In today's world it is difficult to imagine a settlement system without using plastic cards. Often this method is much more convenient than paying for goods, services and making various payments in cash. Today it is not necessary to carry large amounts of money with you (and in most cases you can do without them at all) to make any purchase (from a chocolate bar to an air ticket or a car), pay a bill in a restaurant or make a monthly utility bill. All this can be done with only one bank card. It is accepted by most shops, restaurants, organizations providing all kinds of services. They realize the possibility of paying for their goods / services with a card through the use of acquiring. This article is dedicated to this concept. What is acquiring and what are its advantages for each participant in the calculations?

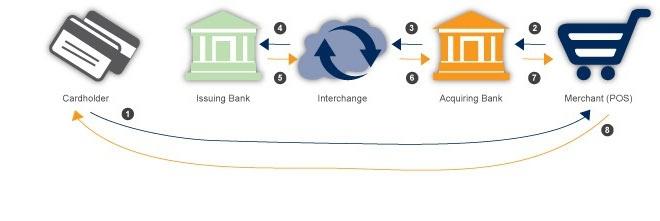

This service is provided by banks to trading and other organizations by installing payment terminals on their territory (otherwise they are called pos-terminals), as well as imprinters. They are designed to read information from the card and invoice the buyer / client. The acquiring bank receives a request and deducts the corresponding amount of money from the client’s account. Plastic card transactions are processed in the processing center of the bank. Based on the reports received on a daily basis, the bank reimburses the company (in its current account) in which the terminal is installed, money for the sum of all operations performed on this equipment. Bank acquiring brings a good income to a credit institution in the form of a commission for such calculations. Thus, for her, this is a good way to earn money.

And what is acquiring for an organization? Does it make sense to use this system if part of the cost of goods or services has to be given to the bank? Of course, he is, and not small. The fact is that this is a great opportunity to attract additional customers / buyers who prefer to pay with a card rather than a cache. As a rule, they do not carry significant amounts of money with them, and the absence of a pos terminal in the organization can lead to a refusal to purchase (often buyers do not return to make a purchase or other transaction, but find a place where they can easily accept card payments). Thus, acquiring (whose tariffs are not so significant for the company) allows us to expand our customer base and increase sales up to 30%.

There are other advantages to using this banking service. So, the company will always be insured against accepting false bills to pay for goods or services, and also save on cash collection . Well, and, of course, it will make it more convenient for customers who do not have enough cash, but always carry a plastic card with them.

And what is acquiring on the Internet? Almost the same, but in virtual space. It is used to pay for purchases from online card accounts in online stores, as well as when making a number of electronic payments (mobile phone top-up, utility bills, taxes, etc.). It is implemented using the web-based interface and also allows the bank to earn money on the provision of such intermediary services.

There is another option for this type of service. What is acquiring when using an ATM? In this case, this procedure includes the withdrawal of cash from a bank card by a person who is not a client of the credit organization to which this device belongs. The client here, like the service provider, is a bank: the first is the card issuer, the second is the owner of the ATM (acquirer).