A letter of credit is a financial transaction in which an order is issued to a payer bank in the direction of the beneficiary's bank. Bank manipulation is carried out on the initiative of customers, on their behalf in accordance with the partnership agreement. The order consists in making payments by an individual or legal entity within the agreed conditions by order.

Examples of banking operations

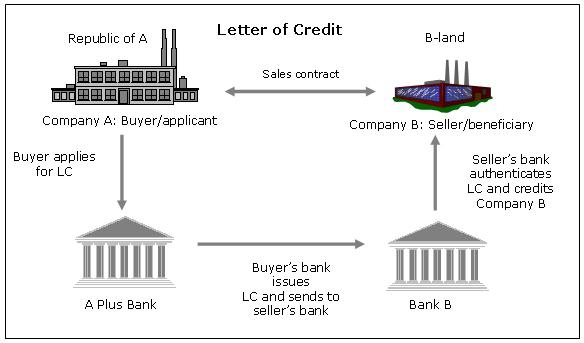

Having studied the concept and types of letters of credit, we dwell on the fact that this format of mutual settlements through the bank has both positive aspects and its drawbacks. The letter of credit can be called a conditional monetary obligation, which is accepted by the bank at the direction of the principal, in accordance with which the financial institution assumes the obligation to make payments to the beneficiary in the amount specified in the documents. This determines a high level of security and guarantees that none of the parties will be cheated. You can describe the situation more simply. For example, one company wants to purchase a specific product from another, but because of the risk, it does not want to pay for it right away. In this situation, the buyer asks the bank to pay for the goods for him, providing him with a receipt that payment will occur later, upon receipt of the goods. The bank transfers a certain amount of funds to the seller, and then, based on the receipt, collects funds from the buyer. Settlements with the bank and between the parties in this format are known as settlements by letters of credit. The types of letters of credit determine the individual subtleties of partnership between 4 parties.

Letter of credit as a form of minimizing risks

In the formation of partnerships between an entrepreneur and an organization, as well as between private individuals and individual entrepreneurs, there is a high risk of losing money or goods at the conclusion of the contract or at mutual settlements. The types of letters of credit presented in the banking sector allow avoiding significant losses when conducting transactions for large amounts. Risk minimization is due to the fact that any financial process under the letter of credit is implemented under tight control at the same time by two banks. Failure to comply with the terms of the contract with each of the parties is completely excluded. The supplier of the product, in fact, like its buyer, simply cannot fail to fulfill their obligations under the partnership.

Types of letters of credit

When using letters of credit for settlements, it is extremely important to choose the appropriate type of operation. Opening of the latter is carried out by the bank solely at the direction of the payer, therefore, the choice regarding the format of the transaction remains with the payer. Information regarding the proposed subtype of a banking transaction is entered into the contract. In accordance with the standards of the Central Bank of the Russian Federation, it is customary to distinguish the following types of letters of credit:

- Covered, or deposited.

- Uncoated, or guaranteed.

- Revocable.

- Irrevocable.

- Confirmed. It can be both revocable and irrevocable.

Covered and uncovered banking

Deposited and guaranteed transactions are the most common settlements by letters of credit. The types of letters of credit determine the specification of the operations themselves.

- Covered operation. In this situation, when opening a letter of credit, the issuing bank transfers funds to the payer's account for the entire size of the letter of credit. This is called coating. Funds are transferred to the disposal of the contractor's bank for the entire term of the contract.

- Uncoated operation. A guaranteed banking operation provides for the transfer of funds by the issuing bank when opening a letter of credit. The executing bank is simply granted the right to debit funds from its account within the framework of the value of the letter of credit. The procedure for debiting funds from a correspondent account held with the issuing bank is determined by special agreements between financial institutions.

