What is the payroll procedure step by step? For beginners, this information is of great importance. Typically, accounting clearance and accruals are made in a special accounting program 1C. It takes into account all operations of the enterprise. This article will talk about how to make clearance and payroll. Step by step for beginners, an algorithm of actions for all necessary accounting operations will be prescribed.

Registration and payroll

Taking into account the established salary, benefits, sick leave, payment of holidays, bonuses, allowances and fines, monthly wages are paid to employees of a company, company or institution. During the issuance of payments to accountants, it is important not only to correctly charge, issue, but also to confirm these operations with documents. The whole procedure is quite complicated for novice accountants, however, experienced workers also constantly update knowledge, read news in this area and get acquainted with new instructions.

The documentation of calculations is part of the accounting for payroll, as the fee is charged for accounting for working hours. For time-based wages, the T-thirteen timesheet is used. This is an internal document that is issued to all employees upon admission to work.

Documents that are necessary for calculation and payroll

Before you understand the payroll step by step (for beginners, detailed information is given below), you need to familiarize yourself with the types of documents for which payments are issued. For registration and payroll using special statements. According to the law (Article 9) 402- dated December 6, 2011 “On Accounting”, all documents and statements on accounting were developed according to standard requirements. But the state does not prohibit enterprises from developing such statements on their own. It is only necessary to approve new forms in the order on accounting policies.

Settlement document T-fifty-one is one of the main accounting documents that is used to calculate payments to employees. The form is filled out as follows: opposite the surname, name and patronymic of the employee is his personnel number, job title, rate according to the contract, the number of hours per month and the amount of payments. This statement must be signed by the accountant who composed it.

Payroll T-53 is a statement that confirms the fact that employees are paid wages. It is convenient to use, since with the help of such a document you can immediately calculate the payment to a large number of employees.

T-49 - this is the payroll of primary accounting, it is necessary for charging labor. It is used in small firms where a small number of workers work. If you use this sheet, the documents T-51 and T-53 are not compiled.

When to pay salaries

Regardless of the number of working days of employees, wages must be accrued for hours worked from the first to the thirtieth day or from the twenty-eighth to the thirty-first day. These accrual conditions are specified in the law of the Russian Federation, article one hundred thirty-third of the Labor Code.

Bonuses are paid at the time of payment of the basic salary or in the manner specified in the documentation of the enterprise. The company pays benefits as the rights to receive arise.

The cashier gives the salary. Payment is issued at the cash desk of the company or transferred to the personal bank account of the employee. Crediting occurs according to data in payroll T-53. The T-53 statement for issuing money is transferred to the cashier for five days, after which it is closed. Upon receipt of the money, employees leave their signature on the form.

Payroll step by step for beginners: postings

In accounting, there are certain rules that govern the filling of data in the program. You cannot violate these rules, since you can distort the data of all accounting. The latter will cause errors, which will be very difficult to fix. Perhaps this will cause reprimand for the accountant or dismissal.

To write the amount of the account in accounting, you need to create a posting to accounts with certain rules. In the posting you need to specify: credit of the accounting account, debit of the accounting account and the amount. A posting is a record in a computer or in a paper journal that records the change in the debit of one account and the credit of another, and displays one amount.

Postings must be created according to certain rules. What is forbidden to enter:

- You cannot write the amount to one account without marking another account;

- Using one posting, you cannot record two different amounts.

Such rules prevent the entry of incorrect information into accounting, which makes it possible to safely balance the final result.

What else should I mention when talking about payroll step by step (for beginners)? Postings in 1C can be created in two ways:

- enter in the form of a document, indicating the debit of the account, credit and amount;

- using a document that will conduct postings on a specially written program algorithm.

Usually a salary is paid from the cash register, therefore, on the basis of a cash check, a certain amount is withdrawn from the current account. To do this, use the wiring D50 and K51. This amount may be with the cashier for only three days. If payment is not made within a specified period, then the money will be returned to the bank on the basis of a cash payment announcement. By posting K50 and D70, payroll is displayed.

Account seventy in accounting

Companies and firms use seventy accounts to display and pay remuneration - these are payments to employees for remuneration. Seventy accounts make transactions for all types of payments:

- salaries;

- bonuses, bonuses;

- allowances and surcharges;

- sick leave, benefits, leave.

Also, with the help of the account, accruals and payments of pensions to working pensioners, and payment of deductions of alimony of certain employees, occur. Usually one such account is used to account for one employee of the enterprise.

Payroll step by step for beginners in 1C

How to use the seventy account and charge employees in the 1C program? The payroll step by step for beginners is described below:

- In the program it is necessary to go to the tab “Salary” - “Payroll of employees of the organization”.

- In the open form, you need to specify the unit.

- The date on the form is set automatically (last day of the month).

- You need to click on the "Fill" button on the toolbar. After that, the program will automatically pull up the entire list of workers from the directory "Enterprise Workers".

- In the column “Result” the employee salary will be automatically set. It can be manually changed.

- In the "Personal income tax code" field, income tax is automatically calculated.

- After entering all the necessary data, you need to save the document by clicking the "OK" button.

