How to issue CTP via the Internet? This is a common question. We will understand it in more detail.

The answer to this question is of interest to many motorists, since the remote registration of compulsory car insurance policies helps to avoid various inconveniences associated with both the human factor and the imperfection of the organization of employees.

How to issue CTP via the Internet, we will tell below. In the meantime, let's talk about the benefits.

Advantages of E-CTP Insurance

Making an insurance policy online has its own strengths and weaknesses. So the advantages of this event are:

- You can save a lot of time and effort;

- no need to adjust to the schedule of insurance companies;

- obtaining insurance through the Internet does not entail any secondary costs - insurance agents simply do not have the opportunity to impose additional costs on the client.

Conditions for compulsory motor third party liability insurance via the Internet

It would seem that with this list of advantages, this method of registration of the policy should be in great demand. However, it is not.

What is needed for compulsory motor third party liability insurance via the Internet

To purchase an online car insurance policy, you must fulfill some important conditions:

- the presence of a stationary computer, laptop, office equipment and access to the Internet;

- possession of free time for entering personal data into the program;

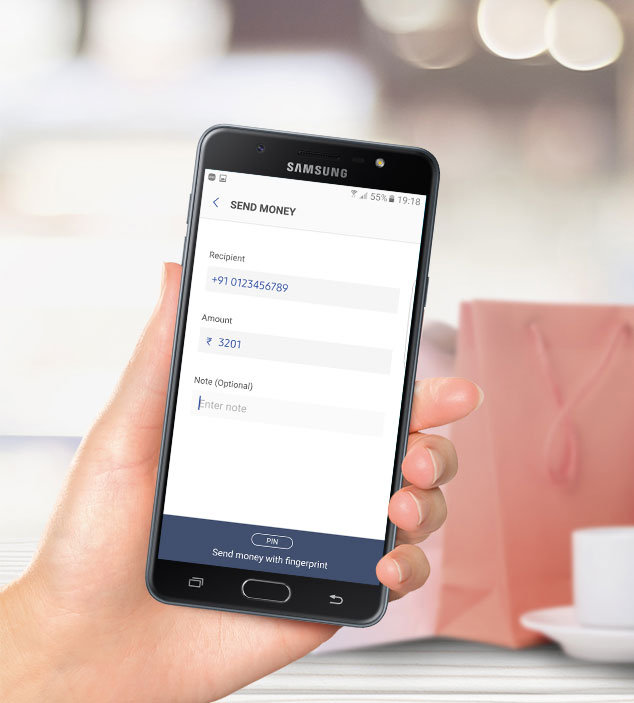

- the presence of a payment instrument (as a rule, it is a bank card).

As practice shows, the presence of all three of these components is far from being available to all applicants for auto citizens.

Not everyone knows how to arrange CTP via the Internet correctly.

How to choose an insurer on the Internet for electronic type of policies?

To get car insurance through the online service of this insurance company, you need to find out if the company offers such services. Currently, several large companies provide insurance services through the Internet:

- "Alfa insurance";

- Moscow Insurance Company;

- "Parity-SK";

- Rosgosstrakh;

- Energogarant;

- Uralsib;

- "Military Insurance Company";

- "Reso guarantee."

Sometimes in the system small malfunctions can occur, in which filling out the electronic form of the insurance policy becomes impossible. In such a case, a corresponding warning appears on the site.

What to consider?

When choosing a company for compulsory motor liability insurance, it is recommended that you read information from reviews of real people, as well as information posted on the official Internet resources of the insurer. The following points should be considered:

- work experience - the insurance company must be engaged in car insurance for at least 8 years;

- the amount of the authorized capital of the company - the more, the more reliable;

- rating among other insurance organizations - can be found on the Internet or on the RSA.

If for a long time a person buys a car insurance from the same insurance company, however, he has not yet established the procedure for issuing OSAGO E-policies, he does not recommend rushing to change everything. Experts recommend waiting a while until progress touches this particular insurance company, continuing to draw up the usual option when visiting the office directly.

RESO

Registration of CTP in the "RESO Guarantee" is also possible via the Internet. To do this, select the appropriate section on the official website of the company. The loan will require registration in your account. Here you need to enter all the required data, confirm the consent to their processing. After that, in your personal account, you need to click on the tab "Issue an MTPL policy." "RESO Guarantee" gives you the opportunity to see your old policies, if you have already been a client of the company.

After filling out all forms, calculating the amount, you will need to pay insurance. Once the payment has passed, the policy will be available for download.

VSK

MTPL insurance policy through the Internet in "VSK" can also be issued. All steps are no different from RESO. You need to register, fill out all forms, calculate and pay. There is nothing complicated about it.

Rosgosstrakh

Learn how to take out CTP insurance through the Internet at Rosgosstrakh?

Getting an online policy is not as difficult as many vehicle owners think. It should be borne in mind that on the official website of the insurer you can:

- Buy protection to a new customer.

- Renew OSAGO (Prolongation).

The procedure is the same. You need to register, enter information about the car and the owner. The entire extension procedure lasts no more than 5 minutes. In this case, the client does not need to download copies of documents and fill out an electronic application.

Rules for registration

Buying a car insurance policy via the Internet is not as difficult as it seems at first glance. This procedure takes place in several stages:

- Registration on the website of the insurance organization. To complete this registration, you must enter your personal data (including phone number, address, series and passport number) in a special form in electronic form. It is necessary to enter such information with maximum accuracy, since the success of the operation depends on this. After registration, a message will be sent to the client’s phone number or e-mail containing an individual login and password to enter the system.

