The level of support and resistance is the basis of technical analysis, concepts that are familiar not only to professional traders, but also to beginners. As practice has shown, prices for trading instruments vary within a clear price channel. Its upper limit is the resistance level, and the lower boundary acts as a support line. Sometimes straight lines flow smoothly from one to another, performing completely opposite functions. Very popular trading systems, which are based on the construction of levels. This is due to the simplicity and accessibility of the chart analysis tool.

The intricacies of building levels: the psychology of trading

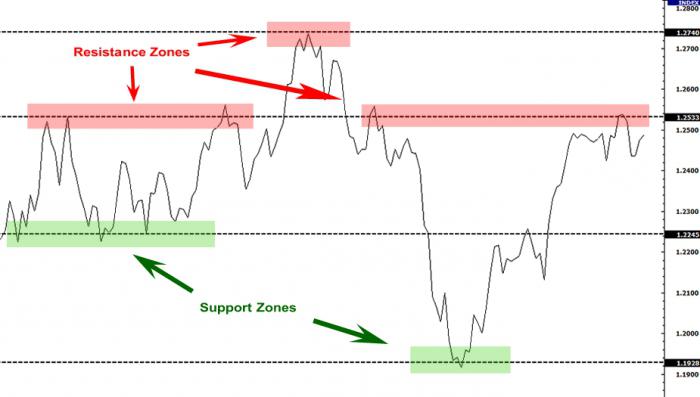

The level of support and resistance is built on the basis of the reversal zones on the chart, also known as pivots. The construction of lines can be carried out after the formation of only one pivot point. When the price after a reversal again reaches the previous maximum or minimum and cannot break it - this is pure psychology, which is due to the uncertainty of market participants in their forecasts and determines the further direction of the price. Ultimately, the price breaks the level and follows the trend or turns around, fighting off the extreme, and goes in the opposite direction. The more times an asset’s price fights off a certain level, the more power it will possess. If you build a schedule, a kind of beacons will form. They signal the presence of areas in which the price will behave in a pattern-specific manner.

What are support and resistance levels?

The level of support is a line that the price is not able to overcome in a downtrend. This is a certain point that is perceived by traders as a place of successful entry into the market. When the price reaches the mentioned mark, traders consider long positions. The region has a huge number of pending orders, after activation of which the price goes south. The resistance level is a similar line, but already one that the price is not able to break through when moving north. Resistance is considered a profitable area for opening short positions. In the region, it is customary to establish a huge number of pending orders, the triggering of which pushes the price down.

Level development specifics

Each trader should be aware that the level of support and resistance are very subjective concepts that do not differ in characteristic accuracy. Clear lines on the chart rarely work. Widespread orientation to certain zones when making trading decisions. Support and resistance zones are the price range in which a large number of orders are concentrated. The situation is due to the use by most traders in their trading strategies of identical techniques of technical analysis. The dominant number of market participants selects similar entry points into the market, which determines the price movement. When the price crosses one of the levels, there is a clear signal to buy or sell an asset, which is facilitated by the acceleration of movement at a certain point in time. A prerequisite is the mass closure of orders by stop orders that were oriented towards the reverse movement. Studying how to determine support and resistance levels, one should take into account the fact that the price quite often moves from one channel to another, which determines the transformation of support into resistance and vice versa.

Unity of opinions is the key to successful trading

Support and resistance levels (the indicator helps to determine them as accurately as possible in a matter of seconds) are visually perceived by almost all participants in the foreign exchange market. These are lines that for a certain period of time inhibit price movement in a certain range. Areas are always considered by traders as potentially profitable entry points to the market. Unity of opinion turns the price in the opposite direction. The ease of use of lines in trade is determined by history. Correct technical analysis works in 90% of situations. Even with the extremes at different levels, the run between them is insignificant, and trade efficiency does not drop.

The power of levels and its effect on price

The level of support and resistance can have completely different strengths. The parameter will depend on how often and how exactly the price reacted to the line. The more bounces from levels in history were formed and the stronger impulses formed as a result of contact with the price, the more powerful the technical analysis tool will have and the more likely it is that once again the price will not be able to break the range. When the price ignores the lines over and over again, we can say that their use in trading according to the standard will be ineffective. The attention of participants in the foreign exchange market is drawn to those concentration zones of orders that alternately fulfill the roles of support and resistance. The strength of the levels allows you to make the most accurate forecast in relation to the further development of events.

Does the foundation play a role?

Trading when breaking through important lines or making a profit on the rebound is very simple, since it does not require an analysis of fundamental factors. The reaction of the price to a certain value can be due to several factors at the same time. Prerequisites may be orders to buy or sell, the prevalence of opinions that the market has already exhausted itself, or hopes for the availability of forces to continue the movement. If there is information from analysts explaining the reasons for the rebound or breakthrough, we can say in advance that it is nothing more than a bluff.

Subtleties of construction or rules that are prohibited to be violated

A trading strategy in which support and resistance levels play a dominant role comes down to buying from support lines and selling from resistance. Sometimes a bet can be made precisely on the breakdown of key lines. The ability to benefit from basic technical analysis is based on the ability to correctly build key lines. Ideal lines within which you can profitably enter the market must meet the basic criteria. Otherwise, support and resistance levels that are not recognized by Forex will lead to a drain of the deposit. The line that the price of the trading instrument bounced at least two times is considered to be working and priority. The more the price responds to certain price indicators in an identical way, the higher the strength of the levels will be. Levels that have shown themselves well in history, in comparison with those that have been practiced relatively recently, have a secondary role.

Permissible errors

Neither a professional trader nor the best indicator can support and resistance levels to the nearest point. Experienced market participants are well aware that the price quite often breaks through the channel, and then with a new force is repelled from its upper or lower boundary and follows in the opposite direction. Situations are permissible when the price simply does not reach the levels, but is nevertheless intensively reversed. These inaccuracies and errors must be taken into account when using tools in trade. When the levels several times break through the price, first in one direction, and then in the other direction, they begin to be ignored by most market participants, and applying them as part of any strategy becomes ineffective. Given the lack of point accuracy, the lines make it possible to trade with a stop to profit ratio of 1: 3, or even 1: 4 or even more.

Building levels at different time intervals

Trading is considered to be the most effective and less risky when a trader undertakes to build a chart simultaneously at several time intervals. This approach allows you to clearly see the situation on the market and, therefore, helps to make the right trading decision. Buying or selling an asset will be accompanied by minimal risks when levels from different timeframes coincide. The strategy will avoid opening deals against the trend, which will increase the chances of making a profit. It is necessary to pay attention to the fact that the levels will not always be purely horizontal. It is allowed to superimpose on the graph diagonals with a slight slope. Clear support and resistance can take place in the terminal not only during flat periods, but also in downtrend and uptrend.

Comparison of levels and other technical analysis tools

An approach to trading is considered effective when support and resistance levels (an indicator puts them on the chart within a few seconds) are compared with other analysis tools. We can talk about the use of option levels in trading that show price tags with the maximum number of orders to close profit transactions. Alternatively, overlay on the graph of Gann angles and Fibonacci levels is allowed . We welcome indicators that can show the volume of accumulated funds within each price range. To get stable profits, it’s not enough to know how to determine the level. You must be able to track additional signals. The probability of a price hike from the level both in the south and in the north direction is exactly 50%. Hoping for luck in trading is unacceptable. The forecast must be supported by no less than three powerful signals, which are almost impossible to refute. Understanding how to determine support, resistance levels only improves, but does not form a strategy.