Electronic payment terminals over the past few years have become widespread throughout the world. But not all of them are as popular as the PayPal payment system . What is it, you will learn from this article.

brief information

PayPal payment system was organized in 1999 by Kiev Max Levchim, who emigrated to the United States. This is a way of making electronic payments, with which you can transfer funds to other accounts, pay for goods and services on the Internet and withdraw money to your bank account. The system also provides a number of additional services: from replenishing a mobile phone account to creating a virtual terminal on the site. Today it has 164 million users around the world who are successfully served in 200 branches and can convert electronic money into 26 different currencies.

Opening an account and linking a card

Registration in the system is free. First, the user needs to choose one and three types of accounts: "Personal", "Premium" or "Business". The purpose of each is clear from the name. Through the "Personal Account" individuals can pay for their purchases in online stores. "Premium" is recommended to sellers with small sales to receive payment for the goods. The Business account offers great opportunities for large companies. For registration, individuals need to specify their e-mail, password, citizenship, address and telephone number, and for legal entities - information about the company.

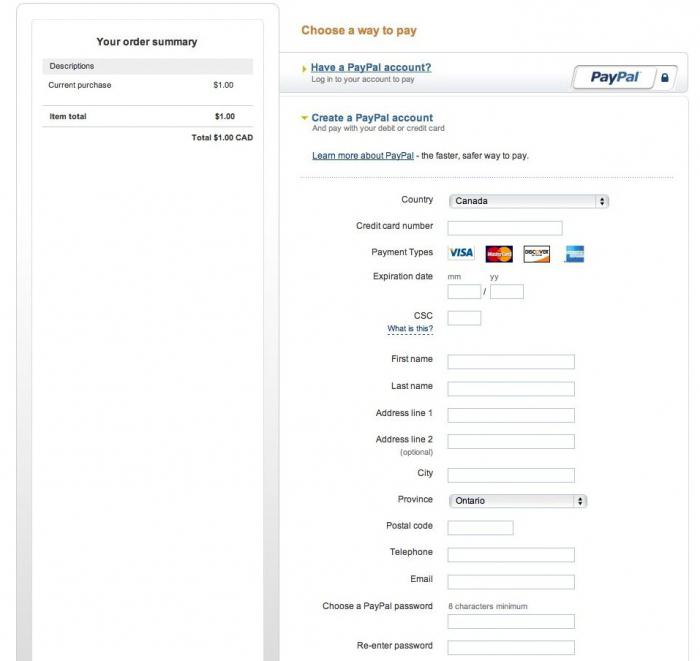

The next step is to attach a credit card such as Visa, MasterCard, Discover, American Express to your account. During this procedure, $ 1.95 will be debited from the account, and three days after checking for the relevance of the cardholder and user data, the money will be returned to the account. During the operation, the system generates a special code that will need to be entered into the account profile. After three unsuccessful attempts, the card will be rejected. For the repeated procedure of linking the card to the account, you will have to contact the site administration. After registration, users will have access to the services of the service. The functionality of the system is different for each country.

PayPal in Russia: prospects and development challenges

PayPal payment system in Russia from September 17, 2013 began to work with rubles. Now, when paying for purchases in an online store through PayPal, Russians just need to indicate the account number and choose the option to write off funds: from a card or from a virtual account. Users can conduct transactions between accounts and withdraw Russian currency to the card of any local bank. Now it's up to Russian stores. The faster they connect this service to their sites, the more transactions will go through PayPal. Representatives of the company are already negotiating with several large Russian online stores on the implementation of the system.

However, users still have problems. Perhaps the only service where the security service quickly responds to a message about an erroneous transfer is PayPal. User reviews confirm this. On the Internet, there is even a detailed instruction on connecting a card to withdraw funds. It is very important to indicate the BIC of the regional bank during the card binding procedure. The user receives further guidance on the action by e-mail.

The PayPal payment system is, first and foremost, the ability to make electronic payments. Although the site administration is taking all steps to increase the security of transfers, there are still complaints about unauthorized access to the account. There are complaints that after some time after making a purchase, SMS from the bank begins to receive information about the withdrawal of funds from the card that was connected to the virtual account. In such cases, it is recommended to immediately open a dispute marked unauthorized transaction. PayPal’s security service responds quickly to messages of this kind.

Belarus - a new market segment

06/17/2014 the list of service countries has been added. The PayPal payment system in Belarus now allows users to make payments not only through bank cards tied to the account, but also through electronic money in the account. Legal entities will be able to use electronic money as soon as any Belarusian bank accepts obligations to repay electronic money issued by PayPal.

How to avoid becoming a victim of scammers

Not only account holders, but also scammers rejoiced at this news. They sent an e-mail message allegedly on behalf of the PayPal administration with a request to immediately update the data in the payment system. When you click on the link from the letter and enter your data, the user automatically loses access to the account and money. In order not to fall for such tricks, you need to carefully look at the sender's address. The security service email ends with "@ paypal.com".

In the meantime, users are actively discussing the issue of how to link MTBank and BPSsberbank cards to an account in the system. There are only two options: wait until the bank activates this option, or use a Russian account. Until recently, owners of virtual accounts from Belarus in their accounts indicated Russia as their country of origin.

What to expect for Ukrainians

PayPal payment system in Ukraine has a number of restrictions. The most important of them is that Ukrainians cannot withdraw money to their bank card. The fact is that the service has not yet received a license in Ukraine. According to Jonathan Romley, vice president of the Avarla campaign, which helps global brands develop the Ukrainian market, the service should not rush to launch in Ukraine. And the matter is not only in licensing. PrivatBank controls half of the market for such services. If he does not want to cooperate with PayPal, then the service will automatically lose a huge market share. But competition is not always an obstacle to market development. For example, in Russia, Yandex.Money did not prevent PayPal from entering the market.

Opening an account and withdrawing funds for Ukrainians

Often you can meet the advice to open an account in the system immediately in dollars, even if you need to make a purchase in a Chinese online store. If there is a need to return the money to your account, you will first have to convert it into dollars, and only then through intermediaries to withdraw to the card. Residents of Ukraine are trying to solve the problem of withdrawing funds in the same way as Belarusians used to: order a Payoneer card with an account with an American bank, but issued with a Ukrainian passport, and then attach this card to a PayPal account. Those who do not want to wait 3 months for a card or risk their money in this way, use the services of numerous intermediaries who convert money to WMZ - the equivalent of dollars in the Webmoney payment system.

Buy on eBay - pay with PayPal

In 2002, the payment system bought an eBay auction for $ 1.5 billion. Most purchases on the site are made through PayPal. There is no commission from the buyer, and the seller will pay 2.4-3.4% + $ 0.3 for the transaction. But users from CIS countries often have problems. For example, if the seller did not specify the method of delivery of the goods to a specific country (Ukraine), the terminal simply will not give the buyer the opportunity to complete the transaction. Here is an example of a different situation. Often, residents of the CIS countries use intermediaries to register at the auction, which provide their services for payment and delivery of goods. In order not to pay an additional fee for a money transfer, users register on the auction website with a delivery address in the USA, and they try to pay for the goods from the account of a citizen of Ukraine. The system also blocks such transactions. There are two ways out: pay a commission to the intermediary so that payments go through his account, or ask the seller to issue an invoice with delivery to Ukraine and agree on any delivery cost. The second option hits the wallet much more than the first.