Many Russian enterprises are required to draw up a document such as a profit and loss account. This source assumes the inclusion of figures reflecting how efficiently the company operates - in terms of generating revenue and ensuring business profitability. This information may be useful for investors, lenders and partners. The need for a corresponding report may also arise due to the company's obligations to provide data to government agencies - the Federal Tax Service, statistics agencies. What features is characterized by the document in question? How to make it right?

Report essence

Profit and loss statement is an example of the most important document from among those that form the financial statements. It can be noted that another name of the source is more common, namely - “report on financial results”. That is how it sounds in many sources of law.

Sometimes a document is referred to as a “profit and loss financial statement”. Regardless of the name, the corresponding source contains: monetary indicators of the company’s activity for the reporting period, information on income with a cumulative total.

Report content

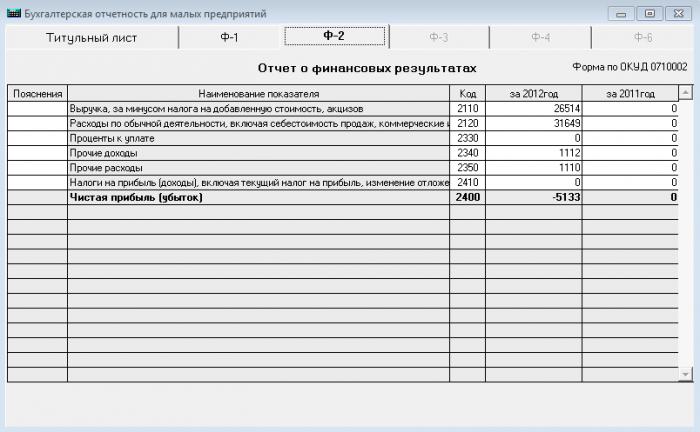

The legislation of the Russian Federation defines a standardized document that reflects the relevant information - Form 2. The profit and loss statement prepared on it includes the following main parameters: profit (loss) from the sale of goods, operating revenue and costs, income and expenses arising from non-operating activities, the organization’s costs of producing products at full cost (or production), selling and management costs, net income from sales, profit tax, are different liabilities, assets, net profit. In general, all this information allows us to adequately assess the effectiveness of the business model of the company.

Document Importance

Profit and loss statement is an example of an important document in terms of analyzing the effectiveness of an enterprise’s business model . This source also includes figures by which you can determine the profitability of the company or individual sections of production (sales).

The overall financial performance of the company is thus characterized by profit margins, as well as profitability. The first criterion can be determined based on the dynamics of sales, leasing of certain funds, exchange-traded activities and other types of activities aimed at generating profit. The second one also depends on the level of costs.

Report analysis

Analysis of the profit and loss statement of the organization allows you to determine how effectively management carries out activities within the framework of certain business processes - production, supply, solving marketing and personnel problems. Possessing relevant information will allow the management of the organization or, for example, investors to evaluate how competently specialists and managers of the company operate, to determine priorities in optimizing the development strategy of the enterprise. The profit and loss statement of the company allows you to identify what factors affect the implementation of the business model of the company, which company has additional resources to improve financial performance. This information is important for both management and investors or lenders.

Report and accounting documents

Profit and loss statement is an example of a document, which, as we noted above, is included in the financial statements. In significance, it is comparable to a source such as the balance sheet. However, the principles for compiling these documents vary widely. So, the balance sheet involves the inclusion of data as of a specific date. In turn, the profit and loss statement should contain information with a cumulative total - for the 1st quarter, six months, 9 months, and also the tax year.

The balance sheet and the profit and loss statement are compiled by all accounting firms. The main task in compiling the first type of document is to reflect information about the property of the company and about the sources of financing its activities. In turn, the profit and loss account records the results of the company and is used to assess the effectiveness of the business model of the enterprise. Very often both documents are submitted to the relevant state bodies at the same time. The noted sources are extremely important also, as we noted, for investors, as well as partner organizations planning to cooperate with the company.

Should the data in the report be considered official?

