Today, in the era of computer technology and the information boom, Internet wallets are a fairly popular topic of discussion. The fact is that doing any work and getting paid for it has become real and without getting up from your own computer. (Subject to an Internet connection). Of course, if there is earnings on the Internet, then there must be a conclusion to the wallet of this earnings. This article will describe in detail what electronic wallets are, their varieties, features, about making money on the Internet with a withdrawal to a wallet and about ways to withdraw earnings from electronic wallets. So, more details.

What are online wallets

In essence, an electronic wallet is a digital payment system platform. Roughly speaking, a digital currency is the same currency as the dollar or the euro, but just after the fact you can’t remove it from the ATM and put it on the shelf, because it is digital. Many transactions and transfers today are carried out directly on the Internet and without reference to cash settlement. For online currency, you can make purchases of things at different sites, book tickets for air transport and even buy products in online stores. This is very convenient, and in many aspects makes online purchases and transfers easier.

Why e-wallets are becoming more and more used

For more than 15 years, users have been earning money on the Internet and using wallets to withdraw their earnings. In addition, making many purchases every year becomes more and more real and convenient with the help of electronic wallets. It is much easier to get it on the Internet and make transactions using it than to use bank cards and terminals, in which you need to coordinate the ratio of currencies and exchange rates, pay large commissions and pay taxes on the income of individuals - entrepreneurs when the funds arrive in your bank account. In addition, after the release of various mobile applications for smartphones and tablets, it became possible to use Internet wallets while sitting in a cafe or driving a car.

It is worth noting that experts and experts in the field of electronic currencies argue that, most likely, the use of cash payments and banking systems will become unnecessary over time thanks to electronic wallets and digital payment systems.

Varieties

Today, digital payment systems can be found on the Web quite a lot. The most common and used are online wallets: Qiwi, Yandex.Money and WebMoney.

Also, due to the growth of cryptocurrencies, electronic wallets for Bitcoin, Ethereum, Ripple and other cryptocurrencies are becoming widely known.

Really a lot of wallets. But all the functionality and use are identical. Having received a certain amount of money, let’s say, on a Qiwi wallet via the Internet, you link to your account an account with the currency in which the funds were earned. After that, “Internet money” is credited to this wallet account. In the Qiwi wallet, rubles are most often used, as well as on Yandex.Money. On WebMoney, for example, the list of digital currencies is somewhat larger. But the whole point of an online wallet is that with the help of exchangers, the currency from an electronic wallet can be converted into the currency of any other electronic wallet.

Because of what they appeared

Many trading platforms and sites for earning freelancing work specifically with electronic wallets. It is almost impossible to meet direct conclusions from such sites on a bank card. In order to make this possible, the developers of such sites need to coordinate many laws of different countries, take into account various aspects of taxation and obligations of those involved in entrepreneurial activities. Besides the fact that it is not so simple and needs professional legal skills, it is also very expensive, because registering as an entrepreneur and paying a lot of taxes for your entrepreneurial activity in different countries is really a lot of money. That is why electronic wallets appeared. Now it becomes much easier to withdraw your earnings with an online wallet.

States and e-wallets

A few words about how states are trying to influence electronic payment systems. The fact is that uncontrolled money transfers are not welcomed by many countries due to the fact that such transactions are not taxed. In addition, many criminal states use electronic wallets for the reason that it is impossible to track the route of funds and persons who carry out these transfers. In this regard, many states are trying in every possible way to influence the development of many electronic payment systems by banning the use of a particular electronic payment system or vice versa, giving the go-ahead on the terms of cooperation and full verification of all wallets. That is why, in order to use such an Internet wallet as WebMoney, first you need to verify your account by sending the administration of this system your personal data. Only after verification procedures does it become possible to use one or another electronic payment system with full functionality.

Personalization

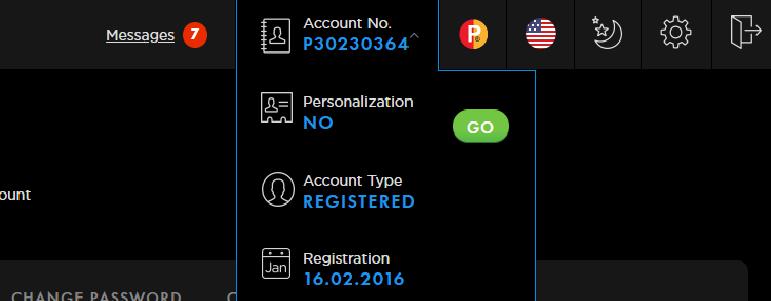

Due to the state’s attempt to influence the sphere of transactions through electronic wallets and due to the desire of owners of digital payment systems to secure all electronic payments of their wallet systems, the personalization procedure has recently begun to gain popularity. The essence of this procedure is to assign to a specific profile of the electronic wallet its specific owner. And enter into the database all the necessary information about its owner. For example, for residents of Moscow and the Moscow Region this option is already provided for Kiwi owners, so that the withdrawal of earnings on the Internet to Kiwi Wallet becomes not only safe, but convenient and fast. For personalization, you must contact any branch of Intercom to fill out the questionnaire and link the basic data to the wallet profile. Representatives of the Qiwi e-wallet system claim that personalization will soon be available for other regions and countries. In addition, many systems are starting to implement a program for verifying and personalizing user profiles.

Features of electronic wallets

Another feature of using electronic wallets is the lack of the need to leave your personal data in your profile. Wallets such as Qiwi, Payeer, Blockchain, and many others do not need verification.

For example, Yandex.Money does not need to send your personal data if you are not going to make transactions for more than 15 thousand rubles a day. But if you are going to work with larger amounts and you have an Yandex.Money online wallet, for example, then there is a need to verify your profile. It will be necessary to send passport data and a statement on the verification of the site administration. This is necessary in order to maximize the security of both your transactions and those who will make transfers with you.

How to use an electronic wallet to withdraw your earnings

For greater clarity, consider how to withdraw earned funds via the Internet using the Kiwi Wallet. After you have registered, created an account on QIWI and received funds, you need to find a suitable exchanger.

There are a lot of sites that exchange electronic currencies. Each exchanger has its own list of electronic currencies with which it works, and a list of exchange rates. The whole point of exchanging currencies on such sites is that you transfer a certain amount from your Qiwi to Qiwi, the amount indicated on the exchanger’s website, after which, at the site’s rate, money is transferred from the bank account of the same site’s bank exchanger respectively. Thus, bypassing many commissions and fees, you can transfer electronic currency into real money into a bank account.

Virtual and plastic cards of payment systems on the Internet

It is worth noting that some large electronic payment systems cooperate with banks in many countries. Therefore, they provide the opportunity to order a virtual or plastic card to pay for services through the terminal or withdraw funds from ATMs. But there are a number of problems in this matter. Firstly, not all banks agree to cooperate with e-wallet systems, as these are their direct competitors and it is not entirely advisable for the banking system to allow e-wallets to be distributed among the population. Therefore, far from all ATMs there will be the possibility of withdrawing money from the card to which the electronic wallet is tied, or there will be such an opportunity, but with large commissions. Secondly, such a card itself is not issued free of charge, and along with mailing, receiving such a card will cost a lot of money. In addition, for security reasons, such cards are not issued for long periods. Therefore, every six months or a year to buy expensive cards with the probability of charging large fees at ATMs is not entirely advisable.