One of the concepts that a personnel officer, a novice payroll accountant, and a payroll economist needs to know is the concept of average earnings. The employee, in turn, knowledge of how this value is calculated helps to verify the correctness of the payments accrued to him, to predict his income. After all, the size of average earnings affects many types of payments. Based on its size, the employee accrued vacation pay, sick leave, business trip, study leave.

The concept of average earnings

All citizens working in the Russian Federation are protected by labor law. So, to calculate the average amount of earnings, the legislative basis is article 139 of the Labor Code of Russia. In addition, the use of this type of earnings for payments is provided for in other articles of the TC. In addition to the Labor Code, the main legislative basis for calculating average earnings are Decisions No. 922 of December 24, 2007 and No. 375 of June 15, 2007, Federal Law No. 255, dated December 29, 2006. The application of all these legislative norms allows us to establish a single procedure for calculating this indicator for all organizations of the Russian Federation.

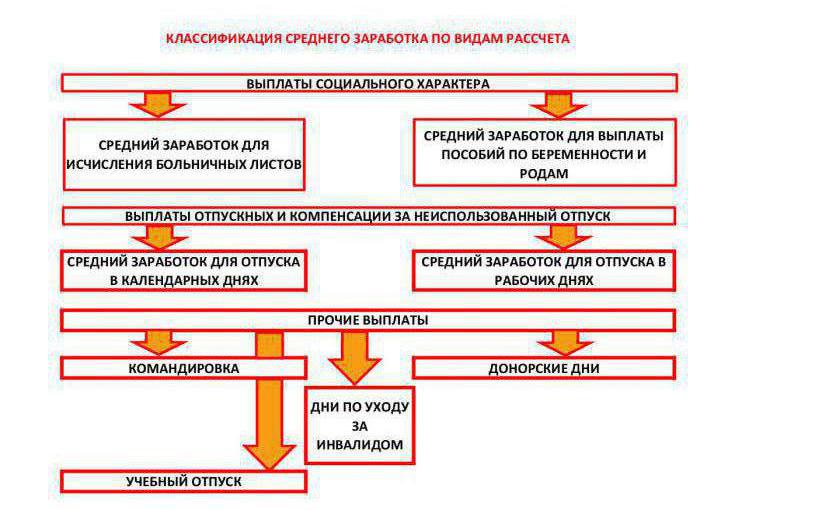

Based on article 139 of the Labor Code, the organization has the right to change the algorithm for calculating the average, however, any such change should be in favor of the employee. The difference can be spelled out in internal acts, regulations. General definition of average earnings: this is the average amount of employee wages (usually per calendar day) calculated in accordance with the requirements of the law. Any accountant is familiar with this. The calculation of average earnings depends on the purpose for which it occurs. By type of calculation, you can offer the classification presented below.

It is based on the type of payment for which the calculation is made, and certain subtleties, parameters, and the legislative framework specifically for these cases are taken into account. A completely separate group should consider the use of the average earnings indicator for economic purposes. This indicator serves as an object of economic analysis, and its dynamics are laid in the budget of the enterprise. And finally, average earnings as a macroeconomic concept serves as one of the criteria for the standard of living of the population.

General algorithm for collecting data for calculation

Before you start calculating the average wage for accounting needs, you must determine:

- On what basis the employee will receive average earnings. Here you need to understand what regulatory documents govern the use of the average in a given situation.

- Billing period - according to the legislation, the average is calculated based on the last year of work. In order to calculate the payments for the period of incapacity for work, they rely on a billing period of two years. If the internal acts of the organization set a period different from that stipulated by law, the accountant will have to calculate the average earnings twice and take a large amount for calculation. If the employee did not work the entire working period, then to calculate the average for holidays and other payments (except social), you need to take into account the number of days worked in the period.

- During what period the employee will receive average earnings.

- The amount of employee income for the calculation period. Here you need to understand which payments need to be considered and which are not. The composition of the recorded payments is also determined by law.

Calculation for temporary disability payments

The employee receives average earnings during the entire period of disability. However, its final size depends on the length of service of the employee (it takes 60% of the average with an experience of up to 5 years, 60% - from 5 to 8 years, 100% - over 8 years). The calculation of the average wage for calculating sick leave is based on Decree No. 375. In this decision, all the nuances of calculating the average for the sick leave are taken into account.