The profit and loss statement is a completely official source. It is certified by the signatures of the organization’s management, and therefore cannot contain data that is presented with the intent of distorting the idea of how things are going in the company. In some cases, firms involve external partners in the preparation of the relevant document in order to improve the quality of the analysis of the business model of the enterprise. This is carried out in the interests, first of all, of the company itself, which draws up the document - the attitude of other market players to it often depends on how responsibly the organization approaches to the formation of this report.

Document structure

The general principle of structuring a report is to reflect indicators that provide an idea of whether a company is unprofitable or profitable. Key information related to this is recorded at the very beginning of the document (this is revenue, sales data, expenses - including management).

After the basic information reflecting the efficiency of the enterprise is recorded in the document, additional indicators related to the formation of income or expenses are entered in the report - for example, interest on deposits (or, conversely, debt obligations), figures reflecting the results of business activities firms before tax. Then, the profitability of the company is calculated after payment of the necessary fees to the budget and is also recorded in the report. Thus, the final financial result is formed - net profit (or, conversely, loss) for the tax period.

Specificity of defining indicators for a report

What should I look for when determining indicators for inclusion in a document such as Form 2? The income statement should, first of all, be compiled on the basis of the accrual basis. What does it mean? Revenue should be accrued at the moment when the buyer or customer of the organization must begin to fulfill obligations related to the payment of goods or services. As a rule, they arise after the products are shipped, or services are provided. Documented, this is usually accompanied by the presentation by the customer of the necessary estimated sources.

So, now we know what Form 2 is - income statement. Let us now examine what are the nuances of compiling this document. The relevant report form is standardized and recommended by the Ministry of Finance. It is necessary to prepare the document before March 30 of the year following the reporting one - if it is a matter of providing data for the tax year. It can be noted that the corresponding form of the profit and loss statement can be adjusted by specialists compiling this document. These or those lines can be deleted (for example, if there is nothing to reflect on certain indicators) or, on the contrary, added by employees of the relevant departments of the company.

How to fill out a report?

How to properly fill in the income statement? Form 2 Form is the first thing we need. It can be requested at the nearest branch of the Federal Tax Service or downloaded on the agency’s website - nalog.ru. The first thing you should pay attention to when filling out the corresponding document is that in each of its lines total indicators are recorded.

It can be noted that the general information about the organization indicated in Form No. 2, in general, is similar to that recorded in the balance sheet, or Form No. 1. Among them: the reporting period, the name of the company (in accordance with the constituent documents), OKVED codes and others that are required in accordance with the form, the legal status of the company, as well as the units used in the document.

In what sequence can a profit and loss statement be completed? We will study an example of the algorithm for compiling the corresponding document based on the key points of Form No. 2.

Paragraph 2110 indicates the revenue of the organization. It represents the amount of income arising from the sale of goods, the provision of services or the performance of work by the reporting company. Subtract VAT from this value. Information for filling in the corresponding paragraph should be taken from account 90 (that is, “Sales”).

Clause 2120 records the cost. Information for its completion should also be taken from account 90 (from debit). At the same time, expenses related to the sale should be excluded (they can, in principle, include all expenses, except management and those associated with transport and procurement activities - for them the profit and loss account form provides for separate lines).

Clause 2100 records gross profit (or loss). The corresponding value is calculated easily - as the difference between the indicators in lines 2110 and 2120.

Paragraph 2210 indicates business expenses. They may be expenses associated with the main types of business activities of the company, with the exception of those related to transport and procurement. Information for the corresponding item must be taken from account 44 (its debit). These expenses are also included in the cost shown on account 90.

Clause 2220 records management expenses — those associated with the organization of the management system in the company. This may be the administrative costs associated with the lease, the payment of labor compensation to employees, the transfer of the corresponding taxes to the budget. The figures must be taken from account 26 (that is, “General expenses”). Note that this data is also included in the debit of account 90.

Paragraph 2200 records profit arising from sales. Of course, this could also be a loss. To obtain the necessary numbers, it is necessary to use the indicators of the profit and loss account, which are contained in paragraphs 2100, 2210, and also 2220. From the first indicator, you need to subtract the second, and from the resulting figure, the third.

