Most Russian citizens know the concept of a payment order, but are not familiar with its full content. If you fill out the document incorrectly, make blots or mistakes, it may be invalidated. Therefore, it is important to know all the constituent elements of this bank paper.

The essence of the payment order

This is a bank document with which the holder of settlement or personal accounts instructs the organization serving his financial assets to transfer a certain amount of money by debiting from his account to the one indicated in the order.

Most citizens who do not know the specifics of filling out a payment order prefer not to use this method when making settlements. This position is incorrect. This document allows you to actually implement any process not prohibited by the law on the transfer of funds from the owner’s bank account to another account.

Features of filling in payment type orders are fixed in the regulatory document. These conditions are established by Order No. 107n, which approves the rules for indicating the necessary information in the appropriate columns. Compliance with these requirements regarding the particulars of filling out a payment order (sample below) is strictly necessary due to the fact that all documents for transferring funds from one account to another are automatically processed by the computer, and any inaccuracy will invalidate the paper. Moreover, it does not matter at all in what form the order was filled out - in writing or in the form of an electronic computer-generated document sent via the Internet.

Despite the fact that the form developed by the Russian Central Bank is complex, not the slightest blots are allowed in the process of filling it out. Each cell should include the relevant data entered reliably and correctly. If there is at least one inaccuracy, the payment order to the bank will be canceled. Especially such a situation can cause serious problems if a document was used to pay any mandatory payments, fines or taxes.

It is extremely important not only to correctly fill out the relevant documents, but also to know the options and cases of their use in the calculation.

Options for using orders

There are many areas of application for documents of this type. Payment by payment order may be carried out in the following areas:

- depositing money as an advance payment for the supply of various goods, the provision of any range of services or the performance of assigned work;

- actual payment of the delivered goods, services rendered or work performed;

- payment of mandatory contributions, fees or taxes to the appropriate budget at any level, payment of funds to various extra-budgetary funds, payment of penalties in the form of penalties and fines, which may be charged by inspection bodies or counterparties under contracts;

- depositing funds in payment of payments on consumer or mortgage loans;

- payment of various periodic payments, the payment of which is stipulated by the contract concluded by the payer;

- transfer of finances to other citizens on a voluntary free basis, under various agreements, court decisions or regulatory legal documents.

Types of Orders

Payment orders (sample below) are filled out differently in different cases. Therefore, it is important to distinguish between the types of such documents. In total, Russian legislation approved two types of instructions: early and urgent.

The key differences of the second type from the first are as follows:

- The money on the payment order is paid in the form of an advance, that is, transferred until the end of any work, until the provision of specific services or until the full delivery of the entire volume of goods.

- Money is paid after the goods are shipped, the work is completed and secured by the signing of the relevant act, the service is fully implemented.

- Finances are transferred to the other side in parts. This method is most often used when it comes to settlements on large totals (for example, completion of a completed house).

Russian law gives citizens and organizations the right to partially pay the amount indicated in the relevant field of the payment order if the amount claimed by the other party is not enough to fully pay off the bill. In this case, the corresponding note is made in the order by the bank organization that is carrying out the transfer.

Forms of the document and its validity

Before considering the particulars of filling in the column of the payment order (personal income tax from the organization, fines, other payments), it is important to understand what forms of the document are used in the calculations and what are the terms of their validity.

There are two main forms of payment documents: electronic and paper. When using the first option, payments are made through the use of the Client-Bank program. At the same time, it is not necessary to output documents on paper (if a copy of it is not needed for submission to any authority).

When making payments using the second option, it is necessary to personally appear at the bank to transfer funds.

Those who prefer to use the first method of payments should be aware that banks independently establish the rules for processing documents, methods for their transfer and options for protecting transfers between financial institutions (to the extent not regulated by the relevant Order of the Ministry of Finance).

The validity period of a payment document for presentation to a bank or credit organization (institution) does not exceed ten days. In this case, the countdown begins after the day when the document was generated by the payer (or the financial institution making the payment).

Within ten days, the client must present paper to the bank for payment. The period for the execution of an order by the bank shall be calculated in a separate order.