For the billing period, take 2 years before the onset of disability. The total number of days in the calculation period is fixed and amounts to 730 days (this is a constant that cannot be changed, since no periods are excluded from the calculation by law).

It happens that the picture for the employee over the previous 2 years is completely unprofitable. (for example, a woman was on maternity leave for a long time), the situation can be changed. The employee asks the manager to use the other 2 years to calculate the average, the amount of income is taken for them. A sample statement for adjusting the billing period is presented below.

There is a marginal income for the year, amounts above which are not accepted for accrual, in 2018 it is equal to 1,473,000 rubles, in 2017 the limit was set at 755,000 rubles, and in 2016 the maximum amount of income with which the average can be charged earnings for the sick-list amounted to 718,000 rubles.

In addition to the maximum limit, the minimum limit is also there. Earnings are compared with the situation if an employee had received a minimum wage for the past 2 years. For the correct calculation is taken, which is beneficial to the employee.

When changing work, a person from the old place must be issued a certificate 182N, which indicates the earnings for two years.

Thanks to this form, at the new place of work, the employer has the opportunity to take into account previous earnings in order to take it into account when calculating disability benefits. The amount of earnings for the billing period includes payments that are taxed by insurance premiums in the Social Insurance Fund. If the payment of insurance premiums was not taxed, it will not be included in the amount of income. For example, do not include:

- sick leave payment in the billing period;

- payment of leave taken by a woman to care for a child;

- payment under copyright agreements;

- material help.

The formula for calculating the average earnings for the sick-list is quite simple. It looks like this:

SZ Bol = UD / 730, where SZ Bol - average earnings for calculating sick leave; UD - recorded income.

We figured out the formula. How to calculate the average earnings for the sick-list is described in the example below.

Example of accrual of sick leave

For example, A. Ivanova, an employee, has an income of 473,000 rubles for 2016, and 496,000 rubles for 2017. Over the past two years, the employee has been on sick leave for 15 days (payment amounted to 17,000 rubles) and twice received financial assistance (in the amount of 3,000 and 7,000 rubles). It is necessary to calculate the average daily earnings for further calculation. Since the amount of income does not exceed the maximum and not lower than the minimum, the calculation will look like this:

NW Bol = (496000 + 473000 - 17000 - 3000 - 7000) / 730 = 1290.41 p.

Calculation of the average for maternity allowance

The calculation of the average in the case of an employee leaving the decree is regulated, as well as the calculation of the average earnings for the sick-list, that is, Decree No. 375. The calculation algorithm is generally similar to the calculation for the sick-list, but has several fundamental differences. The most important of them is that the time is taken out of the billing period when the employee received social payments (she was on maternity leave and on sick leave). The calculation period itself in this case is not constant and is calculated by the actual number of calendar days for the previous two years.

The average formula for calculating maternity benefits is:

Szbir = UD / (D p - ND p, ), where

- SZ bir - average for calculating maternity;

- UD - recorded income;

- D p - the number of actual days in the period;

- ND p - the number of unaccounted days in the period.

The amount of recorded income, as in the previous case, is the income on which the FSS contributions were accrued during the period. Similar to the calculation for sick leave, there is a minimum and maximum level for the recorded income.

An example of calculating the average earnings for maternity

If we assume that employee Ivanova A. And from the previous example goes on maternity leave, will the amount of the average daily wage per day, calculated according to the rules for the average for maternity, change?

The period 2016-2017 totals 731 days (2016 was a leap year). When using the formula indicated above, the calculation looks like this:

SZ bir = (496000 + 473000 - 17000 - 3000 - 7000) / (731 - 15) = 1315.64 rubles.

The amount of average earnings differs from what is calculated for sick leave benefits.

Period for calculating vacation pay and compensation for vacations that were not used

According to article 122 of the Labor Code of the Russian Federation, every worker has the right to annual leave. For the employee for the period of vacation, payment of average earnings is retained , which is calculated in accordance with Decree No. 922. If the employee is dismissed, compensation for vacation that has not been used is accrued in the same way as regular vacation pay.

