A citizen sold a car. Do I need to file a tax return ? This question and the situation as a whole are of interest to many. After all, if you fail to submit documents in the future, you can run into huge problems with the law. Especially when they are big. And therefore, as a report, you have to regularly file a declaration with the relevant tax authority at the place of your residence (or residence in some cases) when selling something. But it is not always needed. The declaration after the sale of a car has a lot of nuances that every citizen should know about. After all, any additional document is nothing more than redundant paperwork. What to do in case of car sale? In what cases is the declaration filed and taxes paid, and in which not?

Long tenure

Has someone sold a car? Do I need to file a tax return? Here, as already mentioned, a lot depends on the situation. It is necessary to report on your transactions to the state, but not always. Actually, the declaration is also not filed in all cases.

The first situation is a long possession of a vehicle. This refers to the car being owned for more than 3 years. Oddly enough, in this case, no additional papers are required. Such a transaction is not taxed, which, in turn, saves owners from unnecessary paperwork. Nothing difficult, right?

Cost

Has someone sold a car? Whether it is necessary to file a declaration or not, this will help to solve many nuances. For example, the cost of a car. She plays an important role. But in combination with all other aspects.

So, if you sell the vehicle too cheaply, most likely you will not pay any taxes. But on the sale of cars to file a declaration still have to. At a high cost, of course, a corresponding alert is written and certain percentages are paid. The exception is cases in which the vehicle has been owned for more than 3 years. Here, as has already been said, regardless of the cost, no securities are to be attributed to the tax.

Thus, the declaration after the sale of the machine may or may not be submitted. There are a lot of points that play a huge role. You can not lose sight of. What other situations could there be? If you sold a car, is it necessary to file a declaration?

Less than 3 years

It often happens that you have to sell property owned for less than 3 years. Especially when it comes to cars. To be honest, in this regard, everything is extremely simple: a declaration is submitted to the tax service. But whether you will pay taxes or not is still unknown.

Payment thereof depends on the cost of the car. Again, low cost is likely to free you from additional payments. But high, on the contrary, will force you to pay some percentage of the transaction amount. A declaration after the sale of a car is really important. Now a little specifics regarding questions about the value of the transaction and tax payments. This worries many owners, both future and current. Knowing certain information, you can remain a law-abiding citizen and not run into trouble.

Quarter million

If you have chosen an option in which the cost of transport is not more than 250 thousand rubles, you can expect a tax reduction, as well as a tax deduction for this amount. Only in this case you will have to have confirmation of your expenses.

It is clear that in this case, you will have to fill out a declaration for the sale of the car, as well as submit it to the tax service. No one is exempting you from this. By the way, 250 000 rubles is the maximum level that is given for all sold property. When you sell several cars, for example, owned for a short period of time, less than a quarter of a million, you can expect to deduct only one transaction. And nothing more.

Huge numbers

But there are situations when the cost of acquiring a car for sale exceeds 250,000 rubles. In this case, of course, a declaration of sale of the car after the transaction is filed. But with one small caveat: you can reduce your income by the amount of expenses and thereby reduce taxes that you have to pay for the transaction.

To translate this idea into reality, you will have to stock up with any documents confirming your expenses. This may be a contract of sale. The most common option that occurs among citizens.

The proceeds from the sale of a car can only be reduced by a deduction when there are no documents that could confirm your expenses for the vehicle. In principle, there is nothing difficult to understand here. The fact remains: the declaration of sale of the car should still be filed. And the only exception here is the fact that the car has been owned for more than 3 years. Not necessarily after you have to pay tax. But you will be required to report on the transaction under all other circumstances.

Collection of documents

Please note: an important point is the preparation of all documents for filing a declaration. If you neglect them, you can generally be left without a corresponding statement and, as a result, receive punishment from the tax authorities. Therefore, responsibly approach the collection of a complete list of documents for the implementation of ideas. Filling out a declaration when selling a car is not such a difficult thing when everything is at hand. So, prepare before starting the process:

- Title of the sold car (copy);

- an agreement on the purchase of your vehicle (the amount that you once paid);

- sales contract (with your price);

- 2-personal income tax (form, original);

- 3-NDFL (form);

- application for tax deduction (if necessary);

- TIN;

- tax office number at the place of registration (4 digits, usually the same as the last of your TIN).

