Technical analysis incorporates a large number of repeating patterns of price movement. Some of them have proven themselves better than others as a source of forecast. One such model is a flag or pennant. A proper understanding of this pattern can be the basis for many profitable strategies.

What does the flag figure mean in technical analysis?

On the graphs of technical analysis, you can often notice a graphic formation that looks like a flag or pennant. This figure is characterized by a sharp forward movement, a price stop at a certain level and subsequent movement in a narrow price range.

What can this pattern talk about? Classical analysis interprets it as a trend continuation figure. If the impulse movement that formed the flagpole was bullish, then the price, going beyond the limits of the subsequent consolidation, will continue to move in the bullish direction. In the case of the formation of a bear flag, the price exits from the trading in a bearish direction.

How to define a flag by appearance

A flag pattern may have a different appearance. Sometimes it is obvious, and sometimes not. In the event that the flagpole is formed by one large candle, the model stands out well on the chart. But there are times when a shaft is formed from several medium-sized pulsed candles.

This design is more difficult to identify. Here it is necessary to give a clear definition of when a figure can be called a flag in technical analysis. If the price movement forming the flagpole is 60-90⁰ relative to the horizontal, then this can be defined as a shaft. Here we need to make a little explanation. Depending on the timeframe, this movement will look different. Suppose that if a shaft is found on a four-hour chart and looks according to our requirements, then everything will look different on an hourly or 15-minute timeframe. The angle will be much more gentle, in addition, the rollback structures will not allow to identify the model as a flag.

The next requirement, which will help to clearly determine that this is a flag, is the occurrence of consolidation at the next significant price level. That is, if the price went in a certain direction, but did not reach the next level of resistance or support, then we can’t say that this is a flag. Even provided that the price movement occurred at the right angle.

The next thing that will determine the shape is a form of consolidation. It should have a price fluctuation in a small range. At the same time, the extremes of these fluctuations should be parallel to each other in the time interval: high and low should not go beyond the price range. If this happens, then this indicates a possible breakthrough of the price for one of the levels of consolidation and the beginning of the next movement.

Another variation of the flag pattern is the pennant. Its differences are in the form of a consolidation zone.

If the flag is rectangular, then the pennant is traded in the form of a triangle. The amplitude of the price movement decreases with the advent of each new candle. In Price Action, such a formation is called a spring. Accumulation occurs: at a certain moment, a rapid increase in volumes occurs, and the spring shoots. Price starts its movement again.

How the flagpole is formed

Any price movement with the subsequent formation of graphic designs is due to the mood of market participants. Most often, flags appear at the moments of the release of strong news, such as the publication of business activity indexes, changes in interest rates, speeches by the heads of large banks. Such events are marked in the economic calendars with three heads, emphasizing their importance. When training in trading, the emphasis in fundamental analysis is placed on just such news.

Often, in anticipation of news, the market freezes and for a certain time moves in a narrow price range. At the time of publication of the news, market participants place a lot of buy or sell orders. If the purchase volumes significantly exceed the volumes of sell orders, then there is a rapid increase in prices. The higher the difference in volumes, the more rapidly growth will occur.

Of course, the news comes in different strengths. The more significant the event, the greater the time span it affects. For example, on August 31, 2005, when the aftermath of Hurricane Katrina was published, the US currency fell by more than 400 points over three days. Less significant events can affect the price only within one trading session.

Summing up, we can say that the stronger the expectations of market players, the stronger the momentum that forms the flagpole.

Appearance

The flag itself appears as an impulse correction. This formation can be explained by the following reasons:

- Waiting for a reversal from the level of support, resistance. When approaching a significant level, traders expect either a reversal or a continuation of the price hike. This is the so-called period of uncertainty, when many close their positions, which stops the price.

- Opening deals in the opposite direction. If the volume of these positions exceeds the volume of transactions that formed the impulse, the price will unfold.

- Obfuscation by a large player (market maker) of small participants. At this moment, the “crowd” either closes its position or opens in the opposite direction.

- Testing at the price of a level. If it is broken as a result of this trade, then a further price hike will begin.