- Filling out the application. After entering your personal account, you need to select the desired service. It can be an initial purchase of an insurance policy or an extension of an existing contract that was previously concluded. There is also no difficulty in filling out this electronic document - the application displays the same paragraphs as are contained in the paper document. The completed application is certified using two methods - by electronic signature or by entering the password used to enter the system.

- Calculation of the price of the insurance policy. If the information data is entered correctly, and the client passed the verification in the Automated Information System without problems, a letter from the insurance company is received in his personal account. This letter indicates two points - the calculation of the cost of car insurance and the way in which you can pay for the service provided.

- Deposit of funds to the account of the insurance company. MTPL insurance can be paid with cards of almost all banks operating in Russia. The largest insurance companies practice the use of electronic money.

- Getting a car insurance. From the moment of receipt of payment to the insurer's account, the completed document form appears not only in the personal account of the client, but also in his email. Along with this, the policyholder receives a whole package of necessary documents (contacts, an algorithm of actions in the event of an accident, etc.). It is recommended that you print out the insurance policy yourself or make a request for a copy of the insurance contract. In this case, the company of the insurer undertakes to send it to the client's address indicated in the application. However, one should definitely clarify whether such a service is paid. On this, car insurance via the Internet can be considered over.

It is recommended that you always have a printed insurance document at hand. The terms of registration of CTP via the Internet are no more than one day.

Registration of insurance on the Gosuslug website

MTPL can be issued not only on the SK website, but also on the portal of State servants. This procedure takes no more than one day and looks like this:

- Registration on the site and the presentation of identity documents.

- In the section "Transport and driving" you must select the subsection "E-insurance". At the same time, you can see a long list of insurance companies - it is recommended to choose the one whose services have already been used. Thus, the client will be able to get the most favorable conditions when establishing the KBM.

- Next, you need to wait until the system redirects to the official website of the insurance organization.

- After that, it is necessary to perform exactly the same actions as in the process of acquiring a car insurance in LC (enter data on all drivers, the car and its owner).

- Familiarization with the calculation of the final cash amount (carried out automatically).

- Next, you need to choose a payment method and deposit funds into the company account.

- Obtaining an electronic copy of the insurance contract in a letter that was sent to the customer’s email address. A copy of this document is also reflected in the personal profile of the system and transferred to a single information database. You do not have to worry about the safety of personal data - the means through which confidential information passes are reliably protected from scammers.

Simplified options

Understanding that filling out an electronic policy form on their own presents some difficulties for many clients, many insurance companies have greatly simplified this procedure. About 7 days before the expiration of the contract they send an SMS message to the client with a proposal to extend insurance online and attach to this message clear instructions on how to do everything right. In this case, the actions of the policyholder should be as follows

- Follow the specified link.

- Enter your phone number and code from SMS - this will help the system find a pre-compiled application.

- This field needs to wait until an email containing a temporary password from the personal account arrives at the email address. This password must be changed to permanent.

- Next - the client logs into the account on the official resource of the insurer.

- It is necessary to find in the LC ready OSAGO with the personal data entered into it.

- Next, the client checks the new document with the old insurance policy.

- If all the information indicated in it coincides, it is necessary to confirm this by putting V, thereby expressing your consent.

- Next - the client goes to the page to make payment for this service.

- All related documentation is emailed.

- Documents must be printed on a regular printer and carried with you.

Renewal of CTP insurance through the Internet

With the implementation of the extension of the insurance policy on the Internet there is practically no hassle. If the client is already registered in the company database and has a personal account, then all information there is automatically saved. At the same time, it will be enough to complete just a few steps for registration and payment of insurance.

Possible problems

Having decided to take out CTP insurance through the Internet, you need to be prepared for some possible difficulties that often accompany such a process. The most common problems when obtaining an electronic form of an insurance policy include:

- Lack of supporting information from the AIS system. Perhaps the whole point here is that the necessary information was not entered at all, or was entered with errors. It also happens that a certain malfunction has occurred in the program. And without such confirmation, the insured simply fails to fill out an application and use the insurance service.

- A thorough check. To purchase CTP insurance on the Internet, you do not need to provide any documents to the office. However, this does not mean that the insurance company will not conduct a comprehensive verification of the data of the insured through its own information database.

- The data on the car (the date of issue of the necessary documents, year of issue, inspection, driver’s license, etc.), as well as all basic information about the driver (accident-free and driver's experience) pass the mandatory check.

- Sometimes the audit may be terminated (at any stage of the execution of the contract) due to the lack of certain information. At the same time, the car owner does not even realize that the inspection passed in time is not displayed in the program and is the main obstacle to the electronic form of the CTP insurance policy.

- Technical errors. When deciding to insure a car on the network, you need to be very careful - all the inaccuracies that will be made during the creation of the application are a reason for refusing to issue an insurance policy (both paper and electronic).

- The impossibility of registration by proxy. To date, online registration of policies can only be carried out by the owner of the car.

- New car insurance. Information in the system is received only after the vehicle has passed the registration in the traffic police. In other cases, it is absent. This means that the purchase of a policy for a new car can only be made with a personal visit to the office of the insurance institution.

We looked at how to issue CTP via the Internet.