Payment of income tax is the obligation of any individual who receives income on the territory of Russia (and beyond its borders). The correct calculation of the amount payable to the budget is possible only with the correct determination of the object of taxation. Let's try to figure out what is meant by the concepts of "personal income tax payers" and "object of taxation."

Legal basis

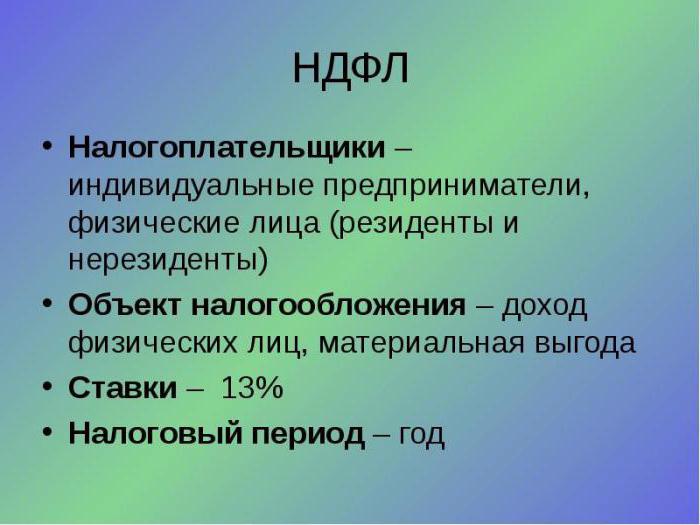

Individual income tax (or PIT) applies to everyone. The usual name for personal income tax is income tax. It is taxed by any individual who has received income.

Such concepts as “personal income tax payers”, “object of taxation” and “tax base” are described in Chapter 23 (almost the most voluminous) of the Tax Code. The legal base of income tax also includes:

- Federal Law N 281-FZ of 11.25.2009.

- Federal Law N 251- dated 07/03/2016.

- Federal Law N 279- dated December 29, 2012.

- Federal Law N 229-FZ of 07.27.2010.

- Order of the Federal Tax Service of the Russian Federation of 10.30.2015 No. MMV-7-11 / 485 and, necessarily, letters of the Federal Tax Service of the Russian Federation and the Ministry of Finance explaining disputed situations.

Basic concepts

According to the provisions of the tax legislation of the Russian Federation, and in particular - article 209, the object of taxation of personal income tax is recognized as income received by taxpayers:

- in the country and abroad by citizens recognized by residents;

- from sources within the Russian Federation by non-resident citizens.

The fact of residence is established by the rule: the days of the person’s actual (confirmed) stay on Russian territory for a continuous 12 months are summed up. Periods of absence are calculated without taking into account being abroad for the purpose of education and / or treatment (but not more than six months). Travel abroad is also taken into account in order to carry out labor (or other) duties that are related to the provision of services or the performance of work at hydrocarbon deposits located at sea.

A tax resident is a citizen staying in Russia for more than 183 days. According to the norms of the law, all his income is taxed at the generally accepted rate of 13%.

By analogy, non-residents are persons who have been in our country for less than 183 days (without a break). This category includes foreigners applying for temporary work, students who arrived in Russia for an exchange, and our citizens who live in the country for less than the specified amount of days. Persons belonging to non-residents transfer income tax at the rate of 30% to the state treasury. Naturally, the object of taxation of personal income tax for residents and non-residents also has a difference.

It is important to recall here that the category “incomes” is not only receipts in cash, less often in kind, it is also a material gain.

And further. The third paragraph of Article 207 of the tax legislation says that Russian military personnel who are called up or contracted abroad are recognized as tax residents of our country, regardless of the actual time they live in our country. As well as employees of state authorities and local self-government, officially seconded to work abroad.

Object of taxation of personal income tax: concept and structure

The tax law interprets the income of an individual as an economic benefit that can be calculated in monetary terms. That is, income is not generated if there is no benefit. As an example, we consider the situation with compensation for travel expenses to a courier or expenses to an employee who has arrived from a business trip.

Economic benefit is represented by income only if three conditions are met:

- its size is subject to assessment,

- you can get it with money or property,

- it can be determined according to the rules prescribed in the 23rd chapter of the Tax Code of Russia.

Article 208 of tax legislation to the objects of personal income tax (2016-2017), received from sources in Russia and / or abroad, includes:

- funds earned from the sale of shares (parts) in the authorized capital, securities, movable and immovable property, etc .;

- proceeds from the leasing of personal property;

- insurance claims payments; in the case of insurance payments, the paid premium is recognized as an object of personal income tax (exceptions are provided for in Article 213 of the Tax Code of Russia);

- pensions, scholarships and similar payments;

- income from the use of registered copyright or any related rights;

- income derived from the use of any vehicle, as well as fines and other sanctions imposed for their downtime;

- salaries and other monetary rewards received on the basis of contractual relations in the civil field;

- dividends and / or interest earned from participation in companies of both Russian and foreign education;

- other income from legal activity in our country and abroad.

