Accounting for low-value wearing items (MBP) is an extremely important category in accounting. In its activity, no enterprise can do without the mentioned phenomenon. In this article we will try to give the most complete and detailed answer to the question: "IBE - what is it?"

Bit of theory

Any company buys and uses many products that cannot be attributed to fixed assets. Here they are in accounting and called low-value wearing items. To make it more clear, we’ll tell you what we are talking about.

What can be attributed to the IBE

In fact, low-value and wearing items are means of labor, but their value is included in the stocks of the enterprise. The basic principle of classifying this or that equipment, tool, etc. as the IBE is to determine its service life, as well as the initial price.

It should be borne in mind that we rank as part of the IBE a part of the organization’s inventories whose service life is less than one year, while their value does not play a role (they are wearing out).

Another principle for classifying goods in this group is the upper limit of the value of low-value wearing items. It is she who determines whether to attribute them to fixed assets or specifically to the IBE. Thus, the cost of IBE is a significant criterion.

Using this definition, overalls, shoes, office equipment, utensils, household items, etc. can be attributed to low-value wearing items. Regardless of the useful life and cost, the IBE group also includes specialized tools, narrow-purpose devices necessary for production; interchangeable parts of equipment; fishing gear; chainsaws.

MB-items cannot include agricultural machinery and tools, construction equipment and tools, livestock. All this is included in fixed assets, regardless of service life and cost.

A bit of history

The money spent by the organization on the purchase of certain items should not be added to the expense item. These things can be used for a long time, and can have one-time use. In the first case, we are talking about fixed assets. But in the second - about negotiable. And the expense is recognized at the time of write-off. This is what accountants thought and think. But back in the last century, experts in this field came to an important decision: items that have been used for several years and which at the same time have a rather low cost are difficult to classify as fixed assets. Therefore, our colleagues decided to remove a certain part of the objects from the mentioned category. They were called low-value wearing items (MBP) and included in the working capital.

Criteria for classifying goods as BMP

The name of this term already has two principles: a low price and a service life - quick wear. The main criterion was the cost limit and the service life. The limit has changed from time to time. But the term of service is always understood as one year. So, theoretically, there could be only four options for assigning acquired things to the category we are considering:

- The item costs less than the cash limit, but is operated for more than one year.

- A thing costs less than a limit, but also serves less than a year.

- The item costs more than the limit, serves more than 12 months.

- An object costs less than a limit and lasts less than a year.

Previously, only the fourth group could be attributed to the IBE and called working capital. Initially, it was assumed that the first, second and third groups will be assigned to fixed assets. But in practice, people remembered the price limit and forgot about the time of service. So the IBE became an independent group. Entire departments of institutes were engaged in research of low-value and wearing items.

How to work with IBE. Theorists vs practitioners

Practice has developed several options:

1. Items for the 12th account “Low-value wearing items” came and went into operation. They passed at the cost of acquisition in an asset. And at the end of each month was debited to expenses 1/12 of this price. That is, the service life could be more than a year, but the cost of equipment or, say, inventory was written off exactly for 12 months.

2. Upon commissioning of the facility , depreciation of 50% was calculated immediately. And the remaining 50% - at the time of its decommissioning.

The second option was used, of course, more often. He was simpler for an accountant. In addition, the first had its drawbacks. In the month of purchase, the entire value of the object passed through the balance sheet, and this illogically increased the profit of this month. Further, of course, uniform depreciation reduced the profit of subsequent reporting periods, but this was not entirely correct. From a scientific point of view, both options were imperfect.

There was another drawback in accounting for IBE. There are things whose price is low. Practicing accountants insisted that these items were immediately written off as running expenses. And here no depreciation and wear are needed. Very convenient, isn't it? But theorists were very confused by this approach. However, their opinion did not particularly affect the outcome of the case. Practice remains practice, because all this reduced the company's profit in the month of purchase, and therefore, simplified the work of accountants.

