Small businesses are constantly waiting for a more profitable and convenient tax system. Someone uses a simplification, but for someone it is quite suitable to pay a single tax on imputed income. Who can use UTII? What you need to know about this tax regime?

Can everyone use UTII?

The question of the possibility of using UTII is of interest to many businessmen. The right to apply a single tax on imputed income is available to all entrepreneurs who comply with the conditions established by law. Can an LLC use UTII? Yes maybe. The subjects of this regime can be both legal entities and individuals engaged in private entrepreneurial activity.

The principles of this system of taxation do not differ fundamentally from the general or simplified, since it also involves the collection of duties. However, with UTII, the tax is calculated not from the income received by the business entity, but from the so-called imputed profit, which is calculated according to a special formula and takes into account the number of personnel, the area of the premises, the vehicles in use, etc.

Today, taxpayers applying UTII are much fewer than those using the general or simplified taxation regime. The thing is that only those entrepreneurs who are engaged in strictly defined types of activities can calculate the imputed income tax fee. The transition to the UTII system is voluntary. The entrepreneur has the right to pay taxes through this system from the first days after the company is registered in the fiscal structure. He also has the right to transfer to UTII in the manner prescribed by law.

General information about the tax regime

By itself, this tax system does not cause any difficulties for those who have the right to use UTII. At the same time, difficulties often arise when trying to profitably combine tax regimes.

In accordance with the Tax Code of the Russian Federation, entrepreneurs are entitled to use several modes. So, for example, few people know that it is possible to use UTII and USN at the same time. However, the calculation and payment of tax payments is carried out for each tax system separately and within the time limits established by law. Accounting for property, financial transactions and liabilities of the company is based on Art. 346 chapters 26 of the Tax Code. If you combine the two tax regimes, the company will have to keep separate records for each of them.

The procedure for accruing and paying the required amounts to state budgets is determined by the tax regime used by the organization. In addition, the law requires taxpayers to account for profits and costs, generate reports and submit them to the Federal Tax Service in a timely manner. If we talk about the UTII regime, then entrepreneurs are required to submit tax reporting by the 20th day of the month following the reporting period.

Activities suitable for UTII

The answer to the question of who can use UTII depends on the type of economic activity. This mode can only be selected if the entrepreneur is engaged in:

- repair, washing and maintenance of cars, trucks, buses, etc .;

- storage of vehicles, organization and equipment of car parking;

- passenger and freight transportation;

- distribution of advertising on outdoor load-bearing structures;

- the organization of catering or retail trade in premises of not more than 150 m 2 ;

- rental of premises, land for temporary use under a lease agreement.

Who has the right to use UTII? First of all, newly created companies registered as taxpayers have this opportunity. In order to exercise the right to apply this tax regime, an entrepreneur must submit a corresponding application to the tax inspectorate.

What is the main difference from other tax systems

The main difference is in the procedure for calculating a single tax. The amount of the fee is calculated not from the income that was actually received, but from the estimated income of the organization. At the same time, the introduction of the UTII system does not imply a complete replacement of other regimes.

Here the tax rate is 15% of the expected income of the company. A single tax on the UTII regime is paid for each quarter until the 25th day of the next month. The taxable base is the profit determined in the price equivalent in relation to a fixed physical quantity, which depends on the type of economic activity.

Basic income is the conditional amount of monthly taxpayer profit. To determine the duty, the obtained value is multiplied by correction factors, the role of which is to determine the degree of influence of various production factors on the indicators of economic activity. If the annual income of an entrepreneur exceeds 300 thousand rubles, then the obligation to use UTII entails the need to pay additional premiums.

What do you need to go to UTII?

The Tax Code of the Russian Federation establishes the right of taxpayers to change the applicable taxation system. You can make such a transition only once during the year. An individual entrepreneur or legal entity can register as a taxpayer at the territorial branch of the tax inspectorate at the place of registration of the enterprise.

The basis for the transition to the UTII system is the statement of the entrepreneur. Confirmation of the right to use the single tax on imputed income is considered a notification of registration. Can IP apply UTII? Private entrepreneurs as business entities have the right to work in this tax system if:

- do not provide services in the field of healthcare, education or social security;

- do not transfer ownership of gas stations or gas stations;

- do not have a large staff of employees;

- were not established by companies whose share in the authorized capital of the taxpayer exceeds 25%;

- Do not engage in entrepreneurial activities under the trust management agreement.

UTII taxation system: the main components

The following elements are important for calculating a tax payment:

- subject, i.e. directly taxpayer;

- object of taxation;

- tax base (imputed income);

- tax rate;

- taxable period;

- duty calculation formula;

- method and deadline for paying the fee.

The subject of taxation is private entrepreneurs and companies that prefer to carry out their activities in this mode. All of them are taxpayers who are responsible for making quarterly tax deductions in accordance with the requirements of tax legislation. The required amount may be paid by the legal representative of the entrepreneur.