Variations of a confirmed banking transaction

A confirmed letter of credit, the types of which may differ depending on the specification of transactions (revocable and irrevocable), is a letter of credit, in which the executive financial institution assumes obligations to make payments regardless of the fact of transferring money from the bank where the confirming letter of credit was issued. The procedure for agreeing on the nuances of the operation is determined by interbank agreements. The answer to the question of what combination of types of letter of credit is impossible lies precisely in the above definition. Other tandems are simply unacceptable.

Revocable and irrevocable operations

It is customary to consider both revocable and irrevocable letters of credit as equally demanded when conducting mutual settlements. Types of letters of credit in this category also have their own specifics.

- A revocable banking operation can be modernized or completely canceled by the issuing bank. The grounds for refusal may be a written order of the payer. Coordination with the recipient of funds in this situation is not required. After the revocation of the letter of credit, the issuing bank does not bear any responsibility to the payer.

- A trouble-free operation can only be revoked if the recipient agrees to change the terms of the partnership and provides it to the executing bank. A partial change of conditions for this category of settlements is not provided.

The recipient of funds for a banking operation has the right to refuse to pay, but until its expiration date and provided that this nuance is specified in the contract. Acceptance of a third party, which is authorized by the rights of the payer, is also allowed by prior arrangement.

Varieties of the main formats of banking operations

Allocate not only the main types of letters of credit, but also their varieties. We can mention the following modifications of the banking operation:

- With a red reservation. This is a contract in accordance with which the issuing bank gives the right to the performing bank the right to make payment in the form of an advance to the supplier of goods. The advance amount is determined in advance and is provided until the moment the service is provided or the goods are shipped. It is these types of letters of credit in international settlements that are most in demand, as they increase the level of trust between the parties.

- Revolving operation. It is a letter of credit, which opens partially on payments under the contract amount. It is automatically updated as it is calculated for each consignment of goods or for a certain volume of services. This letter of credit is ideal for cyclically reducing the monetary volume of a contract for systematic deliveries. Types of letters of credit in this category are popular.

Mutual settlements

When concluding contracts, the agreements must specify the form of mutual settlements, as well as the features of the delivery of goods or the scheme for providing the service. Planned types of letters of credit and their characteristics are necessarily registered in the papers. To avoid problems, papers should contain the following information:

- Name of the issuing bank.

- The name of the financial institution that will service the payee.

- Identity of the recipient of funds.

- The size of the banking operation.

- Types of documentary letter of credit to be used.

- The format of informing the recipient about the opening of a banking transaction.

- The format of informing the payer about the account number, which is intended for depositing money. An account is opened by an executive financial institution.

- The validity period of the letter of credit itself, the timing of the provision of documents and the rules for their execution.

- Transaction payment specification.

Important points

In order for the partnership to be successful, the payer must independently or with the help of a specialist study this format of banking operations, focusing on who uses which types. Letters of credit vary depending on the format of mutual settlements. For a particular case, you need to choose the optimal partnership format. It is worth saying that in case of violation of the settlement format, all responsibility lies with financial institutions in accordance with the law. This is determined by the fact that representatives of financial institutions are especially careful in checking documentation that confirms the delivery of goods, the performance of a certain amount of work, or the provision of services.

Advantages and disadvantages

For this type of cashless payment, both pluses and minuses are characteristic. The positive aspects of the partnership include the presence of a 100% guarantee of payment to the seller of the goods or service provider. The control over the settlement of transactions is carried out by the financial institutions themselves, which eliminates the risk of fraud and the proper fulfillment of their obligations by each of the parties. When conducting a banking operation, due to the delay in payment, the buyer does not withdraw part of the capital from the economic turnover. Payment for goods or services is carried out as if by installments. At the time of signing the contract, the buyer may not have funds in his hands. The same point is also a disadvantage, but already for the seller of goods and the representative of services. They receive money in deferment. It is worth mentioning that the scheme of partnership under a letter of credit is very complicated, it will not work out right away. However, world practice shows that businessmen who once used the offer never use other payment formats. The advantage in terms of high security indicators completely overlaps the complex workflow and relatively high bank commissions.