A pending order is a certain order to open a transaction, which allows a trader to solve a very important task. It provides the opportunity to open a transaction at a predetermined price. Thus, the trader does not have to constantly be in front of the monitor. Compared with immediate orders, trading in this format is more convenient, it reduces the time spent in front of the monitor in anticipation of the moment when the price reaches the optimal place to open a transaction.

The clear advantages of pending orders

A pending order is a universal functionality for trading, with the help of which it is possible to minimize losses, which is a prerequisite for profitable trading. The most convenient periods on the market for using this category of orders are considered to be correctional waves. Wait until the price returns to a certain place and again continues to move along the trend is not quite the right line of behavior. The correction may be delayed, and a pronounced trend can be reorganized into flat, which will only delay the moment of entering the market. In order not to rush or wait at the monitor for an indefinite moment, it is considered more rational to set pending orders at peak levels.

No slippage is an important advantage

Many traders are very familiar with the concept of slippage. This is the opening of an order at a price higher or lower than that which is in the terminal at a certain point in time. The transaction opens a certain number of points in the opposite direction. That is, the purchase or sale is carried out in minus. There can be two reasons for this phenomenon at once. These are illegal actions on the part of the broker in order to cash in, or simply the poor technical component of the terminal, because of which the broker himself is slow in opening a transaction. When pending orders are used on Forex, the broker loses the opportunity to open a deal for the benefit of himself, and the trader gets the maximum accuracy when entering the market.

Characteristics of Pending Orders

There are only four varieties of pending orders available to traders. Let's get to know each of them:

- Pending Buy Stop order. This is a decree for a broker to buy an asset at a price that is higher than the market price. The decree is established in a situation where a trend is expected to continue in the future. The bet is that the chart will break the Ask price at a certain level.

- Buy Limit is an order to open a buy transaction after the Ask price has reached a predetermined value. The type of orders is focused on opening a deal to continue an uptrend after a slight price correction.

- Sell Limit is intended for opening deals at the Bid price with a long downtrend. An order will be activated when the price after a short northern trend falls below the actual value in the market.

- Sell Stop is the next type of order focused on the sale of an asset. Quotations are sold at the Bid price, after the price drops below the actual level.

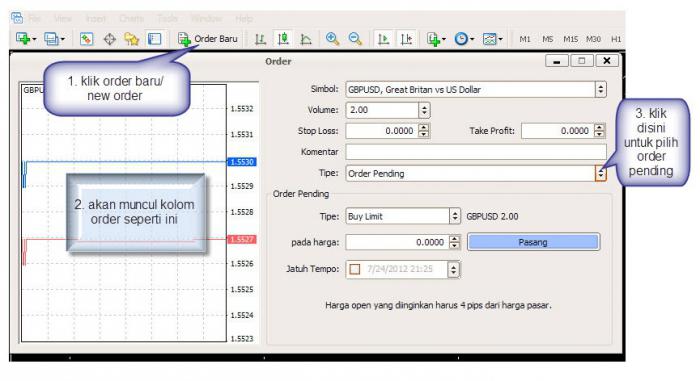

What settings are needed to activate pending orders?

In order to activate a pending order, simply fill out the built-in form in the terminal. As part of the functionality, the volume of the transaction is set. Be sure to fix the price at which the order will be activated. Some brokers require setting stop loss and take profit. Others allow you to ignore these values. You need to pay attention to the type of order that you plan to open. If the selected program does not correspond to the situation on the market, the order simply will not be activated. Another point is the activation time. In the terminal it is proposed to set the time during which the order can be activated. If the price does not reach the predicted level before the set date and certain time, the order is canceled.

Important Points to Watch

Studying the "Forex for Dummies", it is unlikely to be able to find important points in the use of orders. It is worth paying attention to the fact that pending orders do not always work. Brokers may not activate an order if a hep-price gap has formed in the market as a result of a sharp change in price. Gaps can be observed most often after the weekend, especially if important economic or political events take place on the world stage at this time. In practice, if an order falls into a gap, this is actually a signal to cancel it. You can also talk about special conditions for the execution of pending orders, which each broker determines individually. The rules are based on observing distances from the actual price to the order being established. This parameter already preliminarily includes the spread value for each individual pair. Each trading instrument has its own size of this value. The broker reserves the full right to refuse to adjust the order if the price is already in close proximity to it.

Stop Loss and Take Profit as part of a pending order

Trading pending orders opens up gorgeous prospects for traders. Many hours of work in front of the terminal can be successfully replaced with just a few hours of situation analysis for making trading decisions. Orders provide an opportunity not only to open a transaction at a clearly set price, they provide for its closure at a profit or loss. Monitoring the situation in the foreign exchange market is not necessary. The broker will do everything on his own, in accordance with the established prices for closing the transaction. All that remains for the trader is to evaluate the results of his trade, successful or not. The multifaceted settings of pending orders allow you to skim the cream from the market when certain patterns are formed on it, and there is simply no way to be in front of the terminal.

Why are there four types of orders when you can limit yourself to just two?

Studying Forex for Dummies, many newcomers repeatedly ask themselves why there are four types of orders, when you could limit yourself to just two: buy and sell. It's simple: trying to simplify the life of novice market participants, brokers have built the most detailed orders in order to reduce the number of mistakes and mistakes. This feature of orders for working on the stock exchange is especially relevant . As you know, it, in comparison with the "Forex", provides a fairly large amount of commission. And if a deal is opened in the wrong direction for several seconds, and then closed, it is fraught with large losses. Note that all pending orders are carefully stored on brokers' servers and are activated regardless of whether the terminal is turned on when the price reaches a certain level or not.

Why do not orders work?

Many traders who use Forex advisers to configure pending orders, as well as those who set them manually, have repeatedly complained that profit orders simply do not work, provided that the price catches them. The situation is very common, and it is mainly associated with such a thing as a spread, which always plays against traders. There is always a difference between the purchase price and the sale price of an asset, equal to a few points. Thus, opening a transaction, the bidder immediately becomes at a loss. When taking profit, you need to focus on the fact that the spread size must also be added to the established profit level. So, if the profit is at a distance of 100 points from the transaction opening price, it will close when the price overcomes not only these 100 points, but also the distance of the spread itself. As for the stops, they most often close at a predetermined level exactly by the size of the spread.

Interchangeable orders

Each trader should be aware of the existence of such a concept as pending orders for the "Forex" interchangeable type. They are also known as CCA or One Cancles Others. The essence of such orders is that they are set in opposite directions. When one of the orders is activated, the other is automatically canceled. A striking example of interchangeable orders can serve as stops and profits. When one of them is executed, the second instantly closes. Working with this type of orders is very effective from the borders of the price channel. One order is placed in the inner part of the channel and is oriented towards a rebound, and the second - beyond the level of the channel, to break through it. When using standard orders, there is a high probability of getting two negative deals in the end. Unfortunately, work with this type of orders is not adapted neither for the MT4 terminal nor for the adviser of pending orders. According to experts, this format of decrees significantly complicates the life of beginners.

What Forex advisers are there for trading orders?

Today there are many automated trading indicators of various types. The most common Forex advisor working with orders is known as Burn. He makes the installation of two opposite orders from the beginning of the trading session. Stops and profits are set automatically after the activation of the order and after the price has already passed to the level without loss. A pending order is placed on hourly time frames. However, there are traders who experiment on smaller time intervals. The profitability of such a system is variable, but, according to its users, reaches 2% per day. Opening pending orders is a great opportunity for all trading participants to avoid mistakes due to impatience. The use of this trading format is practiced in many trading systems and can achieve good results.