Opening a map of Europe and choosing a tour to the West, a Russian citizen should know about the Schengen visa. This process takes a certain amount of time and requires knowledge of how to quickly obtain the coveted pass to European countries. Having a Schengen visa, you can visit twenty-six countries where the European agreement is in force.

Also, thanks to the "Schengen" you can visit the countries that are in line for the signing of the Schengen agreement: Croatia, Cyprus, Romania, Albania, Macedonia and Bulgaria. The laws of the Schengen states are very strict regarding formalities. One of the most important points in the list of documents to provide an opportunity to travel to the countries of the community is insurance for a Schengen visa. In this article, we will discuss in detail how to get this insurance.

Why do I need insurance and how to get it?

Europe has always been scrupulous in matters of trade and tourism. The Schengen states have a number of specific conditions for the medical care of citizens who want to enter their territory. Medical insurance for the “Schengen” will help prevent unpleasant situations if a tourist needs treatment in Europe. Everyone knows that the provision of honey. services in the West - pleasure is not cheap. It requires significant material investment. In order to avoid litigation at the state level, the Schengen countries have strictly and clearly outlined how exactly citizens who are going to visit Europe should be insured.

Insurance for traveling to the Schengen area is not only a condition of the embassy, but also the possibility of free assistance in case of an unforeseen situation, such as, for example, an illness. Insurance can be issued at any of the insurance companies in your city. There is a more convenient option: many resort to the help of the Internet and arrange it through the site. To do this, you just need to provide passport details and pay the insurance premium.

It is also worth noting that if you are traveling on a package tour, then insurance for traveling to the Schengen area is easier to draw up directly through a travel agency. Here, the tour operator will take care of everything, you will receive a full set of documents, and insurance will be included in the price of the tour.

If you independently resolve this issue, you need to contact the insurance company, submit the necessary documents and data about which country you are going to and for how long. When choosing an insurance company, you should pay attention to its status - if the company is not accredited at the consulate or embassy, then the documents upon the occurrence of an insured event will be considered longer. Give preference to those companies that are accredited in the places where you go.

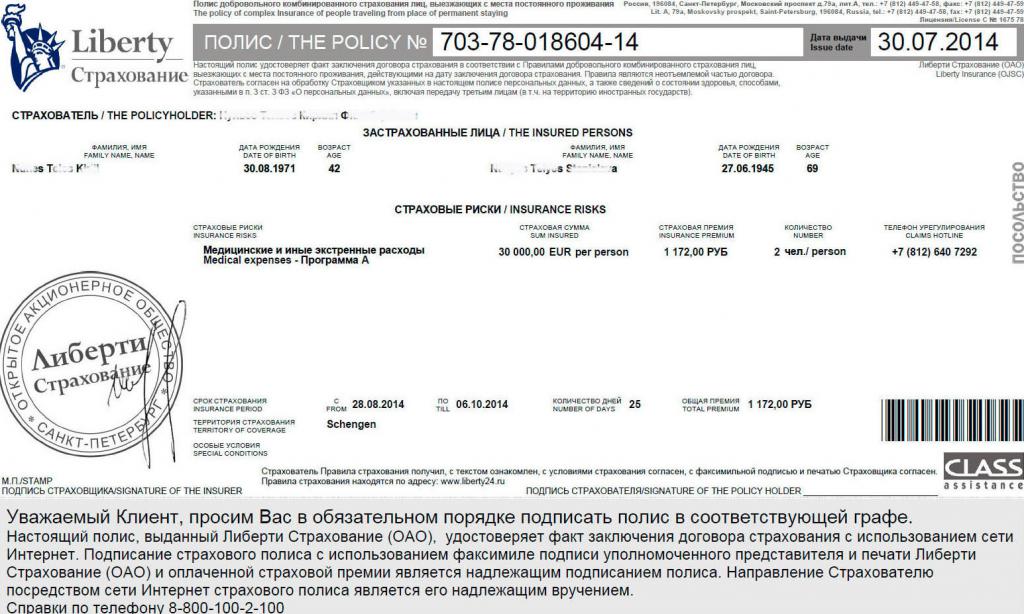

When you register online after filling in the data and payment, you get the so-called electronic insurance policy, which can be printed using a printer. You provide this paper to the embassy, it will be identical to the original.