The economic benefits received in Russia are also subject to personal income tax. They include:

- revenues from the operation of pipelines, power lines, other communications, including computerized networks;

- remuneration and other payments assigned for the performance of labor duties to members of ship crews flying the Russian State flag;

- payments to successors for deceased persons who had insurance.

This list is considered open. This suggests that in a critical economic situation, it can be increased.

What is not subject to personal income tax

In the same tax legislation there is a list of personal income taxes that are not claimed for personal income tax. These include:

- financial assistance paid to one of the parents no later than 12 months from the date of birth of the baby (but not more than 50,000 rubles);

- benefits paid in connection with pregnancy and childbirth, as well as unemployment benefits;

- monetary compensation for harm caused to health at work;

- allowances at the federal level, excluding payments for temporary disability (a sick child is no exception), and other compensation payments;

- cash gifts from the employer worth not more than four thousand rubles;

- alimony;

- remuneration for donor assistance (for donated milk, blood, etc.);

- state pensions, labor and social benefits;

- grants (gratuitous payments) aimed at supporting culture, education, art in our country, provided by Russian, foreign organizations or international (the list is determined by the Government of the Russian Federation);

- payments to volunteers under civil law contracts, the subject of which is gratuitous performance of work;

- Prizes awarded by foreign, international or Russian organizations for outstanding achievements in the field of education, literature, culture, art, science and technology, as well as the media (the lists are approved by the Government of the Russian Federation and the governments of the constituent entities of the country);

- Housing and / or land provided free of charge under any federal or regional program;

- compensation payments guaranteed by law at various levels of government (within certain limits).

And also the objects of taxation exempted from personal income tax include lump-sum payments that are made:

- in the form of targeted social assistance to vulnerable groups from budgets of various levels;

- due to force majeure circumstances;

- by the employer, family members of employees who either retired or died;

- victims of terrorist acts in Russia or family members of those killed by terrorist attacks.

The entire list is contained in the articles of the 215th and 217th Tax Code of the Russian Federation. It is recognized as limited and is not subject to expansion under any circumstances.

Since January 1 of this year, Article 217 received a new paragraph. Now, income tax is not charged on the cost of an independent assessment of the qualifications of an employee.

Calculation of the tax base

The taxpayers of personal income tax are calculating the tax base from the object of taxation in cash. All personal incomes for a certain period are summed up, then multiplied by the rate.

The tax base is determined separately for each recognized type of income, even if different rates are set for them.

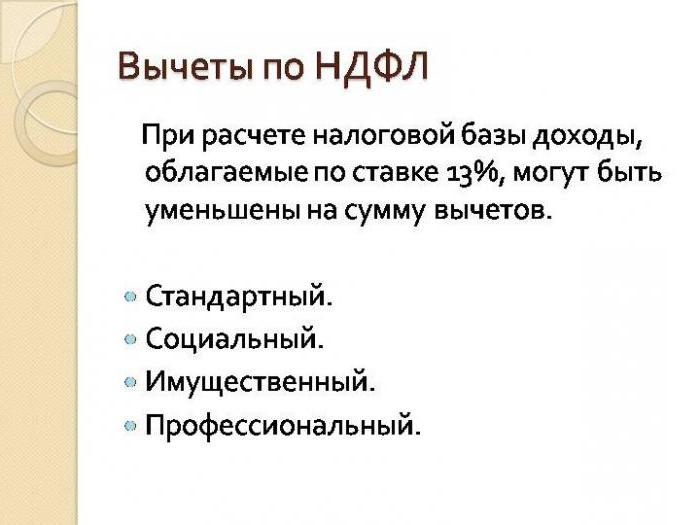

The amount of income can be reduced. For this, various deductions (standard, property, social, etc.) are deducted from it or not taken into account in advance.

The received positive amount is fixed and transferred to the budget. If the result is negative, then the individual does not pay anything, since his tax base is recognized as zero. Also, a negative result cannot be carried forward to subsequent periods or taken into account in further calculations.

If the object of taxation of the taxpayer, the personal income tax was received in currency, before calculating the tax base, it is converted into rubles at the exchange rate of the Central Bank of the Russian Federation on the day it is actually received.

One caveat: when establishing a tax base, it is forbidden to minus deductions from wages approved by a court decision. This can be utility bills, child support, loan payments, etc.

Other features of calculating the tax base of the object of taxation of personal income tax are determined by articles 211st - 215th of the Tax Code of the Russian Federation:

- the tax base for concluded insurance contracts is considered in Article 213;

- income as a material benefit may appear when saving on interest on the use of money received on loan terms, when purchasing goods, as well as works, services under concluded civil law contracts with individual entrepreneurs, organizations or individuals that are recognized as interdependent regarding the taxpayer, as well as when buying securities;

- if the object of personal income tax is income received in kind, then Article 211 of the Tax Code of Russia applies to it (“kind” means services, goods, property, that is, everything that a person receives by non-monetary means, but “in kind” ); here it is necessary to take into account that income in kind is recognized as received from an individual entrepreneur and / or company (organization);

- certain categories of income of citizens arriving from abroad taxed in our country are considered in Article 215 of the Tax Code of the Russian Federation;

- the principles of income tax on income earned from equity in various organizations are spelled out in Article 214;

- From January 1, 2016, the object of taxation of personal income tax can be reduced upon withdrawal from members of the company, and not only upon the sale of a share (or part).