Paragraph 2310 indicates revenue from other organizations. Its appearance is possible if the company invests money in the authorized capital of other enterprises, as a result of which it receives dividends or part of the profit. This type of income is also recorded on account 91 (on credit).

Paragraph 2130 records the interest receivable. They may be associated with the presence of bank deposits, deposits, bonds, or, for example, bills of exchange. Relevant information can be obtained from account 91 (as in the previous indicator, from the loan).

Paragraph 2330, which reflects interest payable, is adjacent to the indicated figures. They may be associated, for example, with loans. The necessary information can also be taken from account 91 (from debit).

Paragraph 2340 records other income. The figures are formed from the proceeds that are recorded on account 91 (for loans), excluding VAT and other fees that are recorded on the debit of this account, as well as not recorded in other indicators, which include the income statement (lines 2310 and 2320 ) Paragraph 2350 reflects, in turn, other expenses. These are the costs that are recorded on account 91 (debit), not counting the indicators from line 2330.

Paragraph 2300 records profit (or loss) that appears before tax. To calculate it, it is necessary to add several indicators, which include the profit and loss statement form, namely, those that are reflected in lines 2200, 2310, 2320, and then subtract the amount from lines 2330 and 2340 from the resulting figure. But this is not all . From the resulting figure, subtract the value from line 2350.

Paragraph 2310 reflects income tax - for the reporting period for which the organization draws up the document in question. The source of the necessary data can be account 68 (that is, “Taxes and fees”). If the company pays tax under PBU 18/02, then paragraphs 2421, 2430, as well as 2450 can also be filled. What is their specificity?

Paragraph 2421 records the firm's permanent tax liability. How? For example, if, when calculating income tax, differences are recorded between the indicators that are included in the accounting and tax records, then the difference found between them becomes constant. If you multiply it by the tax rate, then the corresponding amount will have to be paid by the company to the budget. The corresponding obligation will be recorded on account 99. The specific figures that must be indicated in the paragraph under consideration can be defined as the difference between the debit and credit indicators of account 99 (more precisely, the sub-accounts "Permanent tax liabilities"). This is the specifics of filling out a document if, for example, a company draws up tax documents, a balance sheet and a profit and loss statement at the same time.

Paragraphs 2430 and 2450 reflect deferred tax liabilities. If the company takes into account revenue or expenses in one period, and taxation should be carried out in another, then the corresponding figures form a temporary difference. Income tax acquires deferred liability status. Information for the marked items can be taken from account 77, for example, from account 09.

Paragraph 2460 includes other information. Here information may be recorded regarding other amounts that affect the size of the firm's profit. It can be various penalties, fines, overpayments.

Paragraph 2400 reflects the net profit of the organization. The corresponding figures may also record a loss. In order to get them, it is necessary to subtract from the line 2300 the sum of the indicators of points 2410, 2430, as well as 2450. After that, subtract from the resulting amount the values in the line 2460.

Paragraph 2510 records the result of the revaluation. It reflects the results associated with the revaluation of various non-current assets. In paragraph 2520, the result of other operations is recorded. The corresponding line shall reflect information that was not taken into account by the compiler of the report in the previous paragraphs. Paragraph 2500 determines the financial result for the tax period. It is determined by adding the indicators in lines 2400, 2510, as well as 2520. If the company operates as an AO, then lines 2900 and 2910 should also be filled out, reflecting the profit or loss per share.

Features of working with a document

The finished profit and loss statement (form with all the numbers entered, as well as signed by the head of the company) is submitted to the territorial division of the Federal Tax Service at the place of business.

In some cases, a simplified document may be prepared. Its structure implies the indication of a smaller number of numbers - by groups of individual articles, but without special detailing of certain indicators. This opportunity is open to small businesses. Analysis of the profit and loss statement of large businesses, in turn, involves the study of a large volume of various indicators. This is necessary for an objective assessment of the effectiveness of the organization’s development model — by managers, investors or creditors.