Travel insurance features

Usually insurance in the Schengen countries has several rates. There are three tariff plans: economy, comfort and premium. Of course, its cost will depend on this. Several factors play a role here: the validity of the Schengen insurance, the amount of compensation that is provided for at the time of force majeure, the age of the tourist, what type of vacation you prefer, health status. The difference between tariff plans in the set of options and services.

In the tariff plan "Economy" the least points. Usually, it covers the amount for moving from inpatient treatment home, forced family visit, stay after discharge (until departure home), legal assistance, early return of relatives, administrative assistance, translator and search and rescue operations. In general, the economy package is the most popular among our tourists, since there are still a lot of options. If you go, say, to Portugal to sunbathe by the sea, see local attractions, take a walk along the streets there and sit in a cafe, then the Economy package is a great option.

In the future, the more services ordered by the traveler, the more the amount increases. An important point is "outdoor activities". It was created in case the tourist during the trip is fond of sports, for example, cycling, decides to play football with friends or go down the river in a boat. Here the risk of the possibility of injury becomes greater, so if you are going to have an active vacation, you can include this option in insurance.

When applying for a visa, ordinary Schengen insurance is also suitable, just keep in mind that with force majeure it will be meaningless, because it does not include an item on outdoor activities. That is, the ability to offset costs in sports injuries is leveled.

Having issued the Premium package, upon the occurrence of an insured event, you can be sure that you will receive qualified assistance. European officials value their reputation and do not like conflict situations. Upon learning that your Schengen insurance is framed in accordance with all possible points and options, the hotel will take care of you like a crystal vase.

When choosing a package, the so-called property risks play an important role. The insurance company assumes the cost of transportation and storage of valuable baggage. If it is lost, be sure that the insurance organization will return its cost. In the Premium package, you will definitely find an option about liability insurance. That is, if you damage property or the health of third parties, the insurance company will reimburse everything. Therefore, if a tourist has the means and the desire to spend a vacation without nerves, then it is better to arrange a “premium” and not deny yourself anything.

We summarize the above

So, we figured out why honey is needed. insurance for the "Schengen". We learned what options exist for obtaining it and the features of insurance for tourists, namely what tariff plans are and how the economy package differs from the others. Now add the puzzle.

Choosing an Insurance Company

Choosing an insurance company should be guided by an understanding of reliability and security. Remember the importance of accreditation of the insurer, because a large number of insurance organizations do not have representation in the required city, country. In case of force majeure, if there is no representative office of your insurer in the host city, the assistance will deal with the situation.

Assistance - a partner of an insurance company, responsible for the correct execution of documents in an insured event. Those companies that value their reputation, cooperate with reliable assistants. They are not fit to resort to the services of dubious companies. Here are a few recommendations when choosing an insurance company.

- Experience. It is better to get Schengen insurance from a company with at least five years of experience. The insurer's rating can be viewed through the Expert agency.

- Reviews Believe verified reviews, for example, those people you know yourself.

- Solvency. The company's website and official federal resources will always help to disclose information on the authorized capital and the amount of insurance payments.

Observing these criteria, you will get a reliable insurer.

Documents

When collecting documents you will need an internal passport, passport and TIN. In rare cases, additional help may be required. The policyholder leaves information about himself when filling out the questionnaire.

Insurance options

What insurance is most acceptable for Schengen? A little higher we studied various kinds of packages for obtaining a policy: economy, comfort, premium.

An economy package is a basic set of options at an affordable price. Take such a tariff plan in case your goal is a cultural holiday with a visit to museums, easy walks in the hotel zone, beaches and restaurants. With this approach, unnecessary expenses are useless, therefore, the nuances of insurance here play a secondary role. The basic set of options in any case guarantees you the provision of medical care, transportation to the clinic, examination and subsequent treatment. Depending on the insurer, it is possible to add an item on the provision of services in the field of dentistry. The “Economy” tariff is usually included in the price of vouchers.