Later they decided to cancel the IBE, but this did not fix the problem. But all this is yesterday. Today, low-value and wearing items still exist, and their records are kept. About how this happens, and will be discussed later. So, IBE: what is it and what does it eat with?

Work with PBU 5/98

Accounting for low-value and wearing items is carried out in accordance with the accounting provisions of PBU 5/98 (“Accounting for inventories”). The life cycle of low-value wearing items has three stages: admission, operation, retirement. In accordance with this, the following stages of accounting are distinguished:

- receipt;

- issuance of IBE;

- transfer to operation;

- wear;

- write-off of IBE.

The first and second options are made by analogy with the accounting of materials. But the IBE in operation has its own characteristics, which are due to the choice of type of accounting and write-off.

Items of low value, the price of which is within 1/20 of the established limit for a standard unit, are written off as production costs as they become operational. For BMPs with a value above 1/20 of the established minimum, it is customary to charge depreciation. It is usually calculated in the following ways: percentage, linear, proportional to the volume of production. Briefly explain what it is.

When using the linear depreciation method, the norms are taken based on the useful life of the IBE. Accruing depreciation as a percentage method, one of two options is used: in the amount of 100% upon transfer to operation or in the amount of 50% of their price upon delivery from the warehouse for use, and the remaining 50% upon disposal. Balances from write-offs of IBEs (tangible assets) come at the market price on the date of write-off and are recorded on the financial result (DT 10, CT 80).

In more detail about accounting: stages, features, nuances

Each enterprise keeps records of IBE. How does this happen in practice? The algorithm is simple:

Accounting organization comes goods.

It controls safety.

Determines the value of low-value wearing items.

It controls the operating life.

Writes off worn MBP.

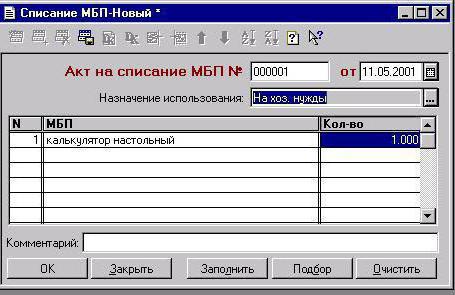

Since 2014, when putting things into operation, BMP wear is not charged for the entire cost, but for half minus the residual. The balance of 50% is charged already at the time of write-off. When transferring low-value wearing goods for use, they are assigned to materially responsible people. Then they are assigned inventory numbers, which simplifies the inventory. At the last stage, an act of cancellation is drawn up (see the sample for filling) of the IBE.

These items must not be forgotten to be removed from the register (from the financially responsible person). Enterprises independently determine the cost limits for IBE. What does this mean? The absolute benefit. Because this category includes, in fact, fixed assets. IBEs in operation undergo moral and physical depreciation, the cost of fixed assets decreases. In the balance sheet they are carried at the residual value, which is the difference between the initial price and the amount of accrued depreciation for a certain reporting period. The initial cost of the IBE also includes the costs of their acquisition.

Depreciation and write-off

Depreciation of the IBE is part of the cost of production. Accruing depreciation for each individual item, as for fixed assets, is difficult. Therefore, they choose one of two methods of accounting for IBE (what it is - we have detailed it above), according to the accounting policy of the enterprise. There is a special act of cancellation. A sample of such a document, presented in the photo below, will help novice accountants navigate this issue.

It happens that IBE issued for use are immediately debited: debit of accounts 20, 23, 26, 25, 31, 43. Or DT 29, 08, 88, 81, 96. Credit of account 12, to subaccount 1.

Accounts for IBE

To account for the movement of the IBE and their depreciation, different accounts are used: 13, 12, 15, 16, 48 ... All actions associated with the receipt of the IBE are the same as when accounting for materials, that is, 15, 16 accounts are used. Then all operations are reflected previously in DT15. Then come and write off to account 16 IBE.

Failed items are drawn up through an act of retirement.

Well, you and I have considered such a concept as IBE: what is it, how are objects of this category recorded and written off. I would like to hope that the time spent reading the material did not go to waste.