The welfare of any country depends on the amount of taxes paid by the population. The more developed is the taxation system, the more severe is the punishment for tax evasion, the more consciously will citizens fulfill the obligation, the more can a country invest in education, science, and the social sphere.

Citizens of Russia are required to pay tax and state fees or other payments stipulated by law. In case of tax evasion or untimely payment, administrative or criminal liability measures are applied. If proof of lack of debt is required (obtaining a loan, bank account abroad), an individual should contact the IFTS at the place of registration to obtain a certificate of lack of debt to the budget. When an organization requests a document, they apply at the place of registration of the enterprise.

What kind of document is this?

The certificate of the absence of debt to the budget belongs to the category of official documents of the established form. It is issued at the tax branch upon application from individuals / legal entities. The requirement reflects the actual absence or presence of debt to the state, and it does not matter how much someone did not pay - 3 million or 75 kopecks. Any underpayment will be reflected in the statement, so before requesting a certificate, you need to make sure there is no debt or pay off it and only then ask for information.

On December 28, 2016, Order of the Federal Tax Service No. MMV-7-17 / 722 was issued, which gives a sample certificate of the absence of debt to the budget, and order of the Federal Tax Service No. MMV-7-8 / 20 established the rules for its execution. Today, the entire system is computerized, so the employee of the Federal Tax Service sees the financial tails immediately, making an appropriate request. Information is issued for the period of circulation, so if someone suddenly remembered the debt and paid it on the day of the trip for help, the center specialist will not see it. It takes some time to process the new data received. The request will have to be done again, and this is a waste of time and unnecessary work for a service specialist.

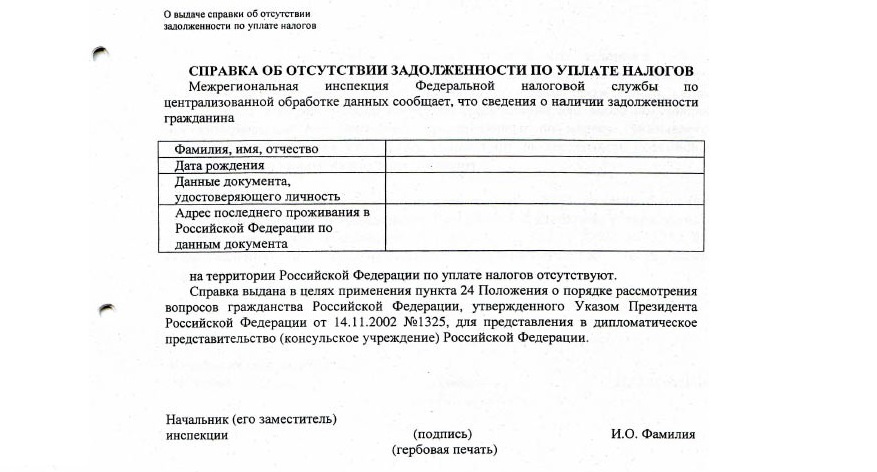

It is worth knowing that the sample certificate of the absence of debt to the budget is advisory, and not mandatory. Therefore, in different regions and structures, the information received may differ externally, but the main points (who issued it to whom) will be saved.

What is reflected in the document?

- F. I. O., name of organization.

- Details (TIN, KPP, company address, registration).

- Date of the application.

- The presence / absence of debt.

- Code of the Federal Tax Service Department.

- Signature of the head, transcript, seal.

Why do enterprises need help?

All registered enterprises, individual entrepreneurs, PJSC, JSC know how to get a certificate of lack of debt to the budget. It is necessary for signing contracts, during participation in the tender, for registration during the bidding process. You can not do without it if the company has become bankrupt or closes operations. If the state adopted a law on assistance to enterprises and allocated subsidies, for example, for the purchase of new equipment for a loan under preferential terms, then only the taxes paid will be the key to obtaining benefits.

In addition, the document is always requested when changing leadership: chief accountant or director. Without it, counterparties, banks will not work, and it will also be needed if the company has changed its registration. The main purpose of the certificate of absence of overdue debts to the budget is to confirm the thoroughness and financial viability of the organization.

In what cases does a physical person need a certificate?

In ordinary life, discharge is required much less frequently. When employed in government agencies, deduction of tax from wages is carried out monthly automatically, in accordance with the law. The need to obtain a certificate of the absence of debt to the budget of a person appears in the following cases:

- processing a loan, mortgage;

- change of citizenship;

- purchase of housing, land and the like.

If an individual decided to open a private business and register an IP, payment information is required.

Force Majeure

Information about the absence of debt to the budget is free of charge, but in urgent cases the state provides for payment for urgency. So it’s more correct to apply the concept of conditionally free.

Information Options

The peculiarity of the extract is that you can find out about a forgotten debt, underpayment only with a personal appeal to the tax. The Federal Tax Service is not a body that identifies malicious defaulters, does not send letters calling for payment of payments stipulated by the state. The whole process rests solely on the consciousness of people. There are several options for ordering help.

You can contact the place of registration of the citizen or registration of the enterprise. The easiest and fastest way. A tax service specialist checks the correctness of the application and immediately, on the spot, corrects errors. In the tax, you need to bring a package of documents, which is checked by the client, pokes fun at the request and is accepted for work. On hand is issued a sheet on the acceptance of documents, where is the date of receipt of the ordered certificate.

