Before starting your business, you need to draw up a clear plan of action and calculate financial indicators. The most basic of these is profit. However, it can be calculated in various ways. And you need to clearly understand the difference between accounting profit and economic. The border between these terms is rather narrow. But it’s important for a finance specialist to be able to distinguish between these terms.

Accounting profit (loss): essence and types

This is a financial result from operating activities. This indicator is calculated for each reporting period according to an algorithm approved by law. The difference between income and expenses is recognized in the income statement.

Taxes are deducted from accounting profit. Payment of fees to the treasury does not always go synchronously. This is due to the features of the use of deductions. If the organization does not reduce the tax base in the current period, then the tax profit will be more than accounting. And this is recorded in the reports. In the next period, the company will exercise its right to deduction, and these figures are aligned. Therefore, economists distinguish several types of accounting profit.

- Gross income is the difference between revenue excluding VAT and cost.

- Profit from sales is the difference between the revenue from goods and the costs of bringing them to the market.

- Profit from ordinary (operating) activity is a financial result that remains after deducting expenses from the main activity (production).

- Profit before tax is a financial result that remains after deducting expenses from all activities. After all, an organization can not only engage in the manufacture of products, but also invest free funds in stocks (investment activity). Or purchase an asset (building), and then rent it out (financial activity). The sum of financial results from all of the above works is profit before tax.

- Net income is cash. who remain in the company after tax.

Economic profit

This indicator reflects the increase in the value of the company. When calculating the indicator, invisible items of expenditure, for example, depreciation, are not taken into account. Not all enterprises save money for OS repair every month. Depreciation reduces the tax base, so it must be taken into account when preparing the balance sheet. But such an indicator will not be included in the economic report.

Accounting profit gives a strategic assessment of the development of the company, and economic - tactical. The accountant's task is to check the reflection of all expenses and the correctness of tax calculation. The economist's task is to identify the growth prospects and bottlenecks of the enterprise.

Opportunity cost

Economists determine the amount of lost profits as a result of choosing a specific investment direction. These are the so-called opportunity costs. For example, the company launches the production of washing machines and stops the production of televisions. At the same time, the cost of the services of satellite operators is sharply reduced in the market, which leads to an increase in demand for televisions. Lost revenue is the opportunity cost.

In accounting, product structure may not be taken into account. It is not the responsibility of the accountant to calculate the demand potential in a particular segment. His task is to correctly calculate profits, draw up a balance sheet and a profit and loss statement. The economist is required to pay close attention to the calculation of opportunity costs. By analyzing these figures, we can determine the direction of investment activity.

Factors

There are indicators that determine the profitability of the organization. They are conditionally divided into internal and external. The first include: the level of competence of specialists, the quality of management of managers, the competitiveness of goods, the organization of production, the adaptability of infrastructure, labor productivity. External factors include: the political situation, the process of regulating the economy, supply and demand in the market.

Accounting profit is recorded according to actual indicators and does not depend on these factors. But the opportunity costs are determined based on the situation on the market.

Why is this data needed?

For what purpose can economic and accounting profits be calculated? The definition of the first indicator is necessary for the enterprise itself. The business owner builds a model, improves it and analyzes it for himself. Settlements must be submitted to state authorities. Profit in accounting is additionally analyzed to identify deviations in the planned and actual indicators.

According to economic profit, experts determine the effectiveness of investing in a business. Provided, of course, that it is correctly calculated. The profit and loss accounting report, its structure and formation algorithm are set at the level of legislation. The company develops the algorithm for generating economic profit independently. Although some industries have generally accepted forms, they are not suitable for the business model of a particular organization. Therefore, experts believe that it is better to analyze the state of the company for accounting profit. Although there are situations when the figures from the income statement do not affect important business processes. Why is that? Yes, because accounting profit does not reflect the real sources of its formation. In such situations, the calculation of the economy can not do.

