A bank guarantee is one of two options by which suppliers working in the public procurement system can enforce the contract. The document guarantees that in case the contractor evades duties, the bank will reimburse the customer for the losses associated with this. In practice, it sometimes happens that a supplier obtains a non-genuine or low-quality bank guarantee. However, if you know all the criteria that a proper bank guarantee of a contract must fulfill, this can be avoided.

Why exactly the guarantee

The bank guarantee is a very convenient tool, first of all, for the suppliers themselves involved in procurement under the law 44-FZ. After all, an alternative to it is only direct transfer of money to the customer’s bank account. This means that funds are withdrawn from the organization’s turnover for the entire duration of the contract, which inevitably entails lost profits. You will also have to pay for a bank guarantee, but this amount is not so great. Therefore, most performers in the state procurement system prefer not to provide their obligations with their own funds, but with a bank guarantee.

At its core, a 44-FZ bank guarantee protects the interests of the customer. At the same time, it is a tool that serves as protection for the supplier. Moreover, from the customer himself, more precisely, from his desire to set fines and penalties for minor violations for the contractor. After all, getting money under a bank guarantee is much more difficult than keeping a fine from collateral made with "live" money.

The risks of poor warranty

You can get a guarantee directly at the bank or through intermediary brokers. And in that, and in another case, there is a risk of getting a poor-quality guarantee. For a supplier, this can mean not only lost time and money, but also a lost government contract, as well as the acquisition of the status of an unreliable counterparty.

The most obvious risk is getting a fake warranty, but this is not the only danger. Sometimes banks try to cheat and prescribe in the text favorable conditions for themselves that are unacceptable in the framework of securing a state contract. An inexperienced supplier may not notice this, and then face the fact that the customer will not accept the guarantee.

Thus, both the customer and the supplier are interested in checking the bank guarantee. The first must make sure that the customer does not reject the guarantee, and the second is obliged to check it in accordance with the law. How to do it? There are several ways, and you need to use them comprehensively.

Right bank

Rule No. 1: only a bank can issue a guarantee. No other organization, including microfinance, can do this. Rule No. 2: to guarantee the state contract, a guarantee is not accepted of any bank, but only those specified in a special list of the Ministry of Finance. Verification of a bank guarantee before it is received is as follows. It is necessary on the ministry’s website to find a list of banks that are authorized by the agency to issue guarantees for state contracts, and make sure that the selected credit institution is included in it.

If the bank of interest is found in the list of allowed, this is a good sign, but not yet complete success. Now you need to turn to the Unified Information System (UIS) on the public procurement website. It is worth checking here how often the bank in question issued guarantees that were not accepted by customers. This can be done in the Unified Register, which reflects all guarantees issued by banks. Later we will come back to him when we talk about how to check the bank guarantee after issuance.

So, in the registry you can use the filter "Refused" and analyze the results for 2-3 months. It is hardly worth contacting a bank whose guarantees are rejected by customers every now and then.

Document Content

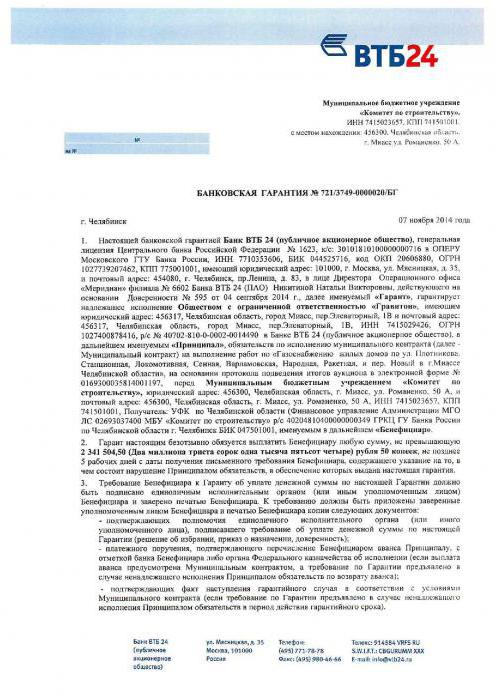

Before signing a guarantee agreement with the bank, you should familiarize yourself with its contents. The text must necessarily include certain provisions, without which the customer will not be able to accept it. A complete list of such conditions is contained in parts 2 and 3 of Law 44-FZ. Among them are: the amount and duration of the bank guarantee, the condition of its irrevocability, the obligation to pay a penalty for late payment, and others. The guarantee must be issued on the letterhead of the credit institution.

