What is volatility? This term refers to price volatility. If you determine the minimum and maximum prices for a certain period on the chart, then the distance between these values will be the range of variability. This is volatility. If the price increases or decreases sharply, then the volatility will be high. If the range of changes will fluctuate within narrow limits, then - low.

Origin of the term

The term “volatility” comes from “volatile” - the middle French word, which, in turn, came from the Latin “volatilis” - “fast”, “volatile”. It is worth noting that in the French language there is another definition of volatility. This term also refers to overstatement.

Volatility theory

This theory is based on the analysis of changes in any economic indicators: interest rates, prices, and so on. In this case, changes occurring over a long time are taken into account. Determining what volatility is, econometrics distinguish two main components. The first is a trend when price fluctuations occur according to a certain pattern. The second is volatility when changes are random. In order to accurately predict the situation, it is necessary to take into account not only the average value, but also the expected deviations from the average level.

For example, when analyzing the securities market, it is necessary to take into account random deviations of indicators, since the value of options, stocks and other financial instruments is very dependent on risks. The theory of volatility was developed by American economist Robert Engle. He determined that deviations from the trend can vary significantly over time - periods of minor changes are replaced by periods of strong ones. Real exchange rate volatility is variable, for a long time economists used only static methods in the analysis based on the constancy of this indicator. In 1982, Robert Engle developed a model assuming a variable spread of volatility, with which it became possible to predict price changes.

Types of Volatility

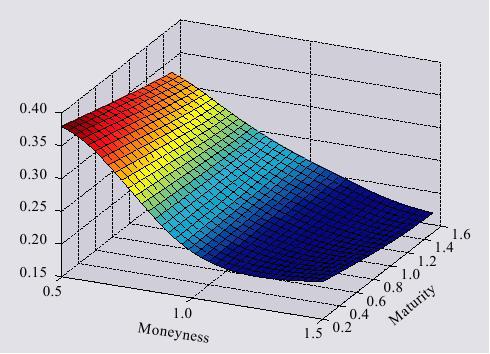

Considering what volatility is, it is necessary to note its two types: historical value and expected. Historical view is an indicator equal to the standard deviation of the prices of a financial instrument for a specified period of time, which is calculated on the basis of available information about its value. If we talk about the expected market volatility, then this indicator is calculated based on the value of the financial instrument, taking into account the assumption that the market price reflects possible risks.

In the market, it is necessary to take into account not only the direction of movement, but also the period for which changes occur, since the probability that the price of assets exceeds the values critical for the participant depends on this. To establish the indicator of market price volatility in general, it is necessary to calculate the stock index of volatility.

How and why volatility is measured

The easiest way to determine this indicator is the standard deviation indicators and the use of the true price range - ATR. First of all, you need to determine the average value of volatility for your currency pair over a long time period, and then in the analysis process you need to note the ratio of current and average volatility.

It is necessary to establish what price volatility is in order to analyze the potential profitability of a currency pair. When the indicator of price changes is at a high level, and the spread is insignificant, then we can talk about high profitability. It is worth noting that a high level of volatility is associated with great risks, since the protective order “stop loss” will be significant, and potential losses also increase.

Bollinger Bands

To clearly see what volatility is, you need to use an informative indicator - Bollinger Bands. He draws a channel for prices, expanding significantly with a sharp jump in change. If the breakdown is in a narrow range, this may indicate the beginning of a profitable movement, but it is worth remembering that quite often such breakdowns can be false. When we determine the average value of the volatility of currency pairs per day, we can subtract this indicator from the formed daily minimum or maximum and ultimately get the goals of taking profitability and placing a stop loss order.

Suppose, given that the pair usually goes within a hundred points per day, then there is no need to put a “stop loss” at a distance of two hundred and there is no point in counting on large profits that exceed the average daily range. If we analyze the price risk in financial markets, then, for example, the calculation of stock volatility should take into account not the sequence of prices itself, but the sequence of relative changes. Thus, it will be possible to achieve greater comparability of various assets. For example, new stocks can increase tenfold and decrease in value, so you cannot calculate the volatility of these stocks using absolute values. In addition, the sequence of relative changes is more stable, in the sense that for it the variance and the average value are stationary, when compared with the same indicators of prices not analyzed. In any case, it is commonly believed.

Volatility indicators

Despite the fact that many employees of dealing centers claim that the volatility of currency pairs indicates a good profitability of the transaction, do not forget that a high level of volatility is an increased risk. On a volatile pair, luck can quickly turn away, and losses will increase significantly. To reduce risks, you must always use a stop loss order, even if the market is moving in the direction of profit and does not say anything about possible losses. In the Forex market, volatility indicators include Bollinger bands, CCI, Chaikin indicators . Also, indicators of standard deviation are used as indicators.