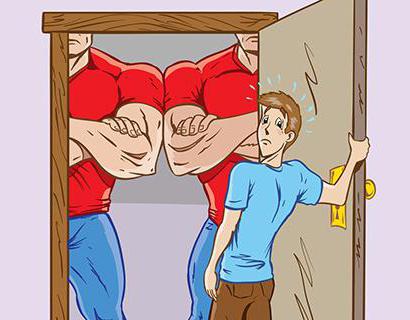

Having borrowed money, you must give it back. And it doesn’t matter who the creditor is - a best friend or a bank. But sometimes financial difficulties of a temporary nature that may interfere with the conscientious performance of the obligations of the borrower. And now, not only the creditor bank’s security service, but also third parties - collectors are getting involved in the settlement of financial debt. And if there is a small chance with the former that they can conclude an agreement such as debt restructuring, the latter will make every effort to make the life of the debtor unbearable.

And what if the debt was formed in more than one bank? If there are several? Continuous threatening calls, letters demanding to return everything at once. As if a sword of Damocles hangs overhead from an untimely debt. Then, specialists come in, ready to help repay the debts.

“Credit Aibolit” - what is it?

They are called collectors of a new type. Such companies are ready to help non-payers to settle the arrears. Now every debtor has the opportunity to use the debt relief service - “debt relief”. “Credit Aibolit” has positive reviews about its work, despite a short stay on the market for such services. To take advantage of this offer, it is enough for the borrower on the company’s website to submit an application for the redemption of his bank debts indicating the name of the bank and the amount of debt.

How does this method work?

As an intermediary, “Credit Aibolit” reviews also has positives. In order to collect the debt from the non-payer, the creditor begins to invest money in this matter. But the non-payer is not able to pay the loan, regardless of the activity of the lender, incurring losses. This method is beneficial for both parties: for the non-payer there is a chance to fully repay the existing debt, which he could not pay for a long time, and the lender is guaranteed a refund of part of the loan amount.

Conventionally, the company divides all loans into 3 categories, each of which is developed according to a certain scheme.

Category 1: borrower loans are already in the long-term delay phase.

- If the client has outstanding loans for a period of more than a year, then Credit Aibolit, on behalf of the non-payer, carries out the procedure of redeeming them from the bank at a cost 4-10 times lower than the original price. Then, the client repayments by installments the overdue debt, which is paid within a few months, not years.

- If the borrower has 2 or more loans, they can be combined into one, and the monthly payment will be adjusted to a size that will not be a burden for the payer pocket.

- If the client allowed minor delays, the company will facilitate refinancing from its partner bank. The joint efforts of Credit Aibolit and one of the partner banks can reduce the interest rate on the loan, reduce the amount of the principal debt, increase the loan term, and delay the next monthly payment.

Category 2: the borrower has loans that are past due, as well as those for which he regularly pays.

- The right decision in this situation, experts of the company consider, will be the union of all loans in one bank and on the best conditions for the client. The application of such a solution is beneficial not only for the borrower, who can not tarnish his credit reputation and reduce monthly payments. The bank also wins - the issued amount of the principal debt with interest for its use is returned. But especially it will be beneficial to banks, increasing their loan portfolio.

Category 3: the borrower has loans, but at the moment there are no delays.

- The client regularly pays on the loans received, but at the same time experiences financial inconvenience. The company will help in refinancing debt in a partner bank, which can offer favorable conditions - reducing the interest rate, increasing the loan term and deferring to get out of a difficult financial situation.

According to statistics, each client of the company has several loans in different banks in the amount of 300-500 rubles. Being subjected to constant pressure from several collection companies, the client ceases to communicate with them over time. And in this situation, the defaulter should be ready to resolve the situation with the bank, which, in turn, must also make concessions.

As the marketing director of Credit Aibolit explains: “Today, about 5 million Russians are not able to fulfill their financial obligations. This leads to social tensions, an increase in crime and in general casts doubt on the very idea of lending. It’s worth removing the hands of collectors from the deadbeat and concentrating his debt with a single creditor, as the situation begins to level off. ” According to the data provided by the Bank of Russia, after the introduction of this practice, the amount of delinquency of individuals decreased from 857.8 to 660.2 billion rubles.

Service cost

From non-payers who used the services of the company “Credit Aibolit”, reviews about the cost are different. The price for the work of this organization is calculated not only from the characteristics of the debt (type of loan, its repayment period and other terms of the contract), but also from the results of negotiations with the creditor. The first stage of payment starts at 5% of the total cost of the loan and ends at 30%. In each case, the amount of payment will be individual.

But what if the debtor does not have the means to pay the aforementioned amount of 5-30%? In this case, the company provides installments for 24 months. The client is given the opportunity to independently choose the optimal monthly payment for himself and the period for its full payment.

Why can the non-payer himself agree with the bank?

Reading reviews of “Credit Aybolit”, one can understand that the company is ready to come to the rescue of those non-payers who really today are not able to bear responsibility for their debts. This solution is not suitable for customers who think that they can not return the loans taken. The main goal of Credit Aibolit is to help the borrower reduce his credit obligations to the level of his solvency. If the borrower independently turns to the bank, then all his efforts to work with his debt may come to the conclusion of a debt restructuring agreement. In the meantime, the non-payer evaded payments, the bank continued to charge interest, fines and penalties. Therefore, you should not hope for a decrease in the main debt of credit debt if you apply to the bank as a private person. Credit company Aybolit "reviews has positive. This is a legal organization that has the ability to conduct several of these problematic clients at once.