In the “Comfort” tariff, the legal points are added to the items mentioned earlier. Insurance for the "Schengen" abroad is sometimes very helpful in conjunction with legal services. It is important to understand that each country lives according to its own laws; ignorance of them will not relieve them of responsibility. Laws are so bizarre that they are not always paid attention to, which may cause certain difficulties.

When making insurance, you can add an item regarding the car. If you carry out your trip by car, if it is necessary to repair it, all of your costs in services will be borne by the insurer. All that is needed is to document a particular case. As a standard, this service is called “Auto Program” or simply “Auto”.

Package "Premium" we discussed in some detail. Let's note a few key points regarding this tariff. The most expensive package of services will allow you to spend your trip without any nerves. Qualified assistance, the provision of legal services, valuable baggage insurance, liability protection in respect of third parties. Here you will find a full range of services in the event of all kinds of force majeure, up to the return of the money spent on buying a plane ticket if the flight is delayed or canceled. Costs are also refunded if the tourist refuses the trip.

Contract

Insurance for leaving the Schengen area border will not be possible without an agreement. Going on a trip, be sure to read the contract that you will sign. Its content is of great importance. When preparing a document, it is possible to forget about a particular point, in addition, it is always worth remembering the human factor: an employee of an insurance company may well be mistaken. If you need reliable protection of finances and health, treat this process with all responsibility. It is better to read the text of the contract several times, if necessary, supplement the document with one or more points - the employee is obliged to introduce them.

Basically, the most valuable information is spelled out in the appendices and notes, so make the main emphasis on them. There is information about situations that will not be considered insurance. If you have any questions, please contact a company employee.

Final stage

Obtaining a policy is the last stage of the procedure. Honey. insurance for "Schengen" is supported by a set of necessary documents. These include: an application form for compensation in the event of an insured event, technical support contacts and an appendix with the necessary information. Having received this package of documents, you can apply for a Schengen visa.

Top 3 insurance companies

In order to facilitate the task, the following are three popular and, judging by the reviews, reliable insurance organizations in obtaining insurance.

- Allianz Global Assistance. German corporation, which was founded at the end of the XIX century. Protecting travelers is a priority in the development of the company. The company has been providing travel insurance since the 1950s, and has made significant achievements in this area. Schengen insurance issued by the Alliance company means that you can count on qualified assistance in all corners of the world. The Germans zealously protect their customers and provide the best possible service. Here you can get any package of services.

- Tinkoff Insurance. A young and extremely ambitious company. Her story is not as rich as that of the Germans. However, this service is available via the Internet. Here you can take out medical insurance in several steps: calculating the price tag, payment, and your policy goes to the specified mailbox. The tourist can only print and take it to the embassy.

- Alpha Insurance. A well-known company has been operating since 1992. Insurance company does not stand still and is actively developing in the field of insurance, including tourists. The range of options and services is quite extensive. You can fill out the form on the official website. Also in the list of insured events there is an interesting item - "Water transport", where we are talking about insurance for travel by water.

Useful Tips

Insurance for a Schengen visa is an important point. Here are three tips that may come in handy. The insurance policy is of great importance in obtaining a Schengen visa, so take it seriously. This document will help you get your coveted visa to Europe.

- Tip one. When choosing an insurance company, in any case, get acquainted with the reviews. As stated above, the ideal option would be to ask a friend about the services of a company.

- Tip two. Carefully read the list of force majeure that the insurance company compensates. Be sure to read the contract and pay attention to the applications and notes, because they always contain the most important information about insurance cases.

- Tip three. If you are satisfied with the services rendered, then if you repeatedly need to get insurance for a Schengen visa, use the services of the same company.

Conclusion

Be responsible for paperwork. In this matter, every detail is important. When applying for insurance to visit other countries, contact competent specialists and your trip will be pleasant and cloudless.