Each organization, regardless of whether it operates under the general taxation system (DOS) or simplified (STS), is required to submit annual accounting and tax reporting (hereinafter, reporting documentation - OD). The annual reporting is the most capacious according to the information on the operation of the enterprise included in it, therefore it is considered very important. Drafting ML has many goals. The accounting OD of the company is of interest not only to the authorities, but also to the enterprise itself.

The meaning of the preparation of ML

Any OD, whether quarterly or annual, contains information about the current financial situation of the company. This information is necessary for state bodies (hereinafter referred to as GO) to represent the situation about the real state of affairs of the enterprise. Based on reports from firms, bodies compile general statistics, which are the basis for analysis and adoption of various decisions at the state level. Due to the information provided, civil defense organizations also monitor the conduct of the company’s activities, and in the event of any gaps, omissions or violations, they impose various fines on the company.

In addition to civil defense, OD is necessary for the enterprises themselves. Obtaining regular information about the financial situation of an organization helps its managers make various management decisions. OD is very important for the stable operation of the entire enterprise and the realization of its development prospects.

Accounting Information Users

Quarterly and annual reporting are a consolidated form of accounting information about the company. Accounting information always has users, that is, those who use this information for various purposes, which were announced above. All users of accounting information are divided into internal and external. The internal ones include the heads of firms, higher organizations (if any), management units (if the enterprise is large). External users include the Federal State Statistics Service (Rosstat), the Federal Tax Service (FTS), the Pension Fund (PFR), and the Social Insurance Fund (FSS). External users also include any individuals and legal entities, since the accounting OD of any company must comply with the principles of transparency and accessibility to any user.

The above external users of accounting information, with the exception of individuals and non-specified legal entities, impose liability on the company if it does not deliver OD on time. In case of delay of civil liability, the company is not entitled to impose a fine.

Types of OD

OD is divided by type: statistical, operational, accounting, tax. Statistical OD is intended for submission to statistical authorities. The purpose of operational OD is operational accounting at the enterprise. This type of OD includes those things that are not reflected in accounting OD, but also necessary for the normal operation of the company. These things include the appearance of employees, production facilities and the like. A characteristic feature of operational OD is the time of its provision, which, as a rule, is equal to one working day. Accounting OD reflects the financial situation of the enterprise. Tax OD is formed for tax accounting purposes at the enterprise.

Accounting OD, in turn, is divided into frequency and volume. By the frequency of OD, it happens quarterly (intra-annual) and annual. In accordance with the law, accounting OD should have increasing character, that is, the documentation for the first quarter should include information only from the first quarter of the year, the OD for the second quarter should contain information from the first and second quarters, and so on. Annual reporting includes information for all four quarters.

The volume of quarterly and annual reporting of the organization is primary and consolidated (consolidated). If the company has subsidiaries, then the accounting OD within the individual subsidiary or within itself will be primary. Consolidated OD is composed of all primary securities of subsidiaries and parent organization inclusive.

OD requirements

The main requirements for the preparation of ML are relevance, integrity, reliability, comparability, timeliness.

- The relevance of the data characterizes the OD as a set of information on the situation of the enterprise on a specific date. It is impossible to provide ML, for example, for the third quarter, in which information will be given for the second.

- Integrity means the provision in the report of information on the operation of the enterprise, covering all areas of its activities and the financial position of subsidiaries (if any).

- Reliability of OD makes it possible for any user of this information to be sure that it reflects the real state of affairs of the enterprise.

- For the purposes of comparing the work of a company in different periods of time, the OD should comply with the principle of comparability, that is, have units of measure common to all periods of its work.

- The timeliness of the quarterly or annual financial statements obliges the company to provide ML in strictly defined by law periods.

In addition to the above requirements, ML should meet such principles as binding, unity of forms and methods, simplicity, public accessibility, brevity, clarity, and transparency.

The procedure for drawing up ML

The drawing up procedure can be divided into two stages: preparation and formation. At the preparation stage, all the necessary information is collected to form the OD. Also at this stage it is very important to detect and correct (when revealing) various errors in accounting, since their presence in the quarterly or annual tax reporting can cause fines from the tax authorities for distorting the true state of affairs of the organization. At the formation stage, the process of compiling the OD occurs. After completing both stages, the documentation must be signed by the head, chief accountant of the company and have a seal.