The object of taxation can be considered the enterprise itself, the process of trade and services, property and property rights. This category also includes profit derived from commercial activities and taxed.

Organizations applying UTII tax base should be calculated taking into account:

- type of activity;

- a physical indicator times the base return.

The final result is multiplied by the deflator coefficient. At the same time, the fixed tax rate is 15% of the amount of imputed income. The tax period in this system is a quarter consisting of three months.

What are the nuances to consider

Those who can use UTII should take into account that tax legislation does not imply the possibility of submitting zero reporting, therefore, before making final calculations, an entrepreneur must take into account several factors. If, for example, physical indicators remained the same during the tax period, the results are multiplied by a factor of 3. If changes have occurred during the reporting period, the company should make monthly settlements and add all three amounts received at the end of the quarter. For enterprises that use several types of activities, the calculation of the tax duty is carried out for each of them, after which the payments are summed up.

To reduce the amount of tax, organizations applying UTII are allowed to deduct from it:

- insurance premiums paid under a voluntary insurance contract;

- payments accrued by the enterprise to the Social Insurance Fund;

- temporary disability contributions.

For legal entities, the rules are not the same as for individual entrepreneurs. If LLC applies UTII, then it is permissible to reduce the amount of taxes by no more than half the amount. This restriction does not apply to private entrepreneurs, they are exempted from the limits, but subject to the absence of deductions for employees with whom an employment contract has been concluded.

Rules and calculation formula

To determine the size of the payment, it is necessary to establish the estimated imputed profit, that is, the value of the estimated income, which is the tax base, and then multiply the amount received by a 15% rate. In the regions, municipalities reserve the right to reduce the rate by a maximum of half. The tax discount depends on the scope of the enterprise and its category.

The tax base for UTII is the imputed profit, which is determined by the basic profitability and physical indicator inherent in a particular type of activity. For example, for retail, this indicator is the area of the commercial premises, and for the company providing household services - the number of employees. In article 346 of Chapter 29 of the Tax Code of the Russian Federation, basic return ratios and physical indicators are established that are acceptable for various types of entrepreneurship. For example, an amount of 1,800 rubles is set for a retail outlet. per month per 1 m 2. , that is, the owner of a small store with an area of 30 m 2 will pay tax on the amount of 54 thousand rubles. For vending sales, the basic yield is 4,500 rubles. from one machine, and firms that provide certain services pay taxes monthly at the rate of 7,500 rubles. per employee.

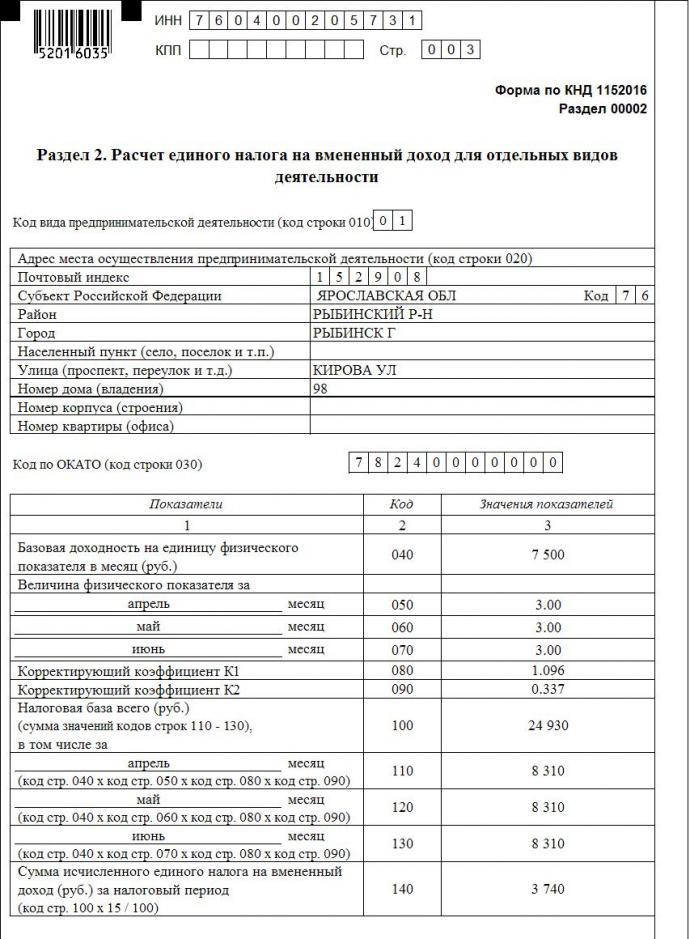

UTII calculation formula for the quarter:

UTII = DB * K1 * K2 * (FP for three months) * 15%,

where the DB is the base return,

AF is a physical indicator,

K1 - coefficient-deflator,

K2 - correction factor.