The procedure for making settlements through instructions

All settlement entities that make money transfers through the use of payment orders (individual entrepreneurs, citizens, legal entities and so on) should know all the stages of payment

The process of making financial transfers consists of five stages:

- The first stage is the presentation of the payment document by the client to the bank. The paper must be prepared in four or five copies (depending on the procedure established by the financial institution). After that, the bank gives one copy back to the client with a receipt mark. This seal is a form of a bank receipt in that the funds are transferred in full.

- The second stage is the transfer of the amount indicated in the document from the payer's account based on the copy of the order sent to the client.

- The third stage is the transfer of money to the bank of the second party to the extent that is recorded in the payment order. When transferring the indicated amount, the bank transfers two copies of the order to another financial institution.

- Fourth - the crediting by the bank of the recipient of money in full to the account of the second party (recipient).

- The fifth stage is the transfer to both parties of the relevant bank statements about the movement of funds in their current accounts. These securities are documents confirming the fact of money transfer.

Order processing

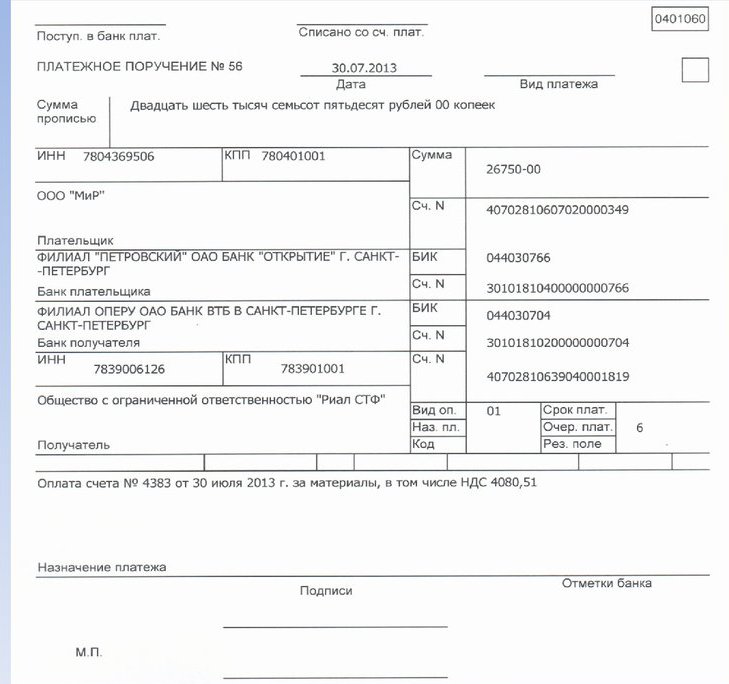

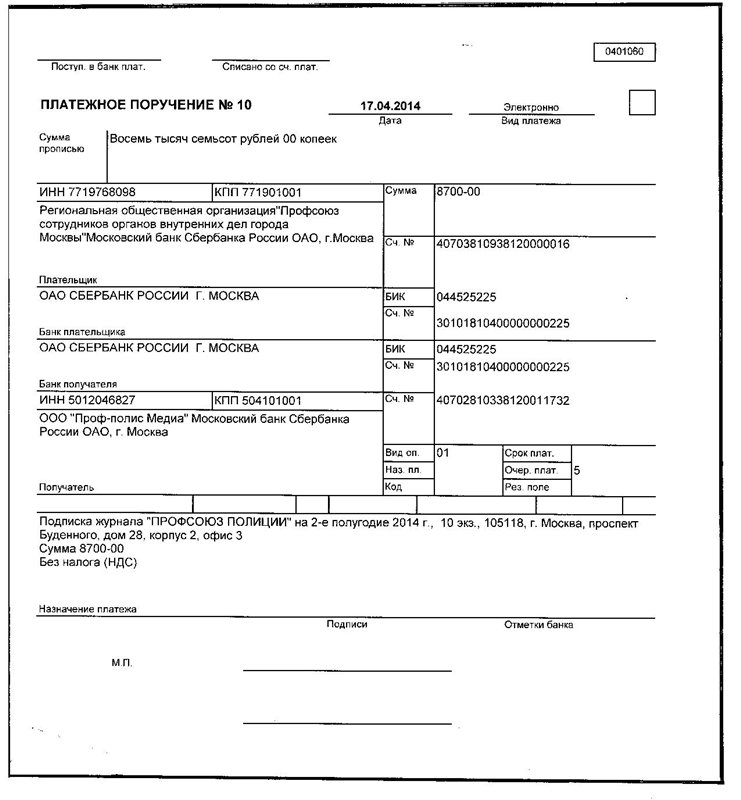

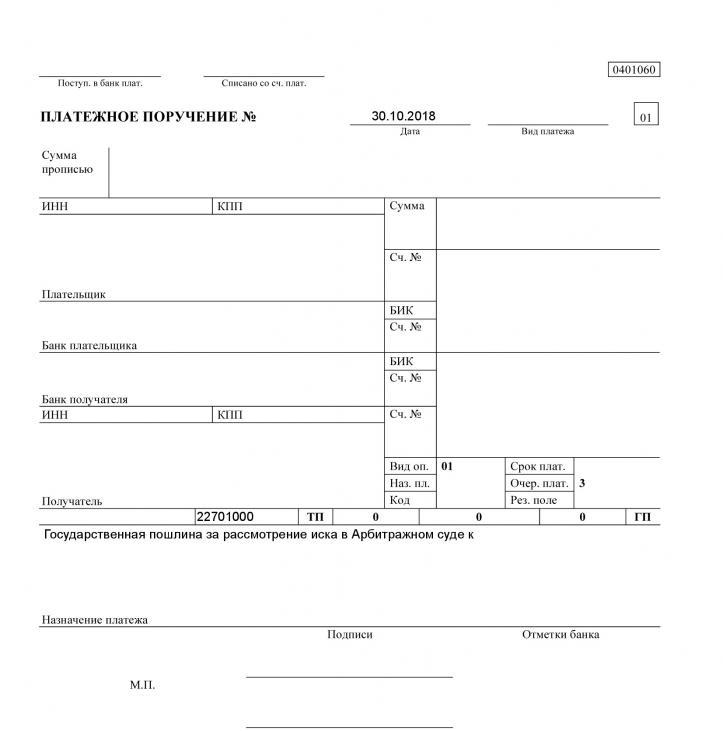

After considering all issues regarding the features of payment documents and their types, you should consider the procedure for filling out a payment order (sample below). The following data must be indicated in the document:

- name of the document itself with an indication of the code for OKUD;

- the date and number of the formation of the order, in accordance with the format established by legislative norms: DD.MM.YYYY;

- type of payment made by the debtor;

- name (surname, name, patronymic) of both parties (payer and recipient), as well as their details: bank account numbers, TIN of the bank and KPP;

