Modern society is socialized. A century ago, a person could only dream of a "social package". Payment of taxes and other contributions did not bode well for the common working people. Over the years, everything has changed. Of course, now the social security system is far from ideal, but it exists. In this connection, each officially employed citizen accumulates part of the funds in federal funds. The mission of calculating and transferring funds, as well as social financing itself, rests with the employer. Accounting for social insurance and security payments is one of the most voluminous operations. Let's consider it in more detail.

What are insurance benefits?

In accordance with the legislation of the Russian Federation, three specialized federal extra-budgetary funds for social services for citizens have been created: social insurance, medical care and pensions (FSS, MHIF, MHI and PF, respectively). In each of the funds, a legal entity transfers a certain amount for its employees.

In the event of an insured event, the relevant fund makes payments to an individual who has a certain insurance experience. The receipt of funds also occurs through the accounting of the employer.

Social Account

Accounting for social insurance and security payments is made using account 69. It has an active-passive structure. On contributions to each of the extra-budgetary funds, sub-accounts are opened:

- 69/01 "Settlements with the FSS";

- 69/02 "Settlements with PF";

- 69/03 "Settlements with the MHIF."

To make social contributions for the employee is the obligation of the enterprise. In this case, the account "Calculations for social insurance and security" - an asset or liability balance sheet? Most often, the data are reflected only in the liability, but the reflection in the asset is not excluded, because the active-passive account and the final balance can be formed in any part of the account.

The increase in the amounts of contributions to the FSS, MHIF and PF, as well as their accrual, are shown in the credit of the account 69. In terms of expenses, the value is indicated in the accounts of the costs of material support for employees, that is, in the debit of the same accounts that reflect the amount of wages . For primary workers, debit 20 will be used, for administrative workers, debit 26 will be used. Merchants write off social tax deductions to 44 accounts.

When paying the amounts of social security for employees, account 69 is debited, thereby accounting reflects the process of fulfillment of obligations by the enterprise.

The role of contributions to the FSS

The Social Insurance Fund is the second largest in Russia. Here, the sums transferred by taxpayers of the whole country accumulate. Part of the funds is funded by the state. Where does the money from this fund go? Thanks to the FSS, an individual can receive compensation in cases of loss of income due to a disability:

- illness

- pregnancy and childbirth;

- caring for a sick relative;

- work injury.

The funds are also used by the fund itself to develop the social sphere and ensure the financial stability of the FSS.

Organization of social insurance contributions

After payroll begins accounting for social insurance and security. The amount that the employer pays to the employee monthly in the form of income for the performance of labor duties is the tax base for calculating the contribution to insurance funds. For organizations applying common tariffs, in 2016 the FSS rate is 2.9%. There is also a limit on the amount of annual income with which tax is not charged. For the current year, it is equal to 718 thousand rubles.

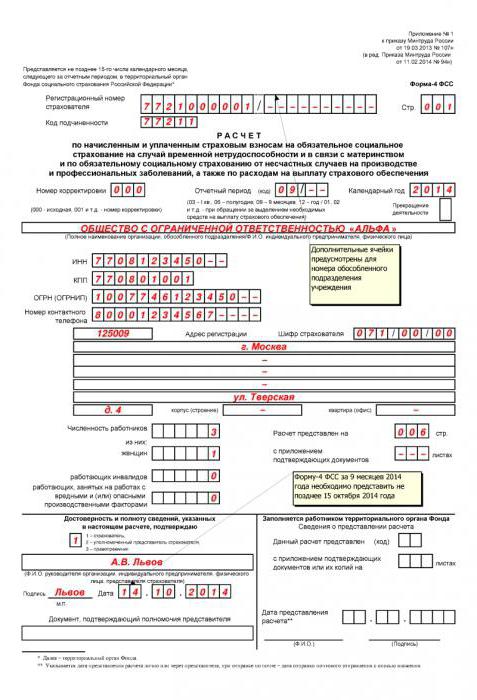

The employer is obliged to independently calculate the amount of the insurance premium, and also transfer it before the 15th day following the reporting month. Each quarter, a legal entity submits a report to the Social Insurance Fund, which contains information on accrued and paid funds related to social insurance. The 4-FSS report form is submitted to the authorized body no later than the 20th day following the reporting quarter of the month. If the documents are submitted in electronic form, the last day of delivery is listed on the 25th. The need to provide a report in advance may arise if compensation is received from the fund for funds paid in excess.

An example of calculating a monthly contribution to the FSS

Accounting for social insurance and security payments is made after payroll. Suppose a hypothetical worker X is an employee of the main chocolate production workshop. He was charged wages in the amount of 22 thousand rubles. It is necessary to determine the amount of the contribution to the Social Insurance Fund, which the employer must pay for his employee. The accountant adheres to a simple sequence:

- Calculate the amount to be charged: 18,000 × 2.9% = 522 p.

- Accrue a contribution to the FSS: Dt 20 Ct 69.01 for 522 rubles.

- Transfer funds to the FSS: Dt 69.01 Ct 51 for 522 rubles.

At this, the enterprise fulfilled its obligation to the social insurance fund over the past month.

Retirement Benefits

A working man throughout his youth and adulthood, rightly deserves a comfortable old age. The Pension Fund carries out its activities so that a citizen “accumulates” part of the pension due to him in old age for his seniority. Like contributions to the Social Insurance Fund, the social security and provision of pension contributions are fully paid by the employer.

