There are a lot of options for investing free cash. Along with risky stock and foreign exchange markets, mutual funds there are also risk-free bank deposits and savings certificates. Credit institutions also offer their customers deposits in gold.

Kinds

Metal accounts are divided into two types: safekeeping accounts and depersonalized metal accounts. In the first case, an individual buys a bar of gold and transfers it to the bank for storage. In the second case, the invested funds are simply tied to the virtual metal. The value of the deposit changes in the same way as the gold rate.

Buying an Ingot

This type of investment is accompanied by the execution of a package of documents. In particular, a certificate is issued to the client (f. 377-k), which indicates all the information about the investment: the number of ingots, their weight, sample, lot, price per ounce. It will be possible to sell bullion in the future only upon presentation of this receipt. It is interesting that on the Russian market, not all banks involved in the sale of ingots buy metal from customers. Moreover, when selling “foreign” metal, the bank requires confirmation of ownership (the very receipt 377-K). Although the situation is not so critical. In Ukraine, for example, banks redeem “foreign” bars from 20-30% discounts. This category includes metals that have the name of the bank in the inscription.

Features

Ingots must be stored correctly and safely. It is not safe to leave an ingot at home also because not every bank is ready to buy a “foreign” ingot. The bank charges an additional fee for the storage service. Imprints, burrs, scratches immediately reduce the cost of the product upon sale. The presence of serious defects may cause a refusal to purchase.

Ingot must be stored in plastic or plastic transparent packaging. You must also immediately find out whether the type of packaging affects the purchase / sale of metal. Some banks only buy bullion in their original packaging. Damage to containers also entails a reduction in the value of the ingot. According to bankers, in this case, the metal loses its attractiveness. The bank may refuse to accept such ingots, since the question of their further sale causes a lot of problems. Although some institutions in this situation redeem the bullion at the price of scrap.

Deposits in gold are not insured. In case of bankruptcy of a financial institution, the client will not be able to return their funds.

When buying and selling an ingot you will have to pay VAT. If the selling price will grow rapidly, then in a few years the profit from the sale will cover losses from the non-refundable tax. You can save on tax by buying metal coins. Their price depends not only on the cost of the metal, but also on international quotations and exchange rates. Investing in coins is more profitable than in metal.

Spread

It is clear that the price for the purchase and sale of metal will be different. The real spread in the market can be 13%. But there is high competition in the banking sector. Therefore, the difference in price can reach 30%. The purchase price, contrary to popular myth, in the Russian Federation is not very different from the world. The difference is 2-3%.

The presence of the quality mark: Argor, Degussa, Umicore also affects the cost of the ingot. This stamp certifies a metal sample and identifies the manufacturer. The latter refers to refining companies recognized as suppliers of the London precious metals market. This reputation has 25 of the 60 companies in the world. The highest class status is assigned by the London Market Participants Association (LBMA).

Compulsory medical insurance

MHI is an alternative to the stock market. A customer buys a virtual precious metal. All information about the investment is displayed on an impersonal account. The owner can make a profit from the resale of the "bullion" or in the form of interest on deposit. The bank does not hand over to the client the metal, but the documents confirming the right of ownership. The contribution is made out not in monetary terms, but in grams. With the right approach to investing, a contribution to gold in a year can bring up to 50% of the profit. But for this you need to focus not only on bank interest, but also independently analyze the market.

The nuances of investing

First of all, you need to choose the type of account. It is better to open term deposits in gold with interest accrual than ordinary ones. Even if the price of a metal rises significantly during the term of the contract, you can always terminate the contract ahead of schedule, having lost a part of the interest.

Interest is subject to personal income tax (13%). If the client takes the deposit in the form of cash, then the bank takes over the functions of the tax agent in calculating the amount of the fee and transferring the funds to the budget. If the client takes the metal bar, then he will have to file a tax return and pay the fee.

Deposits in gold Sberbank

Sberbank was the first to offer deposits in the Russian OMS market. At that time, gold, silver and platinum ingots of different weights (from 1 gram to 1 kg) were on sale. The demand for fine metal was so high that there was simply not enough ingots.

And today, the country's largest financial institution also provides services for opening and maintaining metal accounts. Sberbank provides deposits in gold by no means in all regions and branches. Therefore, the first thing you need to find on the bank's website is a branch that works with CHI. To conclude the contract, the client must provide his passport.

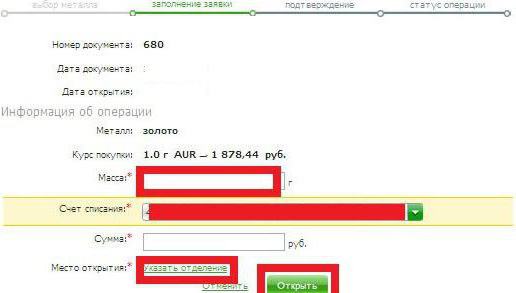

Sberbank also implements gold (metal deposit) upon receipt of an electronic application from the Internet banking system. For its registration, you need to log in to your personal account, go to the "Deposits" section, select the "Open an account" item, indicating the type "Anonymous". At the next stage, you need to select the type of metal, indicate its mass and account number for debiting funds. So, through the Internet, Sberbank makes a contribution to gold. The course is affixed automatically taking into account quotes. To confirm the application, you need to click on the "Open" button, check the correctness of the specified data and "Confirm" the questionnaire. You can also manage your account through your personal account.

The price of metal deposits

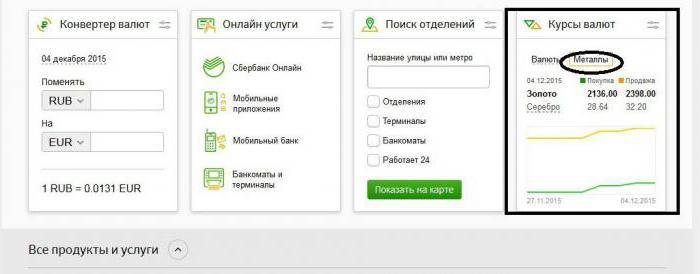

The gold rate today and for any period of the past can also be viewed on the bank's website. To do this, on the main page you need to select "Quotation", the value "Metals" and indicate the time period of interest. If you wish, you can also see the price archive. The bank does not charge interest on compulsory medical insurance. Profit is formed due to rising metal prices.

Benefits

- Virtually no cheaper metal deposits. Gold in the long run is growing in price. Demand for this investment increases dramatically during times of crisis. People are trying to save their accumulated funds by investing in reliable financial instruments.

- When closing the account, the client can receive a gold bar or the value of the deposit in monetary terms. But in this case, you will have to pay VAT in the amount of 18% of the deposit amount.

- On ordinary accounts, profit is formed when prices rise.

- A purchase and sale transaction is executed instantly, without additional operations. There is no charge for opening and maintaining an account.

- Even an underage citizen can open an account (up to 14 years old - with the permission of the parents or guardian).

Banks that offer deposits in gold can suffer only one type of risk - a physical deterioration in the quality of the metal. Gold, like any other metal, is subject to physical wear and tear. Even the fulfillment of all metal storage requirements cannot save from this. In the long run, the price of gold is constantly increasing. The depreciation of the dollar, the main world currency, stimulates central banks to replenish their foreign exchange reserves.

Conclusion

Trading on the market is not for the faint of heart. In the long run, gold can bring real income. It is profitable to invest in bullion, each investor decides for himself. Other things being equal, a contribution to the CHI will bring more profit to the investor than buying an ingot.