codes of economic activity this year, they designate OKVED. In the paragraph “Reliability and completeness of the information specified in this declaration, I confirm”, a code is entered, the number of which depends on who signed the document (head of the organization - 1, trustee - 2).

Initials and painting are put down in the column "Signature". If the signature was put by a notarized power of attorney, information about the official paper, which confirms all the powers assigned to the signatory, is reflected additionally in the column “Document indicating the powers of the representative”.

Detailed plan

How to fill out a VAT return on a developed plan:

- the first section displays information on tax amounts that are to be transferred to the state budget or planned for reimbursement;

- OKTMO code is entered in line 010 (since the beginning of this year, OKTMO OK 033-2013 has been in force);

- column 020 - here in figures the type of budget classification is entered in encoded form, it was created for the purpose of calculating VAT (18210301000011000110);

- line 030 records the data in quantitative terms on the tax to be paid to the state treasury; it is calculated independently by entities-entities engaged in entrepreneurial activity that issue invoices;

- column 040 is intended for affixing the amount of tax assigned for payment, as stipulated in article 173 (paragraph 1);

- column 050 records the amount of the planned reimbursement from the state budget;

- final values of 040 and 050 are calculated based on the information in section 3.

How to fill out a VAT tax return for tax agents for whom the second section of the document is provided? Consider an example. The VAT return is as follows:

- line 010 is intended for affixing a code of the reason for registration with a branch of a foreign organization that monitors the payment of tax fees and submits financial documentation;

- line 020 displays the full name of the subject of foreign business, which is not considered in the tax authority;

- in line 030 enter the TIN of the subject;

- line 040 sets the code according to the budget classifier;

- line 050 is the code for the classifier of territories of municipalities;

- in line 060 write the final calculations for VAT, intended for payment by a tax agent;

- line 070 is used to affix the code of activities carried out by the entity, which must calculate and pay tax fees;

- line 080 shows the amount of VAT calculated by the agent in the current tax period;

- line 090 records the amount of tax deductions that are calculated against future transactions for the sale of goods (services, works).

There is a point at which it is necessary to focus attention when formulating a VAT return for 2014. The form may be filled out with changes in some cases. If there is no data on column 080, then the value of column 090 is written to 060. If there is no data on column 090, a value from 080 is written to 060.

The third section shows the rates of the tax itself, its base, the amount of tax already accrued, the volume of all refunds. The submission of a VAT return implies only the correct execution, which should look as described below.

- the payer must indicate his checkpoint and TIN;

- 010-040 displays data on the amount of tax at a certain rate and on the tax base determined by Articles 153-157 and 159 of the Tax Code;

- 010, 020 - lines for amounts taxed with 18% and 10% rates. The data is calculated by multiplying the numbers c. 3 of the third section by 10 or 18 and dividing the total by 100.

Section plan for the third section

- To calculate 030, 040, the values of paragraph 3 of Sec. 3 by 18, then divided by 118 (if necessary, 18 is replaced by 10, 118 - 110).

- 050 - the tax base and the calculation of VAT are put down here when the company is sold as property.

- 060 - this item records data on the tax base and its amount accrued during the installation and construction works for personal purposes.

- 070 - here the amounts of payments are entered into account of upcoming trade transactions; here the successors record information on various payments in respect of the planned implementing operations.

- 080 - contains information on accruals related to the payment of proposals, which contribute to an increase in the tax base (Article 162).

- 090 - the amount of VAT that must be restored. Also in 090 and 100 they enter data on the amount that was declared at the time of purchase and before it was accepted for deduction, it should be restored during transactions subject to 0%.

- 110 - data on the calculation of VAT that are presented to the client when he transfers the payment.

- 120 - the general calculation of value added tax is entered here.

- 130-210 - VAT amounts determined for deduction. Important note: in line 200, the seller puts down the data recorded in paragraph 070 of section 3. Also here are the amounts accepted for deduction from the successor to the title, and calculated by him from the volumes of various payments.

- 210 - values are entered by the buyer, obliged to pay tax. This is information about the values of deduction and crediting to the state treasury.

- 220 - here the result of adding points 150-170, 200 and 210,130 is recorded.

- 230 - data on the final amount payable, calculated over the entire section.

- 240 - the final amount calculated to decrease in the current section.

The fourth section contains information on actions that are not subject to the burden of taxation, or the rate on which is zero.

