Egyptian civilization is considered one of the oldest in the world. It has always been of particular interest to researchers. In addition to the richest culture, Egyptian civilization was also distinguished by the specificity of the economy. Rationing in the form of firmly fixed incomes and costs was one of the features of this sphere. Its main goal was to ensure uninterrupted supply of households and treasury. Many researchers believe that the history of taxes dates back to the very existence of this state. Let us further consider how rationing was carried out.

General information

The history of taxes began with the definition of objects of standardization. As them were land, grain and other products, the maintenance of workers. The object of rationing was directly the collection of taxes. In ancient Egypt, after floods, there was always a land survey. It consisted in a preliminary determination of the grain tax. Employees in ancient Egypt, collecting taxes, were financially responsible persons. If it is not possible to ensure the established norm, the agent could be executed.

Accounting technology

To understand what tax is in ancient Egypt, you should familiarize yourself with the techniques that were used to maintain the report. Technologies differed by type of record - by type of responsibility and land ownership. In the latter case, the papyrus indicated that the land that is cultivated by a certain person (entered by who exactly) consists of:

- Plot size.

- Norms per unit area.

- The total amount of the fee.

All indicators in papyrus were indicated in red ink. Other records relate to other forms of ownership. They began with the words "part, share." Such entries consisted of 3 digits. The first was black, the rest were red:

- The total size of the plot.

- Taxable part.

- The rate of taxation.

The latter was constant and fixed and amounted to 12/4 measures of grain. There was another recording option. They consisted of 2 black numbers. In this case, the measurement of the plots was carried out in the elbows (for other records - in the Auru). In the sources that have reached our days, it is difficult for researchers to understand exactly the content of the records. However, they symbolically indicated that a certain share of the land was considered uncultivated and therefore not subject to taxation.

Specificity of Inventories

When determining what a tax is in Ancient Egypt, it should be mentioned that the technology of recording and determining indicators depended on the economic nature of the objects. Due to the fact that heterogeneous objects were indicated in one inventory, all types of accounting registration were present in the papyrus. According to modern researchers, it was possible to keep registers separately depending on the type of records. However, since this approach was not used, scientists conclude that economic control was the key link. Its objects were primarily the land and the people responsible for it.

Who paid taxes in ancient Egypt?

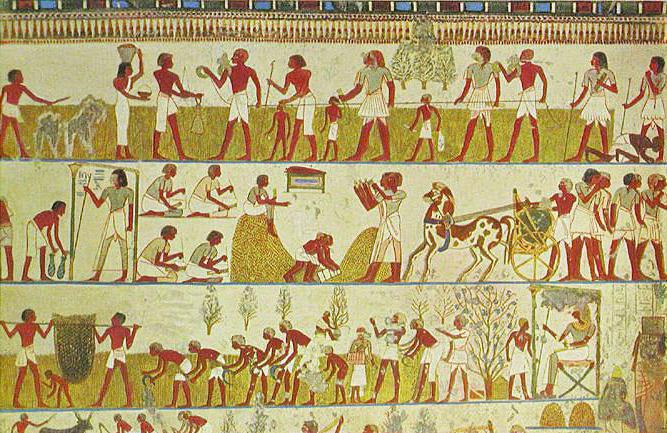

This was primarily done by private landowners. Those people who cultivated arable land were under surveillance all the time. They also withheld tax. However, this happened within the framework of a multi-level system of economic control. Farmers did not actually know what a tax was. In ancient Egypt, crops were harvested for a month under the constant supervision of supervisors. Then he all, in full, surrendered to the warehouses. After this, the surplus of the crop (the amount exceeding the rate of delivery) was returned to the farmers. Its value depended on the size of the cultivated area. In this regard, farmers should have been present at the land surveying and swore that the measurement was carried out correctly. Grain was transported to central storage facilities. After that, he was distributed among the farms, which belonged to the ancient Egyptian pharaoh, including. Each stage, of course, was taken into account by responsible people and controlled. The distribution system involved reconciliations, paperwork, mutual and superior checks. All cases of non-compliance were immediately recorded on papyrus.

Livestock

Explaining what tax is in ancient Egypt, one cannot fail to mention another important material resource - livestock. From the surviving sources it is not clear whether the offspring were subject to rationing, but the census of farm animals in the state as a whole was carried out every 2 years. The cattle was driven to the places where the count was made. There, for the purpose of taxation, animals were branded. In the accounting, the division of cattle was observed depending on the type, age and industrial purpose. According to the inventories, consolidated lists were formed.

Census of property

It was carried out periodically. The census was of great importance in the control system. So, in some documents, determining the date, referred to it. For example, such an entry was made: "The year after the seventh account of the fields and gold." Filing lists of peasant property were compiled indicating cattle, allotments, landings, as well as taxes on these objects. Taxes were called labor. The list of taxes collected from the property was formed, according to the researchers, according to the model of grain records. The same documents also indicated the debt of the person who owned the facilities. Arrears were periodically collected. To do this, officials went with a detachment of guards and mercilessly cracked down on debtors.

Population census

It was carried out every 15 years. In the inventories indicated categories of the population, as well as their property. With special care, labor accounting was carried out. It began with registration of people at the place of their activity. The recruitment document was forwarded to the royal paper management bureau. After that, he went to the overseers of the workers' parties. In accordance with this document, an order of appointment was issued. People were counted over their heads. The personnel list was supplemented by records on the use of force. To do this, lists of names were kept. They made absenteeism for reasons. Rituals in temples, illness of a worker or his relatives, and also a bite of a scorpion were recognized as respectful .

Types of taxes

The ancient Egyptian pharaoh welcomed the formation of economic relations based on the forced labor of slaves and free landowners. There were a huge amount of taxes:

- Apomoira - brought in money and kind (amounted to 1/6 of the crop).

- Grape tax.

- 5% of rental income.

- 10% of the sale value of products.

- 2% for market transactions (including export / import of goods).

- Apostolion - a tax on travel across the country.

The latter was levied on sailors, captains, artisans, and other passing people. There was also a special tax for admission to the desert, a fee for the maintenance of the fleet, doctors, baths, police, local administration and so on.

Monopolies

They were very common in ancient Egypt. So, for example, the monopoly acted on:

- extraction of materials and raw materials (ore, flax);

- production (production of papyrus, oil);

- circulation (import of goods);

- finance (banking organizations).

There were forced monopolies. Their existence was determined by the fact that the owners of the capital were in no hurry to invest because of the high rate. As a kind of monopoly, farms acted. He was also forced. Its essence was to send the funds collected from payers to the treasury. The farmers accepted the products, organized their processing, processing, could hand them over to the merchants and receive a fixed sum for them.

Land

She acted at all times as the main object of taxation. Grain served as the main export product. The owner of the land was the ancient Egyptian pharaoh. However, allotments could be transferred into the possession of peasants, nobles, temples. The processing of the plots was carried out by slaves or the same peasants. In papyri there is a detailed classification of the earth according to various criteria:

- Taxes.

- Agricultural crops.

- Degree of irrigation.

- To the order.

- Possession.

- Quality.

Sites could be transferred from one category to another. This process is mandatory recorded in the documents. The yield assessment was checked by a special commission according to the measurement data by the site. It was also recorded in special documents with stamps. They were made in duplicate. For some categories of the population taxes were not introduced. In particular, judges and scribes were exempted from them.