Example

Two factories produce building materials. According to BU, they have the same revenue and profitability. Comparable items are included in the balance sheet and income statement. But the first customers at the first plant are large holdings, and the second sells materials to small / medium enterprises. After the aggravation of the political situation, the activities of holdings cease in the Russian Federation, customers leave the market. While the first plant is going through difficult times, the second will develop in connection with the entry of new manufactures onto the market. Thus, the different results of commercial activity are visible for enterprises operating in the same segment. Such a crisis could have been predicted if economic analysis had been used.

A successful business enterprise must calculate the financial result, accrue tax on accounting profit. At least in order to submit a report to the Federal Tax Service. The task of the economist at the first enterprise is to analyze the customer base and offer to switch to the segment of small and medium-sized businesses. At the second enterprise, the economist's task is to look for opportunity costs.

Calculation formula

Accounting profit is the difference between gross revenues and costs. It is calculated by the formula:

Pb = Gross Income - Costs.

Gross income is sales revenue net of taxes. Costs are expenses associated with the manufacture of goods.

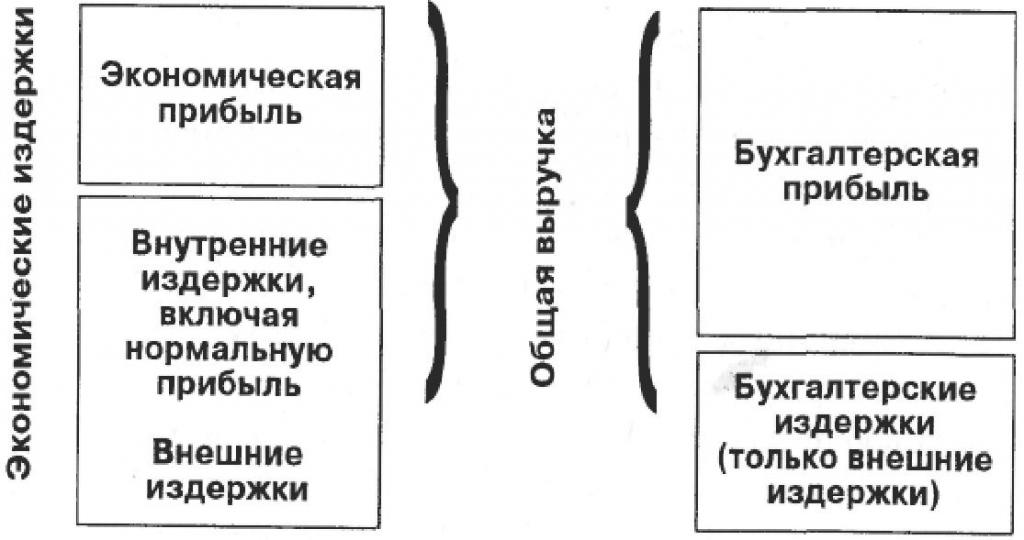

Economic costs include domestic and external costs (procurement, payment of services, labor). In accounting only external costs are taken into account, therefore accounting profit is calculated as the difference between revenue and costs incurred. When calculating this indicator, it is important to consider the following elements:

- Net income - profit from the sale of goods - BH.

- Profit from the sale of fixed assets (buildings, equipment, other means of labor) - Pi.

- Profit from non-operating activities - Air defense.

- Gross profit formula: = + + .

Knowledge of the formula is necessary not only to evaluate the results of activities, but also in order to reduce the accounting of income tax, STS.

Profit planning

The effectiveness of the organization and the possibility of increasing the value of its assets depend on the correctness of building a forecast, profit distribution and finding ways to optimize it. If product prices are stable, then when compiling a forecast for a year, data for the past 3-6 months is selected for seasonal and non-seasonal goods. It does not matter which method was chosen: direct account, analytical, operational leverage.

Conclusion

From the foregoing, we can conclude that the accountant keeps track of the numbers, the economist calculates the strategy. These two specialists do not exclude, but complement each other. In the event of a negative financial result, it is urgent to change the production technology, raw materials or move to other markets. Often the reason for low profitability is low productivity, outdated equipment in the manufacturing sector, as well as high costs for the sale of services or advertising.