When buying real estate (cottage, garage, room, apartment) or land, paying off a mortgage loan, an individual who is a payer of income tax has the right to use the property deduction and return part of the tax payments.

What deduction is called property

For the refund of a part of the income tax upon the acquisition of real estate, the Tax Code provides for a property deduction, which reduces the total income of an individual. Property deduction may be equal to the value of real estate, but not exceed the amount of two million. For a mortgage, a deduction of three million is applied to interest. Any individual paying income tax at the established rate of 13% has the right to such a refund.

How to use a deduction and tax refund

In order to receive a deduction, it must be documented in the regional tax authority at the place of residence. Supporting documents can be a contract of sale, a mortgage, a certificate of ownership. In addition, you need to fill out and submit a personal income tax return3 and a tax refund application for property deduction. Despite the taxpayer’s method of tax refund, the package must be returned to the taxpayer. After receiving the notice, the individual can take advantage of the deduction through his employer or fiscal authorities.

In life, situations often occur when property is acquired in joint ownership of spouses. In such a situation, both family members can exercise the right to property benefits, but for this they must distribute their share of participation.

How to fill out an application for the return of personal income tax, property deduction from the employer

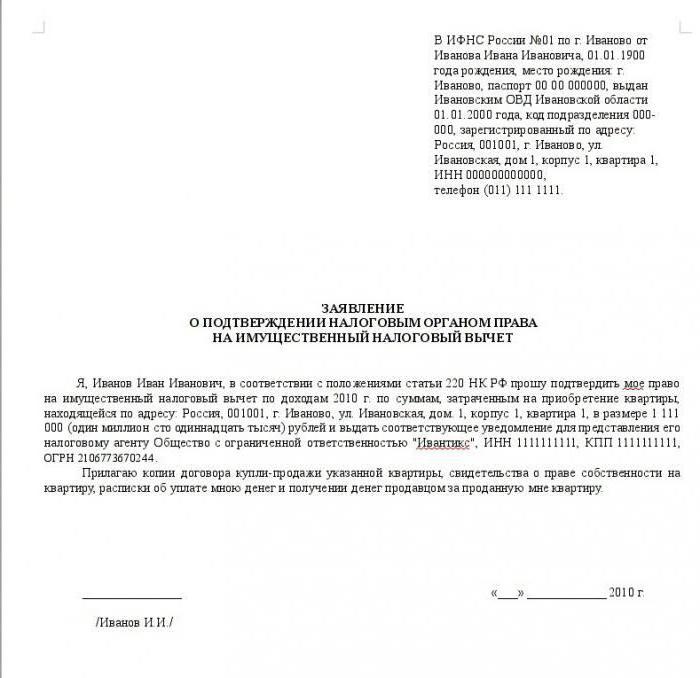

To qualify for a deduction from the employer, you must request a special notice in the tax. The procedure for obtaining such a document will be as follows. The taxpayer fills out a tax refund application for property deduction and submits it to the supervisory authority for consideration. After thirty days, the tax issues a notice that must be provided to the accounting department of the enterprise. The provision of the deduction starts from the moment the notice is issued, in other words, the income tax will be reduced in the nearest wage. The tax refund application for a property deduction, the sample of which is posted below, has a rather simple form of filling.

A document is addressed to the head of the tax inspectorate to which an individual applies. In the “heading” of the application, it is necessary to fill in the personal data of the taxpayer, address and telephone number. In the main part of the document, the applicant asks to confirm his right to use property tax benefits and issue a notice to reduce the amount of a particular employer. An application for a tax refund for a property deduction is signed by the applicant, and copies of documents confirming the right to property and settlement documents are attached to it.

Can I submit an application by mail

The legislation establishes a certain procedure for submitting documentation to the IFTS. In order to submit an application for a tax refund in case of a property deduction, it is not necessary to personally report to the supervisory authority. The easiest way to send documents by mail is a valuable letter. Upon receipt of correspondence, the tax authorities will send a notification form with a note on acceptance of the documentation. This method significantly saves time. After considering the application, the Federal Tax Service Inspectorate will inform you when you need to arrive and pick up the notice for deduction.

Individuals quite often use property deduction to reduce income tax rates. The total amount of the return can be 260,000 rubles, and this is not an extra money. In recent years, such a deduction has become more accessible by simplifying the return procedure.