The calculated period for calculating the average earnings for vacation pay is usually the last fully worked 12 months (year). The following days are excluded from the billing period:

- when the employee did not work while maintaining average earnings;

- when the employee was on sick leave, on maternity leave;

- if the employee was idle for reasons within the competence of the employer;

- days on which the employee was at the weekend to care for a disabled child.

According to paragraph 6 of Decree No. 922, if all the previous 12 calendar months consisted of excluded periods (for example, an employee was on maternity leave), then an earlier equal period is taken for the billing period. When recalculating the months on days for calculating the period, according to Government Decision No. 642, it is generally accepted that there are an average of 29.3 days per calendar month. If in the month there was a period excluded from the calculation, the number of days taken into account is determined using the proportion:

D prin / D month = DSr and ck / 29.3.

From the proportion is the desired value of days:

DSr claim = (D prin / D month) x 29.3 (days), where:

- D prin - the number of days taken into account in the billing period;

- DSR and SK - the desired number of days per month, which will be included in the calculation of the average.

Income for calculating vacation pay

Income is also taken for the year. According to the Decree No. 922, the amount of income includes all payments that are established at the enterprise. Included:

- directly accrued wages;

- cash rewards;

- payments related to working conditions;

- premiums.

Amounts that were paid for excluded periods, as well as:

- material help;

- compensation for food;

- travel compensation;

- training compensation;

- compensation for utilities.

Summarizing all of the above, we can derive formulas for calculating the average daily earnings for vacation pay. For example, an employee worked in a billing period without excluding time. The formula is as follows:

SZ ot = UD / (12 x 29.3), where:

- SZ OTP - average earnings for vacation pay;

- UD - recorded income.

For example, the employee did not work out the full billing period. The formula would be:

SZ OT = UD / ((M op x 29.3) + D cf ), where:

- SZ OTP - average earnings for vacation pay;

- UD - recorded income;

- M op - the number of months worked in full;

- D Wed - calculated by the formula above, days in months, worked out incompletely.

Special cases related to vacation pay

It often happens that by the time the incident occurs when the employee is paid average earnings, he did not have time to work 12 calendar months. In this case, the period will be the time that the employee actually worked, and the income will be used for this period, respectively.

When accounting for premiums in income, on which the average is calculated, the following features are taken into account:

- the bonus is included in earnings if it is accrued no more than once a month;

- if the premium is paid for an incomplete billing period, it is reflected in proportion to the actual time.

Example of calculation of vacation pay for a fully worked out period

In the case when the employee has worked out the full billing period, the calculation of average earnings is quite simple.

Ivanova A.A., whose vacation is expected in June 2018, has fully worked out the period from June 2017 to May 2018. Her monthly salary was 30,000 rubles, for 12 months, respectively, this amounted to 360,000 rubles. It is necessary to calculate what average daily earnings will be for calculating vacation pay. According to the formula above, the calculation looks like this:

360,000 / (12 x 29.3) = 1023.89 p.

An example of calculating vacation pay if there was an excluded time in the billing period

Here you need a layout for months, followed by summation. An example is presented below.

Having these data, it is easy to calculate the average:

334,246 / 333.39 = 1,002.57 p.

Calculation for other types of payments

In addition to social payments and payments during the vacation period, there are other cases established by law when an employee receives an average salary. Such cases include:

- business trip days;

- days when the employee undergoes a mandatory medical examination;

- days when a worker donates blood as a donor;

- study leave;

- weekends provided to parents of children with disabilities.

How to calculate average earnings for the above periods is defined by Decree No. 922 of December 24, 2007. The algorithm is completely identical to calculating the average for vacation pay.

In economics

In the economy of an enterprise, average earnings per month, quarter, half year, year becomes an object of planning and analysis. Special budgets for wage costs are planned. For example, it may look like the one shown below.

The enterprise management does everything possible to fulfill the established economic indicators, including the size of the average wage.

In macroeconomics, at the level of the Russian Federation as a whole and its subjects, statistical authorities keep records of average incomes of the population. In 2016, the average earnings in Russia amounted to 35,369 rubles, in 2017 - 39,085 rubles. An analysis of the growth of this indicator must be carried out taking into account inflation for the same period.

The average earnings calculated for accounting needs, for the needs of micro- and macroeconomics - a very important and necessary concept. Without it, building a coherent economic system is impossible.