The banking system of any industrialized country is widespread and inclusive. It is no secret that it is quite difficult to imagine any financial transactions without the participation of banks. Over the past few decades, the banking system has received such a massive development that this has led to an excessive growth of commercial credit organizations. Accordingly, in conditions of a large increase in the number of non-state banks, the need to assign an individual number to each organization has increased.

For this purpose, there is a

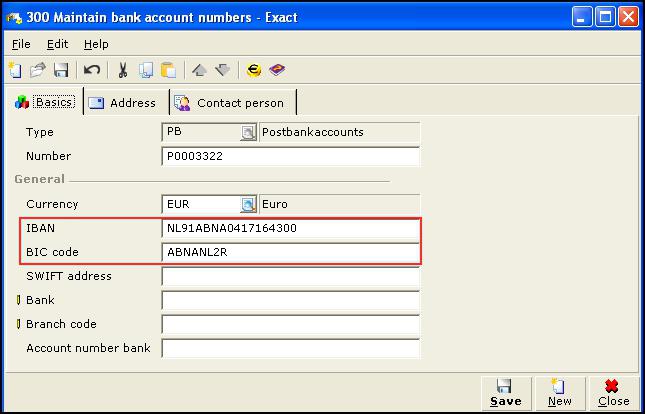

BIC, a bank identification code, by which it will be possible to determine a particular credit institution. Today, knowing

what a BIC bank is, you can find any financial institution recorded in the registry, even if its name is missing.

What is a BIC bank?

What is a BIC bank? Often people who are far from the banking system, when filling out payment documents to pay bills, come across this term and are at a loss. This data is often required when paying bills and transferring funds for services. The identification number is a nine-digit code that must be included in the details of the financial institution, regardless of its time of operation and scale of activity. The nine-digit codes of all banks are entered into a single register maintained by the Bank of Russia, which in turn is engaged in assigning numbers during registration of a credit institution. However, you should not consider the assigned cipher as a simple set of numbers, since each of them will not only allow you to find a bank by BIC, but also provide certain information about a particular institution.

The first two digits represent the code of the country, in this case, the Russian Federation, the third and fourth are responsible for the code of the region in which the branch of the organization is located, the next two indicate the conditional number

of the Bank's

structural unit . From the seventh to the ninth digit, the credit organization’s number is hidden in the Central Bank branch, where a

correspondent account is opened

. At the same time, each of the nine digits will help determine the BIC of the recipient bank if the name of the organization to which the funds are to be transferred is unknown. Foreign lending companies use alphanumeric encoding.

Where is BIC used?

It is unlikely that bank employees will ever ask themselves a question like “what is a bank’s BIC?”, Since it is they who have to work with this set of numbers daily. The use of this cipher is mandatory on all payment documents that have at least minimal relevance to a credit institution. At the same time, most people encounter BIC without paying attention to it, since it is even indicated on utility bills and cellular communications.

What information can I get on the BIC?

Knowing the nine-digit code, you can become the owner of completely comprehensive information about a commercial financial organization, to whose account money transfer is planned. A sample list of useful data is presented below:

- location of the bank and date of its opening;

- the name of the institution itself;

- the correspondent account of a credit institution and some facts from the history of its existence, if any, in the general data register of the Bank of Russia;

- no less important is the opportunity to find out the division of the Central Russian Bank that issued the accreditation to this institution.

How to find a bank by BIK?

Do not think that the search for the required organization is inaccessible to most citizens. Each credit company is not only recorded by its identification number in the register, but is also regularly indicated in a special directory issued by the Central Bank. In addition, if you need, for example, to find the answer to the question of how to find out a BIC of a bank, you can use special online search services located on the official website of the Central Bank of Russia.

How to get a BIC for a credit institution

Not every financial company has the right to be in the banking system, moreover, not every one of them has the right to be called a bank. If the online service did not help you in finding an answer to the question of how to find a bank by BIK, it is quite possible that the organization you are looking for is not in the financial system of the Russian Federation. This is due to the fact that the assignment of an identification number with recording in a single register is carried out exclusively by the Central Bank. The registration process can be carried out only through an official statement with the provision of all the necessary documents confirming the legality of the company. The code is assigned in the order that all banks obey, starting with the first digit indicating the country and ending with the seventh, eighth and ninth digits, which indicate the conditional number of the client’s credit organization, where the main correspondent account is opened.