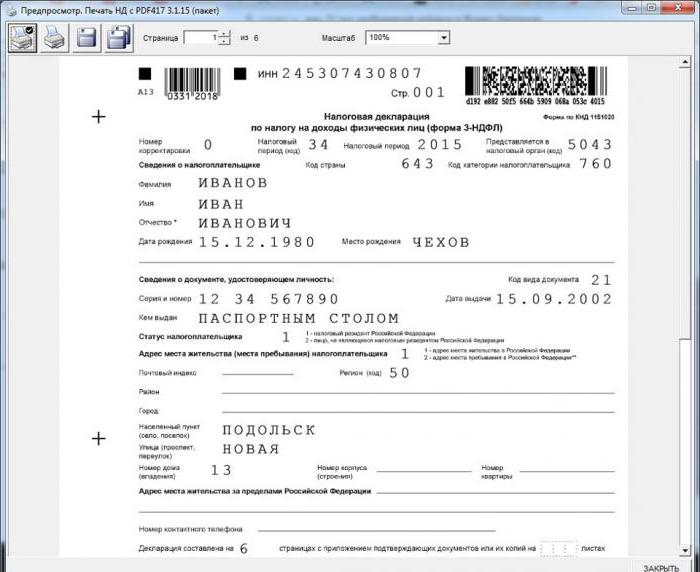

That's all. Now you can see a sample declaration when selling a car, fill out your own documents and forms, and then contact them in the appropriate department of your tax service. If you try hard, you can quickly deal with all the paperwork. Declaration of sale of the car is drawn up quickly and without problems.

Deadlines

An important point is the procedure and deadlines for submitting a document. A tax return (sold a car or an apartment - it doesn’t matter) must be submitted to the tax office in the year after which the transaction took place. That is, if you sold the car in 2015, then the corresponding declaration must be submitted in 2016. Etc.

The tax reporting period also has its limitations. At the moment, declarations are submitted by taxpayers until April 30 of each year. Before that, you must fill out all the papers on income-expenses, fill out a declaration (when selling a car and not only), collect a complete list of papers with copies to confirm your report, and then contact the tax office. It is advisable to deal with this issue as soon as possible. The faster the better. Do not put off everything in the last days.

Filling 3-PIT

Perhaps the most difficult thing in our business today is the direct filling out of the declaration. Honestly, no one does this manually. Everything is done on a computer. And so you have to enter only the initial data. And the computer does the rest for the user.

A citizen sold a car? How to fill out a declaration? It is worth starting with the form of 3-personal income tax. Every year it changes a bit, so try to find the current version for your case. The first stage is the section "Setting conditions".

Here you need to set some parameters that will help you subsequently with filling in general. Select the type "3-NDFL", then put a mark in the item "Taxpayer Attribute". As a rule, a different individual is indicated here . We put a tick in front of "Recognized earnings" in the next step. In this case, you must have documents confirming income / expenses. Confirmation choose personal. You can move on.

About the declarant

A tax return is unthinkable without filling out information about the applicant. Here, fortunately, everything is extremely simple. All the data about you that are available will have to be recorded in this paragraph. Fields cannot be skipped. Otherwise, the declaration will not pass the verification and will not be formed at the very end.

Once you fill in all the empty spaces, click on the image of the house in the upper left corner of the window. There, you will also need to enter data about yourself. As a rule, about your registration + passport details. Nothing difficult. Perhaps this is the easiest step of all that are available.

Income

An important section that affects your taxes is income. If you fill them out incorrectly, you can either overpay or not pay extra. Not the best options anyway.

Here you must specify all the data on the sale of the car. The "+" in the "Sources of payments" section will help. Write information about the buyer of the car, then click "Yes." Nothing more is needed in this section. Again, click on the "+". A window appears with the inscription: "Revenue Information".

Select an income code. In our case, it is 1520. It serves to display the receipt of any income from the property. Below you should write the amount of car sales. To deduct below, select code 903 (flow rate). And record how much you spent once. Your expenses in the tax return play an important role. Then, in the field "Deduction Code" (without any additions), "0" is put down, the month of the sale of the vehicle is put. Nothing more is required from the user. You can click on "+" again in the source of payments. Fill in all the fields that appear using the 2-NDFL certificate, which must be prepared in advance. This is an optional but desirable item. Especially if you already have all the data. There is nothing difficult in this step. Just retype the information you have in the appropriate fields. And nothing more.

Once this step is completed, you can save the changes. Everything, now it’s clear how you can fill out a declaration for the sale of a car. There is nothing special about this. You can print the document in multiple copies, and then file the appropriate request with the tax authorities. Please note: if the filling is incorrect, the computer will not allow you to generate and fill out a declaration. It will be necessary to fill in the missing fields and correct all errors.

Practice

It is not so difficult to file a declaration on the sale of a car when there is at least some practice. Very often, citizens simply do not understand the whole process. And the panic begins. Yes, not everyone is given the opportunity to immediately fully understand exactly how to correctly fill out a declaration.

If you want to save yourself from unnecessary paperwork, you can easily contact the special companies that prepare reporting documents for the tax. Just do not forget to provide them with the full list of securities, which was listed above. Usually all declarations and statements are made very quickly. But you have to pay for the services. And not really little money. Has someone sold a car? You can file a declaration after the transaction without too much headache. Pay trained people, and they do everything for you.