Bets

The general tax rate is 13%. It applies to most income received by a tax resident. Naturally, the first in the list is salary, followed by remuneration for civil law contracts, income from the sale of property and other benefits not specified in Articles 2-5 of the tax legislation.

Several cases are prescribed in the norm when the object of taxation of personal income tax is recognized as income of a non-resident of Russia. They are taxed at a total rate of 13%. Here is some of them:

- income of foreign citizens working on the basis of a patent with individuals;

- income of foreigners invited as highly qualified specialists;

- incomes of participants in the federal program to assist voluntary immigrants (former compatriots) from abroad to our country; including members of their families wishing to relocate together permanently;

- income received from the labor activity of crew members whose vessels fly the state flag of our country;

- objects of taxation of personal income tax of payers - foreigners or persons; deprived of citizenship who received temporary asylum in Russia or are recognized as refugees.

The tax legislation provides for a number of objects of personal income taxation to which the rates are applied: 9, 15, 30, as well as 35%.

9 percent rate

It is applied if received:

- The economic benefits of the founders from the trust management of securities coverage. Such economic benefits are subject to personal income tax and can be obtained on the basis of the purchase of mortgage participation certificates received before January 1, 2007 by the securities coverage manager.

- Interest on securities (in particular bonds) with mortgage coverage, and issued before January 1, 2007.

15 percent rate

It is made upon receipt of dividends received by individuals, non-tax residents, from organizations registered in Russia.

The objects of personal income tax to which a 30 percent rate applies are as follows:

- income earned from securities issued by Russian organizations, and the rights to them must be accounted for in a foreign holder’s custody account (nominal), a custody account owned by a foreign authorized holder, and also a custody program custody account paid to persons for whom information was not provided to the agent on taxes;

- all economic benefits received by an individual not recognized as a tax resident, with the exception of income for which taxes are levied at a rate of 13 and 15%.

35% rate

It is applied in cases:

- if interest is received on deposits with banks, but an excess of the amount of interest is possible, which is calculated either on ruble deposits (assuming a refinancing rate of the Central Bank of the Russian Federation increased by 5%) or on deposits in convertible currency (assuming a rate of 9% per annum);

- economic benefits from the actual value of any prizes and / or winnings received as a result of participation in contests, games and other events for the purpose of advertising services, goods, works (provided that the prize or the declared value of the prize exceeds 4,000 rubles);

- income, as a payment for the use of funds taken on credit from consumer cooperatives contributed by their members (shareholders);

- if the object of taxation of the personal income tax is the material benefit that has been obtained as a result of savings on interest on credit (borrowed) funds in case of exceeding the amounts specified in the Tax Code (Article 212, paragraph 2);

- if interest is received for the use of funds received from shareholders in the form of loans by an agricultural credit consumer cooperative.

Personal income tax for individual entrepreneurs

Individual entrepreneurs are legally recognized as independent payers of mandatory fees and taxes. A businessman pays income tax if he conducts business under the general taxation system.

In the case of the use of wage labor and its payment, an individual entrepreneur becomes a tax agent for personal income tax.

The principles for calculating and paying this tax by merchants are spelled out in Article 227 of the Tax Code. The main one is the object of taxation of personal income tax for individual entrepreneurs are only income earned from doing business. Moreover, income can be expressed both in cash and in kind, as well as material gain, which is defined in Article 212 of the tax legislation.

The tax base

The entrepreneur determines it individually for each type of income, if different rates are set for them. Legislatively provides for the taxation of the income of an individual entrepreneur at a general rate, i.e. 13%.

The third paragraph of Article 210 of the Tax Code of the Russian Federation determines that the tax base at a rate of 13% is calculated as a monetary form of income, except for tax deductions prescribed by Articles 218 - 221 of the tax legislation, taking into account the features provided for by Chapter 23 of the Code . It follows that for individual entrepreneurs the right is laid down to reduce the tax base for the following tax deductions:

- recognized as standard articles of the 218th Tax Code of Russia;

- investment prescribed by article 219.1 of the code;

- social, prescribed by Article 219 of the Tax Code of the Russian Federation;

- when transferring losses in transactions with financial instruments of derivatives transactions and / or securities to future periods (Article 220.1 of the Tax Code of Russia);

- property disclosed in Article 220 of the tax legislation;

- professional, prescribed by article 221 of the Tax Code of the Russian Federation;

- when transferring losses from membership in an investment partnership to future periods (Article 220.2).

Professional tax deductions are subject to the rules by which recognized expenses will be:

- substantiated;

- documented;

- appeared as a result of activities aimed exclusively at obtaining benefits.

The criteria described must be met at the same time.

, :

- , .

- ( ). , , , , , ( , ).

. , .

Post scriptum

, – , - (, .) ( , ), ( ).

, 208- , , . , , . , , / (, ), , , .

, , , .

, , , .

(, , , .), .