AiManiBank, whose problems are limited by dissatisfaction with a certain percentage of customers, until recently was known only in Gorno-Altaysk. Over the past two years, the financial institution has been active, which allows it to reach the federal level and become on a par with the largest banks in the country. At the moment, the network of branches has 31 offices in different parts of Russia. The financial institution works only with individuals who have access to a wide range of services. Among the offers there are deposits and rental of safe deposit boxes, a wide range of loan products. The most popular service, which draws attention to such an institution as “iManiBank” in St. Petersburg and other cities of the country, is car loans.

Bank History

AltaiEnergoBank, opened in 1992, became the base bank for opening an institution such as AiManiBank, whose problems did not pass by during the economic crisis. His story ended in 2013. During this period, in the financial world, as a result of rebranding, “AyManiBank” appears. At the first stages of work, AltaiEnergoBank provided services exclusively within the framework of one region. Since the mid-2000s, the leadership of the institution made a serious decision to enter the federal level. Since 2009, the institute has been included in the list of the top 500 banks in the country. After rebranding, the financial company changes the location of the main office, which has now moved to Moscow. In 2013, a complete change of the institute’s development strategy takes place. If in 2012 the main focus was on consumer lending, then, starting in 2013, the main forces were directed at obtaining car loans. By the end of 2014, AyManiBank, a problem that did not have time to comprehend as its predecessor, was already included in the list of the top ten banks in the country in terms of the volume of loans issued to buy a car. Today, car loans remain a priority. Other banking products were also raised to a higher level.

Active development of car loans

As mentioned above, the main banking product of the institute is car loans. It is in this direction that vigorous activity is being conducted, integration with dealer networks for the sale of cars is being carried out. New partnerships are systematically formed, the list of points at which private clients can get a loan is expanding. Most products, with the exception of deposits, are aimed at customers who have already received a car loan. They can be considered exclusively as convenient and profitable additions to loan servicing. The management pays great attention to convenient banking services to its customers anywhere in the country. Each client has access to such tools as a personal account on the official website of the institute and the Internet bank AyManiBank - Ay-Click. Remote access to accounts is constantly being improved. The list of Internet services is systematically expanding, new opportunities appear, and the level of security improves. In negotiations with new potential partners, the bank management is constantly expanding opportunities in terms of payment for its services, offering more and more new methods of payment. Today, car loans can be repaid on special concessional terms through such payment systems as Leader and Eleksnet, Rapida and QIWI, CyberPlat. AiManiBank in St. Petersburg and its other representative offices in the country are members of the United Settlement System, which includes 120 domestic banks forming a 40,000th representative office.

Bank reviews

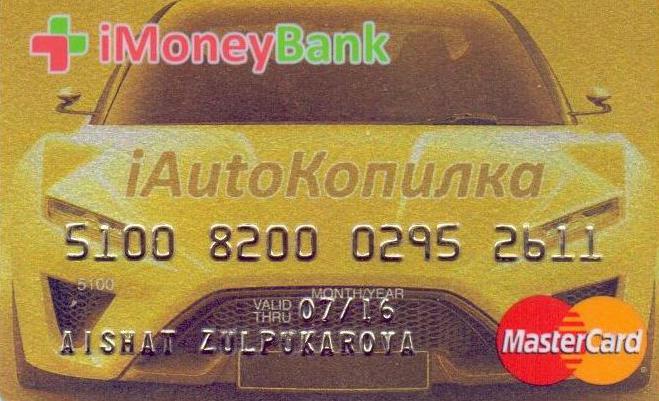

“IMoneyBank”, whose office addresses are very easy to find in the largest cities of the country, attracted a large number of customers with its offers, which led to the emergence of a huge number of feedback on partnership with the institute. Experts, having evaluated most of the reviews, agreed that the bank has both advantages and disadvantages. Many customers speak positively about the variety of car loans. I was pleased with the return of part of the funds to a bank account when buying fuel on the institute's card. “IMoneyBank” reviews are not only positive. There is a fairly large percentage of customers who complain about the dubious reputation of car dealerships with which the bank has partnerships. As for deposits, quite often people talk about confusing partnership conditions and a rather complicated interest calculation system. As for car loans only, the main emphasis is on a rather large overpayment. There are people who received a package of services not promised in advertising, but stumbled upon a gross refusal. As for the Avtokopilka card, opinions were divided. There are many customers who are completely satisfied with this banking product. Not without cardholders, in whom the plastic was blocked after several months of use, along with all the funds that are on it. According to them, CB “AiManiBank” demanded to provide a package of copies of documents due to their absence in the database. With early repayment of a loan to buy a car, refusals to return insurance were noticed.

Ratings and insignia

The main financial indicators brought “AyManiBank”, whose problems are limited by resentment from customers, which is typical for each financial institution, in the list of the top 200 banks in the country. The largest banking portal, Banki.ru, according to customers of banks that are visitors to the project, has provided the institution with a position in the top ten financial institutions of the country according to the results of the national rating. In 2014, the Expert RA agency recognized the Internet banking of a financial institution as one of the most functional Internet services in the country. It can be concluded that the leadership of the institution was not wasted. According to Moody's, in 2014 the institution was rated Baa3.ru on a national scale, and B3 on an international scale. The bank is marked as stable. The Rus-Rating Agency also noted the bank as stable and assigned it a national rating of BBB + and international BB.

What does not suit bank customers in car loans?