There is also an option to use the postal service. Not everything is so simple here. Theoretically, you can send a request in a tax letter. But this should not be a standard letter. Options:

- Registered notification letter. The citizen will return a notice on which will be the date of receipt of the letter and the name of the person who received it. In this case, it will be easier to look for him in the office of the Federal Tax Service. The cost of the letter depends on the weight, a letter up to 40 grams (7 A4 sheets) will cost about 100 rubles at the time of 2018.

- A valuable letter with a description of the attachment with a simple / custom notification and declared value. More reliable option. Together with the sent papers, an inventory of all documents indicating the number of sheets is enclosed in the envelope. A mail officer checks the availability of all documents, signs 2 copies of the inventory, one returns to the client along with a receipt for sending. You can track the receipt track when a document is received, and the notification will return later if the mail does not lose it along the way. The cost depends on the weight, the number of papers (each document is evaluated), the estimated cost of writing up to 40 g is at least 200 rubles.

- Delivery service. Guaranteed delivery in the shortest possible time from hand to hand. Payment depends on the choice of the company, the weight of the letter, the distance.

It is important to remember that if there are errors in the documents, names are illegibly written, not the whole package of documents is provided, then the certificate will be refused.

No one forbids using your personal account on a specialized site. A common type of service today. It is necessary to go through the standard registration on the website of the Federal Tax Service and make an electronic request, where to indicate in what way you want to receive a certificate. Do not trust mail, the letter may be lost. If it is not possible to personally come to the tax office, it is worth specifying a valid email address where to send the document.

What data to indicate when ordering a certificate?

There is no single sample and the rules for filling out a certificate of no debt to the budget. There is a general form that you can write by hand yourself or ask for help from a specialist. The statement indicates the standard data:

- F. I. O. (without abbreviations) + Passport No., series, by whom issued;

- details (for the enterprise);

- place of registration / registration;

- who requested help.

In the absence of debt, the client receives an official response from the tax service about the absence of debt. In another case, a letter is sent with a list of organizations to which he owes, plus the amount to be paid is indicated.

Additional documents

When preparing to submit a request for lack of debt, it is necessary to collect all receipts of payments, make copies of checks, so that, if necessary, provide them to the employee of the Federal Tax Service. For enterprises, it must be remembered that the person filing the tax request (most often the chief accountant) must have a notarized power of attorney to perform this particular type of action.

How long to wait for help?

There are no clear rules for filling out a certificate on the absence of debt to the budget, but the terms for issuing it are strictly regulated. The document is drawn up 10 working days (keyword) days, full two weeks. Therefore, all certificates are ordered in advance. It is recommended for entrepreneurs to make control requests every six months to avoid penalties and fines for arrears. It is enough for an individual to request information about his debts annually. The state allows all, without exception, citizens of the country to independently monitor payments of tax fees.

If a citizen received a certificate, but the data in it do not agree with his calculations, it is necessary to reconcile the calculations with the Federal Tax Service.

More help options

Time is money, so there are situations when a certificate of lack of debt to the budget is necessary, so to speak, yesterday. The state provides for such cases. If you need an urgent certificate about the absence of debt to the budget, you can contact the Federal Tax Service, pay the fee, indicate the time for issuing the certificate, for example 1 day, and get it without delay.

It is worth considering the option when a citizen cannot spend time visiting a tax office. Then you should contact the law company, which will fully take over its receipt. The cost of services is three times higher than the state duty at the Federal Tax Service, but the person is exempted from waiting in line. But there is a risk. The law firm should have good recommendations, since confidential information about the financial side of the client falls into her hands.

Relevance of extract

In Russia, each document has its own validity period. Certificate of the absence of taxes, despite the difficulties in obtaining, is not issued for a long time. According to the rules, a certificate of no debt to the budget has a short validity period of 10 days. This is due to the fact that enterprises, individual entrepreneurs and other organizations submit monthly information to the tax authorities about taxes paid. In addition, companies forecast their payments for the next calendar year, and in the case of a decrease / increase in monthly tax payments, they report to the state agency why this happened.

If a person collects documents for taking a loan from a bank or forms a package for participation in a tender, it is better to order a certificate from the Federal Tax Service Inspectorate last, in order to meet deadlines.

Business Insurance

Any business is risky, but there are things you need to know to protect yourself. If a person is preparing for a deal, he needs to collect information about the partner at different levels. The security department in tandem with the legal department will necessarily ask the Federal Tax Service for a certificate confirming that the counterparty has no debts to the budget, you only need to know the organization’s TIN. On the official website of the Federal Tax Service, a certificate is provided free of charge.

More detailed information about the company will help to collect paid services. To do this, you need to find a competent company that can be trusted with confidential information, and conclude an agreement with it. Further, the company works independently: it checks the economic side, legal documents, fills out a certificate on the absence of debts to the budget and submits it to the tax. The client’s task is to wait for evidence of the organization’s trustworthiness / unreliability.

Internet resources make it possible to find out how economically stable the company is, whether it previously had debts, legal proceedings, debts to the state, and non-payment of salaries to employees. The information received will help you decide whether to take the company as a partner.

What does the tax certificate give?

Individuals, small enterprises and huge corporations strive for one thing - stability. The state is trying as much as possible to protect everyone during various transactions, including making available the possibility of obtaining a certificate of lack of debt. Citizens must meet the state, paying taxes in full, clearly understanding: the life of our society is built on our money.

Do not think that strict rules exist only in Russia. On the contrary, compared with Western countries or the United States, where tax evasion is considered a serious crime, the Russian bureaucracy only teaches citizens to be conscious. It will be a long time before everyone realizes the need to be honest not only to themselves, but also to society.