There are times when a company cannot come to the rescue of a deadbeat. But do not worry: the client will not lose anything in financial matters. Payment to Credit Aibolit specialists will be made only if there is a guarantee of a positive solution to the problem. If consensus cannot be reached, the organization will notify the payer. Real reviews of Credit Aibolit company report that most creditor banks are rather willing to meet the question of repurchasing debt, as they are also interested in getting a partial amount of their money back.

What loans does the service apply to?

Studying reviews of Credit Aibolit LLC, people can see that the company carries out its work only with individuals. And only with those borrowers who faithfully fulfilled their loan obligations, but the occurrence of serious financial problems did not allow them to repay the loan on schedule. Basically, the company prefers customers who have overdue more than a year. For such defaulters a definition has been developed - “360+”.

Today, the organization cooperates with 40 banks, which are in the TOP 100 financial institutions.

How long will it take to resolve the issue

It will take from 2-3 weeks to several months to resolve the issue of debt. Such a long period of time is due to the fact that not all banks are ready to sell the debt of the non-payer “retail”. The repurchase procedure is quite costly for the creditor bank, so it is easier for him to sell several debts at once, that is, in bulk. This operation is also beneficial to the non-payer - it gives him the opportunity to "write off" his debt with more favorable conditions.

Reading in different sources about the company “Credit Aibolit” reviews, whether they are real or not - everyone decides for himself.

Activities of Credit Aibolit at the legislative level

The work of the company is carried out strictly in accordance with the legislation of the Russian Federation (Part 1, Article 382 and Article 12 of the Federal Law No. 353). Using this method as the closure of financial delinquency, legal consequences can be avoided, in contrast to bankruptcy proceedings.

Credit Recovery

After contacting the company Credit Aibolit LLC, the reviews of which speak for themselves, can restore credit standing. Most importantly, if the creditor bank went to meet the deadbeat and sold the loan, then the biggest step has already been taken - the debt has been eliminated. The next step to begin the restoration of credit history will be the need to take a small loan and make regular payments on time. Only using this method can you again earn a new, clean credit reputation.

Ask Credit Aibolit how to pay past due debt

To get help from the company, you need to fulfill just a few conditions:

- On the official website, leave a request where you specify the necessary data, as well as get acquainted with the size of the possible savings.

- The company creates an appeal to the bank for the repayment of a dysfunctional loan at a discount.

- The company informs the borrower on what conditions are the purchase of debt and the closure of loans.

- “Credit Aibolit” provides the client with a contract for review and decision.

- The client signs the contract, and the next day all loans are closed.

- The non-payer makes full or partial payment for the services rendered.

- The company provides a former defaulter with a certificate of closure of his bad debts.

Credit Aibolit company reviews of real people about his work with clients he places on the main page of his site.

Opinions of representatives of some banks and collection agencies

As Pavel Sigal, vice president of the Opora Rossii Entrepreneurs Association , notes, for banks and MFIs, such a scheme for paying off “suspended” debts is extremely beneficial. Dysfunctional customers need to carefully look at the terms of the contract, and especially on how the debt collection process will go.

Here are some more reviews about Credit Aibolit:

- Elena Dokuchaeva, president of the Sequoia Credit Consolidation collection agency, on the contrary, doubts the need for this service. “Credit Aibolit” - what kind of company is this? If the debtor decided to pay off his debt, then why does he attract a third party? The debt will be bought by the seller for a "penny", and then bought by the debtor in installments. This creates a feeling of collusion between the deadbeat and its lender-buyer. The decision to sell the debt should be made by the creditor, not the debtor. Elena Dokuchaeva believes that this fraud blows uncleanliness. Also, in her opinion, the sale of dysfunctional debt is possible only when the bank's security service has already worked with the client, and then the debt has been transferred to the collection agency for collection. And when even the collectors have already signed their powerlessness in collecting the debt, the creditor may decide to sell it. In 2015, the overdue debt period was increased from 700 to 900 days. This is due to closer cooperation of banks with collection agencies.

- Alexander Savinov, deputy chairman of the collection agency Sentinel Credit Management, is sure that this scheme will not be widely used. This will be a rarely used tool, since the disadvantage of buying up such debts is quite obvious. Their cost will not be enough even for the administration of administrative costs for the organization of the transaction. Alexander claims that it is very difficult to redeem a lot of debts from different banks.

- Anna Blinova, head of the late collection department of Home Credit Bank, expressed a rather negative opinion about Credit Aibolit. Their bank does not cooperate with organizations of this kind and has no legal obligations to them.

- The only financial institution that responded positively and optimistically to the upcoming changes was Summer Bank. As a rule, delinquency in "360+" is bought no more than 5% of the total. Chairman of the Board Alexander Samokhvalov said that they are ready to cooperate on such conditions.

Reading customer reviews about Credit Aibolit, you still don’t notice a catch. But this is only in theory. In practice, it is better to prevent the occurrence of debts.