Fill rates

- Column 1 contains operations in the form of codes.

- Column 2 prescribes tax bases regarding codes for which the rate for the reporting period is zero.

- Column 3 shows information on deductions from operations from items 1 and 2.

- Column 4 is intended to derive the amount of VAT relative to each code.

- Column 5 contains data on tax assessment that were previously deductible for actions that did not have documented reasons for the rate of 0%.

- The tenth line displays the entire tax amount that is deductible (third column + fourth column - fifth column).

Filling out the fifth section is necessary if the organization receives the right to include tax amounts with a documented zero rate in tax deductions.

There is a certain system for filling this section.

- Column 1 carries information about the operation code.

- Column 2 shows the taxes for each process, and a confirmed zero rate is required.

- Column 3 reflects the tax amount for all transactions.

- Column 4 contains tax bases for each code.

- Column 5 records the tax volume at unreasonable zero rate codes, which appeared in the period indicated in the declaration, the right to deduction.

Section six is executed if the organization carried out activities with an unconfirmed justification of taxation with a zero rate.

Decor:

- Column 1 - information about the codes of operations.

- Column 2 - for each action, the tax bases are displayed separately, as indicated in Article 167 of the tax legislation.

- Column 3 contains a mark on the amount of tax.

- Column 4 contains information on sales deductions for all codes for which zero rates have no confirmation.

- The results for columns 2, 3, 4 are entered on line 010.

- If the data in columns 3 of line 010 is greater than the data of columns 4 of line 010, line 020 is filled.

- If the situation is the opposite of the above, fill in line 030.

The seventh section contains information on actions that are not subject to taxation, or exempted from tax liability, and on foreign transactions.

- 1 column 010 - information about the codes of operations.

- 2 columns 010 - the cost of proposals that are not subject to VAT and are sold abroad.

- 3 columns 010 - the price of material acquisitions or services to which VAT is not applied (with respect to each code).

- 4 columns 010 - information on tax amounts that were received when paying commercial offers.

- The 020 line documents the amount of payment (or advance payment) for commercial offers that have been produced (carried out) for more than six months.

Responsibility for submitting inaccurate information

The basic rules for preparing tax documents for submitting a report to the relevant authority were described above. It should be noted that Article 81 of the Tax Code defines actions in case of insufficient data, erroneous filling of sections, other errors.

If deficiencies are found, the organization is required to submit a VAT return in an updated version. In addition, a fine and arrears are levied in favor of the state for filing the “clarified”. The base of the tax legislation of our country provides for cases when an entity obliged to pay taxes has a chance to get rid of responsibility for providing accurate reporting.

In what cases can responsibility for the clarification be avoided?

- The tax payer managed to submit the specified information before the tax inspectorate informed him of the fact of the discovery of the process of understating the tax amount that was established as payment, or before the notice of the beginning of the financial audit of the situation.

- The residual amount and interest were paid prematurely until the moment when the clarification was submitted to the tax authorities.

Features of filing revised declarations

First of all, it should be noted that the "clarification" must fully confirm the correct information. It is also necessary to take into account the fact that the VAT return tax period for each payer does not provide for the same amount of time.

All data must comply with legal standards. Tax agents may reflect the data of those taxpayers who have found errors or distortions.

In general, there are two main reasons for the need to submit specified information: underpayment or overpayment. In case of underpayment of tax by the organization, it is obliged to enter clarifying information. But if the error was discovered by the taxpayer after the submission of the declaration and did not lead to an underestimation of the tax base, then the obligation to correct information from the organization is removed.

For a refund to the tax authority in case of an overpayment, there is also no need to submit a clarification. This is regulated by article 78 of the tax law. But at the same time it must be said that the tax authorities are very responsible in returning funds, and are trying to confirm the fact of overpayment by an updated declaration. , , "" - .

, ( 210 ). .

, :

- , 145 .

- , .

- , ( ) , .

, .

. , , ; - . , , .

- . , «», , . - . -, .

Another copy is sent to the control book of received invoices and recorded in the purchase journal. These rules are established by a decree of the Government of the Russian Federation adopted in December 2000 (No. 914).

It is necessary to pay attention also to the fact that in the above version the invoice is not issued by the selling entity, therefore, an application for deduction from the advance amount that has been transferred is not allowed. You can only use your tax advantages when the advanced products are finally registered.

We hope that our information will help you calculate the VAT correctly and correctly fill out the declaration.