The Witte financial reform was an important stage in the development of the Russian economy in the late 19th and early 20th centuries. It strengthened the ruble not only in our country, but throughout the world thanks to the establishment of its free exchange for gold. The reason for its implementation was the instability of the monetary system in Russia at the end of the century. However, after the “recovery” of the ruble, the prestige of the domestic economy increased significantly, which led to increased investment and the inflow of foreign capital.

Causes

Witte’s financial reform was caused by the need to create a stable currency, which the monopolistic associations that arose at the turn of the century so needed in our country. The fact is that at the time in question, under the influence of the main trends of the world economy, large monopolistic associations, such as cartels and syndicates, began to appear in Russia. For large cash transactions, a currency was required that would preserve the value of financial capital.

At first, the government tried to solve the problem by issuing the so-called excess paper money, but this did not help. By the end of the century, the need for the introduction of a gold currency became apparent . Witte's financial reform was carried out according to the Western European model. The fact is that the gold-coin standard was introduced in many countries of Europe in connection with the emergence of a single global market. Russia actively conducted foreign trade, and therefore, like its partners, needed a similar monetary system.

goal

The tsarist government was interested in developing the country's foreign economic relations . The latter circumstance was strongly hindered by the fact that the ruble, although it was a convertible currency, was nevertheless not strong enough to serve as an exchange equivalent.

Foreign entrepreneurs often did not dare to sell their face values, since he was not provided with gold. Witte’s financial reform aimed to overcome this barrier and put the ruble on a par with European monetary units. This was to attract foreign investment and investment in the domestic economy.

Preparatory measures

Witte's financial reform, which dates back to 1897, was prepared by his predecessors. Bunge and Vyshnegradsky understood the weakness of the paper monetary system and tried to replace it with a metal standard. Both wanted to make the domestic ruble strong enough so that it could be freely exchanged not only for silver, but also for gold. To achieve this goal, they set the task of creating a reserve of this valuable metal, pursuing a protectionist policy, making foreign loans, as well as restricting imports and increasing exports of goods.

Thus, even before Witte came to the post of Minister of Finance, the domestic currency rate was stabilized. By the year of the reform, the gold reserves of our country reached more than 800 million rubles. The State Bank, under the new minister, introduced foreign currency into circulation and stopped speculative actions on the credit ruble.

"Recovery" of the economy

The implementation of Witte’s financial reform was a natural continuation of the policies of his predecessors, who, with their measures, achieved a solid fixation of the ruble and an end to exchange speculation. Thus, all the necessary prerequisites for the introduction of the gold standard were created. The stock of this precious metal, a stable exchange rate, a well-formed budget, the development of foreign and domestic trade, and the independent work of the Ministry of Finance contributed to the "recovery" of the domestic economy and became an incentive for a breakthrough in industrial development, which Russia had reached by the beginning of the First World War.

Minister of Finance Policy

Sergey Yulievich Witte held this post for ten years and during this period he achieved considerable. Thanks to his efforts, railway construction was accelerated, a profitable trade agreement was concluded with Germany, a wine monopoly was introduced, which became an important source of replenishment of the state budget. Thanks to his monetary reform, gold turnover increased sharply, and the number of paper units fell, which, of course, increased the prestige of the Russian economy in the world market.

Sergei Yulievich Witte achieved the "recovery" of the domestic financial system, which was reliable until the outbreak of World War I in 1914. However, it should be noted that many contemporaries were unhappy with the abolition of bimetallic circulation in the country, since the bulk of the population began to experience an acute shortage of monetary units, which negatively affected their purchasing power.

gold standard

This concept means the recognition of gold as the main monetary commodity and the only equivalent of values. The advantage of this system is that it is not subject to inflation. In the event of a fall in economic activity, this valuable metal settled in the hands of contemporaries, when the situation stabilized, it was put into circulation again. The Witte financial reform of 1897 was primarily beneficial for the development of foreign trade, as it facilitated the payment of transactions. The land standard and the nobles were very unhappy with the introduction of the gold standard, but the enterprises of the domestic bourgeoisie received a new impetus for development, largely due to the export of bread, which increased incomes.

First measures

The Witte financial reform, the reasons for which were caused by the instability of the monetary system of the second half of the 19th century, began with the decree of the emperor of 1895, which allowed to pay for transactions with domestic gold currency or credit tickets at its exchange rate. However, new monetary denominations entered the circulation rather slowly. Therefore, the State Bank decided to buy a gold coin at a good price - 7 rubles 40 kopecks.

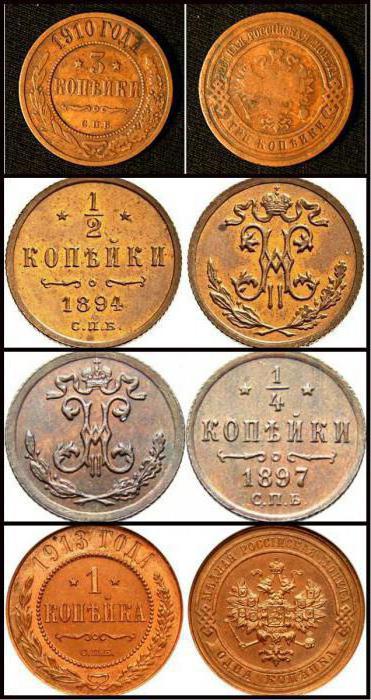

The latter measure helped stabilize the relationship between paper and metal monetary units. In 1897, the government decided to introduce gold circulation in Russia. Coins from this metal began to be minted in 1897. The first of them were worth 5 and 10 rubles. Imperials (15 rubles) and semi-imperials, which amounted to half their value, were also issued. However, it is significant that the majority of the population still preferred paper money, as it was easier to keep on hand.

Effects

The Witte financial reform, the results of which turned out to be very positive for the domestic industry, was prepared in strict secrecy, since its developers were not in vain afraid of opposition from the court circles and the local nobility. The fact is that the introduction of the gold standard strengthened the position of the Russian bourgeoisie, but led to a fall in prices for agricultural products. After the reform began, its initiators were sharply attacked by the public.

However, Witte secured the support of the emperor and the special financial committee and secured the approval of his project. As a result, the ruble exchange rate stabilized, and domestic entrepreneurship received a new impetus for development. The positions of the domestic economy on the world market have strengthened, which has brought Russian industry to a new level. One of the shortcomings of the reform is the increase in Russia's debt due to the attraction of foreign capital, but the cost of borrowing has fallen.

In addition, during the reform, there was an increase in state property due to the creation of a gold reserve and the acquisition of railways into the ownership of the treasury. The success was facilitated by the skillful budget policy of Witte, who refused to save state funds. He contrasted this frugality with financial activity, contributing to the inclusion of capital in industrial turnover. So, monetary reform strengthened the Russian economy and brought it to the world level.