Errors in OD

The organization must correct all errors identified during the preparation of ML. Errors are divided into material and non-material. A mistake is recognized as significant, affecting the management accounting of internal users of this accounting information. That is, if it is able to greatly change the business strategy of the enterprise. Similarly, a significant error is determined for external users. In other cases, the error is regarded as insignificant, but it also needs to be fixed.

Any errors can be freely corrected prior to the submission of annual reports and its approval by the Civil Society or other internal or external users. If the OD has already been handed over to users, but has not yet been approved by them, then it is necessary to send the corrected OD to them with a note on replacing the old version.

There are two options for fixing significant errors. By reflecting the identified error results in account 84 “Retained earnings” or by retrospective restatement.

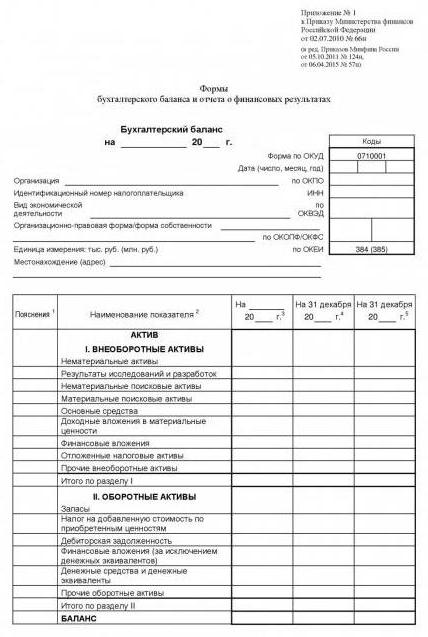

The main forms of annual reporting

Forms of ML that all enterprises are required to provide to civil society: both large and small, are the completed form. balance sheet (No. 1) and the form of the report on financial results (No. 2, otherwise called a statement of loss and profit). In addition, the following must be attached to the balance sheet: report form on rev. capital (No. 3) and a motion report form. den funds (No. 4). An explanatory note should also be attached to the balance sheet, covering those things in the activities of the company that cannot be represented by numbers. Enterprises operating under the simplified tax system may not provide Forms 3 and 4. These reports must be submitted to the Federal Tax Service and Rosstat at the end of the year or at the beginning of the next (for the previous). At the same time, an individual entrepreneur, regardless of his tax system (DOS or STS), may not provide an annual balance sheet and investments in the Federal Tax Service, but must also submit them to Rosstat once a year.

The above composition of the annual reporting is basic, but not exhaustive.

List of annual OD for firms on DOS

The following is a list and timing of annual reporting for organizations operating on DOS:

- VAT declaration - until the end of January (Federal Tax Service).

- Forms 6-NDFL, 2-NDFL - until the beginning of April (Federal Tax Service).

- Form 3-NDFL (for individual entrepreneurs) - until the beginning of May (Federal Tax Service).

- Form 1-IP (for IP) - until the beginning of March (Rosstat).

- Form 4-FSS - until the end of January (FSS).

- Form RSV-1 - until mid-February (PFR).

- The average number of employees is until the end of January (Federal Tax Service).

- Three types of tax declarations (property tax, transport tax, land tax) - until the end of January (FSS).

- Confirmation of the main type of activity (not for individual entrepreneurs) - until mid-April (FSS).

- The balance sheet and investments - until the end of March (Federal Tax Service, Rosstat).

The list of annual OD for firms on the simplified tax system

Below is a list and terms of annual reporting for organizations working on the simplified tax system:

- Form 4-FSS - until the end of January (FSS).

- Form RSV-1 - until mid-February (PFR).

- The average number of employees is until the end of January (Federal Tax Service).

- Two types of tax declarations (transport tax, land tax) - until the end of January (FSS).

- USN Declaration - until the end of March (Federal Tax Service).

- Forms 6-NDFL, 2-NDFL - until the beginning of April (Federal Tax Service).

- Confirmation of the main type of activity (not for individual entrepreneurs) - until mid-April (FSS).

- Form PM (for small enterprises) - until the end of January (Rosstat).

- The balance sheet and investments - until the end of March (Federal Tax Service, Rosstat).