- location of banking organizations with full name, accounts (correspondent and subaccount), BIC;

- the purpose of the payment made, with the obligatory indication of the amount of VAT to be withheld (if such deductions are not made, a mark is placed in the document);

- the amount of money to be transferred (first in digital format, then in alphabetical);

- determining the queue for the execution of the specified payment, which is established by the norms of Russian legislation;

- type of financial transaction;

- signature of the transferring bank employee with the seal.

Not only timely acceptance of the document depends on how correctly filled out the document, but also the timing of the transfer of funds to the recipient.

Codes in the payment order

For the most part, filling out money transfer documents for individuals and legal entities is identical. The main differences are observed when entering information for certain codes.

To enter various information in the payment document, certain fields are reserved. Most of the data is encoded. For all entities (beneficiary, payer and banking organization), the code value is the same. Such a uniform data entry system allows you to automatically record all financial movements between different accounts.

Also, this form of filling in securities is a guideline for all entities to correctly record information in payment documents. The unified data entry type is the same for everyone. The differences relate only to which cells and fields which of the entities carrying out the translation enter what information. Some fields are not filled out, and in some, only banking institutions can enter data.

General instructions for filling out a document

All cells in the payment document have their own individual number, which helps payers and others to understand where and what data to enter. Each translation paper contains a set of numbers in the upper right corner (0401060). This number is the designation of the new form of payment order approved in 2012. This form has been enacted by Regulation No. 383-P issued by the Central Bank and is valid to date.