In 2016, the contribution rate to the PF at the general rate is 22% of employee income. The maximum annual amount of earnings from which payments are calculated is 796 thousand rubles. An amount exceeding this amount is charged 10%, which should also be listed in the Pension Fund.

In addition to self-calculation and calculation of payments to the pension fund, the employer is also obliged to provide the following types of reporting within the deadlines established by law:

- the SZV-M form about personal data of officially employed workers (full name, SNILS number) - monthly and no later than the 10th day;

- RSV-1 form - for each quarter no later than the 15th day of the second month of the reporting month when compiled on paper and by the 20th day in electronic form.

The RSV-1 report contains detailed information on the paid and accrued amounts, the tariffs for which the calculations are made, as well as the data of the insured. The form is an obligatory document for all types of organizations (including the simplified tax system, the OSNO and UTII).

Example of calculating pension contributions

Contributions to the Pension Fund fall under the accounting for social insurance and security. Postings are made after payroll. For example, the salary of an accountant at a trading company is 16 thousand rubles. The contribution to the PF at the general rate in this case will be: 16000 × 0.22 = 3520 rubles.

The wiring is made: Dt 44 Kt 69.02 at 3520 p. The transfer of funds to the PF is accompanied by an entry: Dt 69.02 Ct 51.

Accruals from the excess amount of income

Now we will calculate the contribution to the PF to an employee with earnings exceeding 796 thousand rubles. in year. Deputy the chief receives a fixed income under the contract of 70 thousand rubles per month. How much will need to pay in the PF for this employee? We will calculate:

- 796 000 ÷ 12 = 66 333 p. - a limit amount of wages per month for settlements at a rate of 22%;

- 66 333 × 0.22 = 14 593 p. - the amount of pension contributions from the maximum allowable salary;

- 70 000 - 66 333 = 3667 p. - the amount of excess of the maximum income;

- 3667 × 0.1 = 367 p. - contribution from excess income at a rate of 10%;

- 14 593 + 367 = 14 960 p. - the total amount of the contribution to the Pension Fund for the month.

For the same amount of earnings, the FSS will be assigned only from an amount not exceeding 718 thousand rubles. per year (59 833 per month). With the excess value, the social insurance rate, in contrast to the PF, is 0%

Medical support for citizens

The last social payment to the federal fund is health insurance. Its presence allows a citizen to receive qualified medical care free of charge. Deductions to the FFOMS are made monthly, from the entire amount of income, i.e., a taxable limit for this type of deductions is not provided. In general, the health insurance rate is 5.1%. Data on transfers are indicated in the reporting of RSV-1, which is submitted to the Pension Fund.

Let us determine the amount of contributions to the FFOMS and other social funds by the example: the salary of an employee of the main production amounted to 36 thousand rubles. Make calculations on social insurance and security. Postings will be made as follows:

- 36000 × 2.9% = 1044 p. Dt 20 Kt 69.01 - the contribution to the FSS has been assessed.

- 36000 × 22% = 7920 p. Dt 20 Kt 69.02 - the contribution to the Pension Fund is accrued.

- 36000 × 5.1% = 1836 p. Dt 20 Kt 69.03 - the contribution to the FFOMS is accrued.

The transfer of funds to the respective funds is confirmed by entries: Dt 69.01, 69.02, 69.03 Ct 51.

Apply reduced rates

In 2016, some enterprises can count on reducing rates on payments to social funds. Mandatory conditions are given in the Tax Code of the Russian Federation. The table shows the legal entities and preferential rates on social payments that can be applied.

Reduced tariffs for 2016Type of legal entity (conditions) | Rates,% |

FSS | PF | FFOMS |

participants of the FEZ Crimea and Sevastopol | 1.5 | 6 | 0.1 |

residents of the technology-innovative SEZ |

residents of the free portal of Vladivostok |

Organizations having an agreement with the SEZ on theater or tourist activities | 2 | 8 | 4 |

Business companies formed by scientific budgetary institutions |

Companies for the development and implementation of computer programs, databases |

Pharmacies and pharmacists-IP on UTII | 0 | 20 | 0 |

IP “according to the patent” |

Participating companies Skolkovo | 0 | 14 | 0 |

Year after year, there is a reform and improvement of calculations for social insurance and security. A greater number of benefits are being created for employers in order to encourage them to faithfully pay the "social programs".

Control of settlements for FSS, PF and FFOMS

Like the verification of any other data, the audit of social insurance and security payments is an integral part of the organization of accounting. The main goal, which is aimed at reconciling indicators with actual values for social payments to federal funds, is the establishment of the fact of correctness of the calculation of the base for calculations, the amounts of social contributions themselves, reflection in accounting registers and preparation of reporting documents.

The auditor who verifies the calculations for social insurance should pay attention to fidelity:

- payroll;

- application of tariff rates ;

- accrual of benefits from federal social funds;

- accounting records confirming the fact of accrual and transfer of insurance premiums;

- data of the general ledger and the column “Calculations for social insurance and security” in the balance sheet on account 69;

- compilation of reporting documents on social insurance and the timeliness of their submission to the relevant authorities.

Calculation, accrual and use of citizens insurance funds is compiled on the basis of reliable data on the amount of earnings and, if there are reasonable reasons for applying reduced tariffs, zero rates or the complete absence of transfers. In cases established by law, an enterprise can always count on the reimbursement of funds paid in excess to the funds. The essence of the calculations for social insurance and security is to protect the country's population and provide support in the most vital situations, while not burdening the business segment with excessive waste.