Particular attention should be paid to the following points. The guarantee should indicate that the bank is obliged to indemnify in full, and not only in the part not covered by the penalty. Losses must be indemnified for any failure by the supplier to fulfill its contractual obligations. At the same time, the bank should not require the customer to provide court documents as evidence that the contractor neglected his obligations. This is important, because not every case of termination of a contract comes to court.

What else to look for

As with any transaction, when concluding an agreement with a bank, you need to focus on average market conditions. Therefore, it is worthwhile to study the proposals of several credit organizations in order to understand how long a bank guarantee is usually issued and how much it costs.

A bona fide guarantor will require the company to submit at least constituent documents, tax and accounting reports, and procurement information. The study of these data takes several days, so the warranty is usually issued within a week. If they promise to give it to you already today and / or ask for a minimum set of documents, then such a proposal looks extremely suspicious. You should also be wary if you are asked to pay for the guarantee not at the bank, but at the details of a third party.

Warranty issued: check the entry in the Register

If the preliminary work is carried out carefully, then this significantly reduces the chances of getting a "fake" or poor-quality guarantee. However, it’s too early to relax. After receiving the document, you need to check it in the Register of Bank Guarantees, which was mentioned above. This applies only to guarantees that are issued to ensure the execution of contracts under the law 44-FZ.

The guarantee must appear in the register no later than the next business day after issuance. The obligation of the placement is assigned by law to the issuing bank. Verification of a bank guarantee in the register is carried out by the name of the guarantor or supplier, the contract number or the purchase code. As a result of the search, information about the guarantee should be displayed on the screen, and the status “Posted” should be on the left side, where its amount is indicated.

No warranty: what is the reason?

In rare cases, there are delays in the placement of guarantees associated with the malfunction of the UIS website. But anyway, if tomorrow the guarantee is not in the registry, this is a very bad sign. Indeed, in this case, the customer will consider that the winner of the purchase has evaded his duties. The customer will not be able to sign a contract with such a supplier, otherwise he himself will break the law.

If checking the bank guarantee on the government procurement website yields a negative result, you should first contact the bank that issued it. Perhaps there was some misunderstanding - in which case it should be resolved as soon as possible. If it becomes clear that the guarantor is acting in bad faith, you should file a complaint with the Central Bank.

Verification of a bank guarantee through the CBR

So, with guarantees under the state order, everything is quite simple, since there is a special registry. But with corporate and commercial tenders, the situation is somewhat different. Banks have no obligation to publicly place such guarantees, so they will have to act on their own.

A preliminary check of a bank guarantee can be carried out on the website of the Central Bank. Thus, you can make sure that the bank in principle issues guarantees. To do this, select the “Information on credit organizations” section and look for a guarantee bank in the directory.

Immediately after the search, the status of the banking license will be visible. By clicking on the name of the bank, you can see a list of its financial documents by year and month. You should open the document “Revolving statement data” at the last available date. Next, in the “Off-balance accounts” section, find account 91315 - it is on it that banks display data on guarantees. The values on this line must be non-zero, and the revolutions are comparable with the amount of the guarantee.

Of course, this is only a superficial analysis - you won’t get accurate information about the authenticity of your guarantee. To do this, you must officially contact the bank that issued the guarantee with a request for confirmation of its authenticity. A similar request can be submitted to the Central Bank of the Russian Federation.

Conclusions and Tips

So, it is not difficult to verify a bank guarantee under 44-FZ, or rather, the very fact of its issuance. However, it is equally important that it be correctly drafted and include all the necessary conditions. A poor warranty can have very unpleasant consequences for the supplier. Moreover, applying to another bank for a new document is the smallest of them.

Therefore, experts strongly recommend that individuals who apply for bank guarantees to ensure a state contract familiarize themselves with the provisions of article 45 of the said law on public procurement. It is not difficult to understand all the intricacies of this legal norm, however, this will prevent the receipt of a document that is incorrectly prepared.