Physical indicators when calculating the tax are indicated in whole units, they are rounded according to traditional mathematical rules. If there has been a decrease or increase in fixed indicators, the new values apply from the current month. The correction factor is set by regional authorities, so its value can vary from 0.005 to 1. The deflator coefficient is determined at the federal level. Today it is 1.868 (in accordance with the Order of the Ministry of Economic Development of the Russian Federation No. 579 of 10.30.2017).

How to calculate tax, sample

An example of calculation is useful to everyone who can use UTII. As an example, take a situation in which you need to determine the amount of tax payment for one of the quarters of 2018. The object of taxation is a store with a sales area of 55 m2. So, the following conditions are given:

- physical indicator = 55;

- basic profitability = 1 800 rubles;

- standard tax rate UTII = 15%;

- deflator coefficient = 1.868;

- correction factor = 0.7.

Now let's make a calculation. First, we determine the tax base, that is, the value of imputed income:

VD = 1800 * 55 * 1.868 * 0.7 = 129 452.4.

Thus, the amount of single tax for the quarter will be:

(129,452.4 * 15%) * 3 = 19,417.86 * 3 = 58,253.58 rubles.

Next, for example, consider the option of calculating tax for a private entrepreneur who specializes in the provision of domestic services. You can use UTII FE regardless of the availability of personnel. In our case, there are no employees in the state, therefore, an entrepreneur should use a unit as a physical indicator, since he will only consider a tax for one person - for himself. At the same time, the basic profitability in this case is no different from that which would be applied if employees were hired. It is 7,500 rubles. Previous indicators K1 and K2 remained unchanged. To calculate the size of the single tax, you must first determine the imputed income, which is:

VD = 7,500 * 1 * 1,868 * 0.7 = 9,807 rubles.

This is the same monthly tax base that must be multiplied by three and 15% to calculate the tax.

The quarterly payment will be:

9 807 * 3 months * 15% = 4 413 rub.

If an individual entrepreneur or LLC applies UTII without hired personnel, the amount of accrued tax can be reduced by the amount of insurance contributions made in the reporting tax period. Thus, the taxpayer managed to make fixed payments totaling 4,000 rubles. In this case, UTII will be 413 rubles. (4413 - 4000). If, in carrying out his entrepreneurial activities, the entrepreneur hired employees, he can also use the right to reduce tax. However, only part of the amount of insurance premiums covering no more than half the size of the quarterly fee will be taken into account.

Features of combining UTII and USN

Further information for those who are interested in whether it is possible to simultaneously use UTII and the simplified tax system. Any enterprise is entitled to use two tax regimes if a number of conditions are met and certain features are observed. For legal entities, such a combination of regimes is not always convenient, since it obliges to further detail the data of accounting and tax accounting. If the individual entrepreneur uses UTII and the simplified tax system, he will also have to take care of the competent organization of the distribution of tax accounting information.

So, for example, combining two modes requires enterprises:

- differentiation of profits according to analytical accounting;

- separation of direct costs and separation of accounting for indirect costs;

- strict distribution of employees by type of activity;

- assignment of property to each type of activity;

- development of an expense distribution algorithm.

And although private entrepreneurs who decide to use UTII and the simplified tax system, are not required to keep records, many questions arise when conducting tax accounting. When combining imputed and simplified systems, entrepreneurs often prefer the “6% Income” mode. This simplified model is in many details similar to imputed taxation. Despite this, the combination of regimes obliges to share costs. If to use UTII and the simplified tax system "Revenues minus expenses 15%", the amount of tax deduction becomes lower, therefore, it will be possible to reduce the amount of duty slightly.

For entrepreneurs who do not hire personnel, when combining UTII and STS, it is possible to apply the tax deduction to one of the fees in full. Thus, they can reduce the amount of tax to 100% on actually paid insurance premiums. However, the law does not prohibit the distribution of deductions between the two taxation systems that are applied by IP at the same time. However, practice shows that it is more profitable and more convenient to distribute the deduction, focusing on the share of actually received profit for each regime for the same period.

Individual entrepreneurs hiring employees are not able to apply the full amount of insurance premium deduction to the tax paid. Taxpayers applying UTII and STS 6% have the right to reduce both duties by a maximum of half due to the amount of contributions paid for all staff, including the entrepreneur himself.

In what cases the right to use UTII is lost

If the taxpayer does not comply with at least one of the requirements that apply to entrepreneurs wishing to use UTII, he automatically loses the right to apply this regime and is transferred to the general taxation system. The loss of the right to use the imputed system occurs as a result of:

- changes in the permissible type of activity;

- exceeding the permissible number of employees;

- increase in the share of founders in the authorized capital (more than 25%).

After losing the right to use UTII or combining it with other regimes, the taxpayer must submit a notification to the tax service within five days. The amount of taxes paid for the quarter in which the loss of the right to use UTII will have to be recalculated in accordance with the DOS.