Cells are filled in the following order (by number):

- Three - the serial number of the payment document. It consists of several digits (a maximum of six). When citizens submit the document, the number is put by the bank.

- Four - day of payment: DD.MM.YYYY. When filling out a document in electronic form, the day is set automatically.

- Five - the type of payment (postal, urgent, telegraphic).

- Six - the transferred amount (in words). Numbers and all names must be indicated in full.

- Seven - the transfer amount in numbers.

- Eight - payer data. Citizens indicate their last name, first name, patronymic // place of residence as in the passport. Organizations indicate the name in abbreviated form // location as in the constituent documents. Individual entrepreneurs indicate their surname, name, patronymic // place of residence as in the Certificate.

- Nine - payer's bank account (twenty characters).

- Ten is the name and city of the payer's banking organization.

- Eleven - BIC of the payer.

- Twelve - correspondent type account (or subaccount).

- Thirteen is the name and city of the beneficiary's banking organization.

- Fourteen - BIC of the recipient.

- Fifteen - the recipient’s subaccount.

- Sixteen - recipient data. Citizens indicate their last name, first name, patronymic // place of residence, as in the passport. Organizations indicate the name in abbreviated form // location as in the constituent documents. Individual entrepreneurs indicate their surname, name, patronymic // place of residence, as in the Certificate.

- Seventeen - settlement account of the recipient.

- Eighteen is the type of operation performed (by default, payment documents have 01).

- Nineteen - the period of the transfer (the payer does not fill out).

- Twenty is the purpose of the transfer of funds.

- Twenty-one is the ordinal line of a particular payment (under Article 855 of the Civil Code).

- Twenty-two - UIN (organizations - 20, citizens - 25). If it is not, zero is set.

- Twenty-three is a reserve.

- Twenty-four - the purpose of the transfer (details of the contract, type of service provided, and the like).

- Forty-three - if any - stamp of the payer's side.

- Forty-four is the signature of the payer.

- Forty-five are bank notes on both sides.

- Sixty - payer's TIN.

- Sixty-one is the payee's TIN.

- Sixty-two - the day of receipt of the payment document by the banking organization (filled out by the bank itself).

- Seventy-one is the day the money is debited.

Filling in the remaining cells

Each document has ten cells filled in only with a special purpose of the payment order (taxes, customs payments):

- One hundred and one is the status of the entity transferring funds.

- One hundred and second - the checkpoint of the payer.

- One hundred and third is the checkpoint of the transfer recipient.

- One hundred and fourth is KBK (type of income in the Russian budget: duty, tax, insurance premium, trade fee and other obligatory payments).

- One hundred and fifth - OKTMO (formerly OKATO). The code is put down (eight to eleven digits). The number depends on the location of the payer (the settlement is indicated in accordance with the classification established by the legislation).

- One hundred and sixth - the basis for the translation (letter designation, consisting of two characters). For example, OT - payment of overdue debts, DE - payment of the customs type.

- Hundred and seventh is an indicator of the tax payment period: monthly (MC), quarterly (CV), half-year (PL), annual (DG) with the obligatory indication of the day of payment.

- One hundred and eighth is the number of grounds for the transfer.

- One hundred and ninth is the date of transfer of the document, which is the basis of the payment.

- One hundred and tenth - the type of payment made (the recipient or payer side is not affixed).

Distinctive features

Persons who fill out and process payment documents must clearly understand how all four copies of securities are distributed:

- one remains in the banking organization as a reporting document;

- the second is the legal basis for implementing the procedure for crediting financial resources to the account of the beneficiary in a banking institution serving him;

- It is transmitted together with the extract from the beneficiary's account to the client of the bank as confirmation of the transfer;

- issued to the transferring entity with the bank stamp affixed, which confirms the acceptance of the order for execution.

It is important for the payer to contact the financial institution that made the payment the next business day to make sure that the payment order has been accepted and processed and that the funds have been successfully withdrawn from his account. This need is due to the fact that the document can be skipped by the bank even if there is insufficient money in the account.