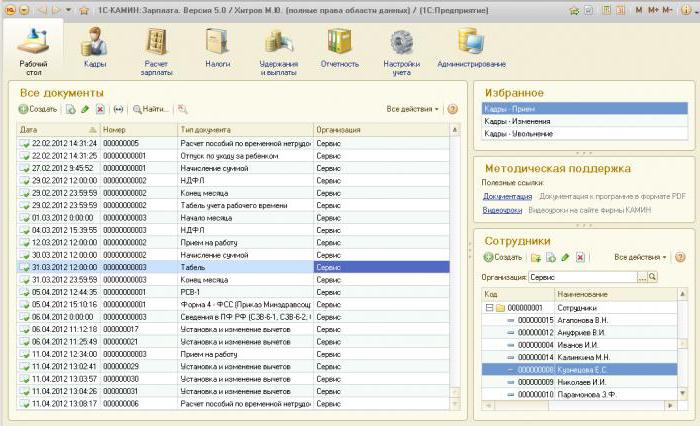

Program 1C-FIREPLACE

1C-KAMIN program is designed for calculating salaries, taxes, insurance premiums, for maintaining personnel records and for reporting. It is used in large enterprises and small firms, in any field of activity. Includes all tax regimes: unified taxation system, simplified tax system, UTII. Its advantages are as follows:

- the program does not require modifications for each enterprise;

- simple interface;

- payroll can be done for employees of several companies;

- “1C-Reporting” is built in the program (sending company reports to the FIU, FSS, IFTS);

- you can use 1C-Connect and 1C-Link.

Fireplace program

What opportunities does the program provide for the accountant during payroll? The program performs a number of necessary calculations that are necessary when calculating payments. Feature List:

- calculation and crediting of wages for divisions, sources of income, periods of accrual;

- payment and calculation of salary and tariff, piece-rate payment, as well as crediting of premiums and bonuses;

- accrual by the average coefficient of wages (travel and vacation);

- calculates social benefits;

- conducts payment for length of service and payment according to KTU.

The sequence of payments

How to make payroll using the program? Payroll step by step for beginners in the FIREPLACE:

- You must go to the tab “Payroll” and click on the navigation panel “Types of accrual”. Types of accrual - this is income in the form of payments, bonuses, allowances, etc.

- To enter a new charge, you must click the "Create" button. There are three bookmarks in the form of a directory item.

- In the accrual field, you must enter the name of accruals.

- Choose a type of income.

- In the field “Type of income for insurance premiums” you need to specify the method of accrual, which is taxed.

- Indicate cost item.

- If the payment is calculated as a percentage of the amount of other charges, then you need to check the box in the empty window "There is a base." After setting the flag, the “Base” tab is activated, in which the base of charges is indicated.

- If you select the “Do not index” checkbox in an empty window, the accrual will not be indexed.

- It is necessary to save the directory item with the "Write" button.

- In the tab “Included in the base” it is necessary to form accruals, deductions and deductions.

- To save the entered data, click the "Write and Close" button.

Piecework pay

Piece-rate payment is a calculation based on the quality and quantity of work done. It can be divided into individual payment and brigade. Individual accrual is paid to one person for performing a certain type of work. Brigade accrual depends on the amount of work and individual salary, the whole team.

Piecework wages can be divided into certain types. There are 4 types of piecework payments:

- Simple piecework is a payment that is based on the tariff grid of rates and a single tariff-qualification reference book of work and profession.

- Piece-and-premium is a payment not only for product development, but also premiums.

- Piecework-progressive is piece-rate payment, in which products that were produced within the normal range are paid at a piece-rate.

- Chord is a single payout.

How to make payroll step by step for beginners on piece-rate pay? To do this, you must perform certain actions:

- Set up the calculation type.

- Introduce technical operations.

- Enter piecework outfit.

- To accrue and calculate the salaries of the employees of the enterprise.

Payroll calculation in 1C 8.2

In 1C version 8.2, there are two ways to calculate and payroll step by step for beginners. You can manually calculate using documents in a certain sequence. You can also use the Payroll Assistant. Payroll is step-by-step for beginners without using the “Salary Accounting Assistant” implies the following actions:

- Enter all personnel orders.

- Entering fixed surcharges and allowances.

- Calculation of payments for one month.

- Crediting insurance premiums with payroll.

- Formation of payroll statements.

Salaries in budget organizations

In what order is the payroll step by step for beginners in a budget organization? For step-by-step payroll, it is necessary to establish data on the staffing table, rank of employees, the rate of tariffs on time, as well as information on time tracking for a month. It is necessary to take into account the regulatory acts that govern the charging of payments.

In order to streamline and normalize wages to state employees, the law introduced:

- Unified tariff schedule.

- Hourly pay.

- Tariff categories.

The calculation of the average salary in the Russian Federation in 2017

In 2017, as in previous years, according to the law, according to Article one hundred and thirty-sixth of the Labor Code of the Russian Federation, wages must be paid twice a month. If the employer violates the conditions, it may be administratively liable. Therefore, payroll step by step for beginners should be carried out by these types of payments:

1 advance payment due to future salary. It is a certain percentage of the main payment.

2. Full-time salary. Depending on the working days, it can be charged both for one half and two half months.

The main indicators of the average salary in 2017:

- the amount of payments accrued for one year;

- calendar work time for twelve months;

To calculate the average wage, use the formula: Average salary = Payments for the year / for twelve months.