Due to the fact that AyManiBank LLC specializes in car loans, a large number of reviews about the financial institution are associated with this particular type of product. People write that at the stage of registration of a partnership, bank employees do not always provide truthful information about loan conditions. There is information that, upon signing the contract, the bank’s specialists voice certain loan conditions, and after the documents are already signed, they turn out to be completely different. As for the last comment, the customers themselves are to blame. People, trying to save their time, simply do not bother reading a multi-page contract and sign it immediately. This becomes the cause of an unpleasant situation in the future, when it comes time to make a monthly payment. Such grievances can be seen not only in relation to an institution such as AyManiBank in Moscow, but also in relation to other banks. In contrast to the negative reviews about the company, you can find many words of gratitude from customers who skillfully chose a car loan and regularly fulfill their obligations under it.

Future plans

“IMoneyBank”, whose rating is at a fairly high level, for the majority it is not so much a regular bank, but a service that provides assistance in obtaining car loans. One of the bank's specialties is loans secured by automobile transport. Now there are about 30 branches throughout the country, the management plans to open at least 50 more branches. Offices are planned to be located in each of the federal districts of Russia. This will allow us to quickly and efficiently provide services to all corporate clients. In the future, it is planned to attract foreign investors to a financial institution, which will open the way for the establishment of one of the top 100 banks in Russia. The idea is planned to be implemented in the next three years. Over the next five years, the bank is planning to enter a leading position in its segment of activity. If you believe the business plan of the bank, which is being implemented ahead of schedule, in the future it will become the most dynamically developing financial institution in the country.

Reporting as of May 1, 2015

The AyManiBank institution, whose reliability is at a fairly high level, belongs to the category of medium-sized Russian banks. He holds the 170th position in net assets in this category. As of May 1, 2015, the net assets of the financial institution amounted to 22.87 billion rubles. In total, assets increased by 8.12% over the year. Asset growth negatively impacted ROI. According to the data for the next reporting period, as of April 1, 2015, profitability decreased from 0.76% to 6.63%. Moody`s reports that the financial institution is exposed to high credit risks, and the level of creditworthiness remains low in 2015. There is every chance of a further downgrade. Compared to the 2014 indicators and estimates, which were noted above, the situation has worsened. If we compare the work of the bank with other financial institutions of this category in the country, it is difficult to call it negative. The financial institution did not have to deal with the interim administration and liquidation or bankruptcy proceedings. Despite the difficulties that are typical for the entire financial sector of the economy in the country, the institute has not taken responsibility. Deterioration or decrease in statistics in the period 2014–2015 more perceived as the norm than a malfunction. Almost all banks were hit by the crisis, and AyManiBank is no exception. The fact that he continues to work and expand his network of branches, despite the tough economic conditions, only increases customer loyalty and increases the level of trust.

Deposits

The AyManiBank institution attracts deposits very actively. This is due to the large number of promotions and bonuses that many investors are attracted to. The relatively high interest rates in the financial market, which range from 13.07% to 15% depending on the program, attract attention. The most advantageous offer of a financial institution is 16.29% on a deposit that provides for the capitalization of interest. At the moment, the financial institution is regularly fulfilling its obligations, and there are no reports of default on interest or principal deposits. There are people who talk about fulfilling promises by a financial institution. “IMoneyBank”, which accepts deposits of individuals to this day, provided one of the clients with a television at the end of the deposit. You can observe a slight change in the volume of deposits with a parallel increase in the amount of personal funds of the bank, with MKB and correspondent accounts inclusive. Interest liabilities of a financial institution on deposits increased by about 10.4%, from 17.4 billion rubles to 19.21 billion rubles.

Liquid assets

The bank’s liquid assets include those funds that can be converted into money in the shortest possible time to return to their depositors and to fully fulfill their obligations. Liquidity is an integral part of reliability. The liquidity of assets indicates that over the past month there has been a change in the volume of highly liquid securities, there has been an increase in cash at the Bank of Russia cash desks and accounts. Interbank loans increased, while highly liquid assets, taking into account discounts and adjustments, changed from 4.01 billion rubles to 9.78 billion rubles. Over the last reporting period, “iMoneyBank” increased the deposits of individuals several times, which was accompanied by an increase in liabilities to customers. In parallel with the last year of the financial institution’s work, due to the economic situation in the country, capital outflows for the year increased from 1.08 billion rubles to 1.75 billion rubles. The comparison of highly liquid assets and the volume of capital outflows forms a ratio of 558.26%. This shows an excellent margin of safety, which can overcome a much greater outflow of capital than the one that is taking place now.

To summarize

Having assessed the situation with AyManiBank (reviews, ratings and statistics), experts classify the financial institution as a relatively reliable institution. It is recommended for investments, but in the amount of no more insurance provided by the deposit insurance agency in the amount of 1.4 million rubles. The downgrade of Moody's, with a long-term negative outlook inclusive, which caused a panic among depositors, is more relevant not to the activities of the bank itself, but to the economic situation that has developed in Russia today. The bank itself simply reduced the volume of issued car loans, but did not violate the rules and continues to regularly fulfill all its obligations to customers. There is no reason to worry investors today, and the main merit belongs to the deposit insurance agency. Prudent investors are not recommended to make deposits for the reason that in the event of adverse events, their funds may simply be frozen. As for customer feedback, they are positive and negative. As in the situation with other financial institutions of the country, it is impossible to satisfy the interests of everyone. Moreover, people themselves, by virtue of their carelessness and neglect of cooperation with banks, agree to conditions that are unprofitable for their specific situation and then express their indignation. A little care, a detailed consideration of the terms of the partnership, a suitable banking product - and cooperation with the bank will leave only a pleasant impression. The agency’s special services respond immediately to any complaints.