It is good when a trader who uses technical analysis of financial markets in his work knows the reason behind the pattern. This allows you to understand the logic of further price movement.

Bull market pattern

If we take the classics of technical analysis, the bull flag should be directed in the direction opposite to the impulse movement. That is down. But, as practice shows, often the corrective movement occurs sideways, moreover, if the trading is directed upwards, then the pattern in this case increases, and the likelihood of its breaking into the bullish side increases. However, in some cases, the direction of the flag flag up may indicate the beginning of a smooth turn. Therefore, you need to look at which way the price goes from consolidation.

The most important thing in a flag pattern is not its direction, but the price movement in the side channel, going beyond which will mean new growth.

Bear Market Pattern

The bearish flag, according to the classics, looks like a correction directed upward after the bullish bearish movement. Unlike the bullish pattern, the main thing here is going beyond the lower limits of the price channel correction.

In order to accurately identify that an exit has occurred, you need to wait until the price is fixed outside the consolidation.

How to calculate where the price will go

In order to use the refinement of the figure of the flag at Forex, you need to be able to calculate the magnitude of the price movement after exiting the consolidation. Two methods can help with this:

- A simple way of calculating is to postpone the flag’s price and postpone the distance traveled by the price when forming the flagpole from the level that formed during the correction. The resulting level will be the goal of profit taking. That is, this calculated point will show where to install take profit.

- The second method is more complicated and uses a Fibonacci grid in the calculations. This method takes into account the depth of correction forming the flag shape in the technical analysis. You need to pull the grid on the flagpole. This will be 100% of the initial movement. Then you need to observe to what level the movement will be adjusted. In this pattern, the correction is rarely more than 61.8%. Depending on the level, the profit target will be set. With a correction of 23.6% to 61.8%, take profit is set at 161.8%. If the correction dropped to 78.6%, then the price hike is expected to 127%. As in the previous version, you need not just to start from correction. The main condition is a breakdown of the price channel.

How to secure a deal when working with a pattern

In the technical analysis, the flag figure does not always work out the mathematical expectation assigned to it. Therefore, you need to use methods of fixing a possible loss - placing a stop order.

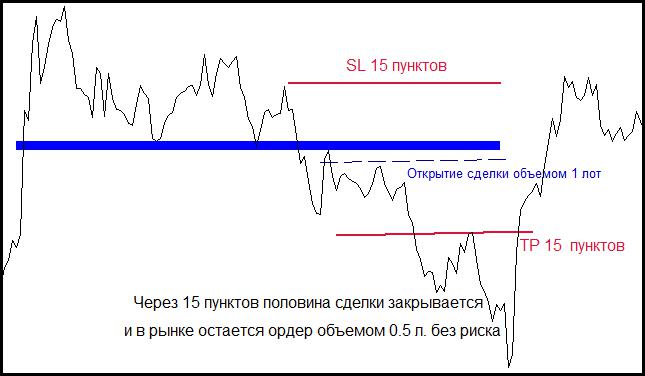

In addition, when the price moves in the right direction, it is necessary to transfer the transaction to breakeven by dragging the stop loss level. Another method that helps reduce risks is to close half of the transaction volume when it reaches profit equal to stop loss. This method is called “Safe.”

If when working on a trading strategy, the rules for opening a transaction are observed, then you can almost always count on the price moving in the right direction. Often the initial impulse is 7-15 points. Naturally, the trader wants to get the most out of the movement. However, the market can turn around at any time.

According to the rule "Safe". either two trades of the same volume are opened, or one that, upon reaching the stop order, will be closed halfway. If two deals are open, then one of them closes. For example, opening a deal with a volume of 1 lot for sale at a price of 1.2981, we set a stop loss at 1.2994. Stop will correspond to 13 points. Add to them a spread of 2 points (there will be a spread on each currency pair) taken by the broker. As a result, we get 15 points. This will be the minimum profit that the initial impulse will give. Therefore, in order to secure the deal, we open a stop order that closes it in half, i.e. 0.5 lots, at the level of 1.2966. Now when this level is reached, half of the transaction will be closed, and a profit of 15 points will be recorded. And since the size of stop loss is also equal to 15 points, then if our forecast does not materialize and the price unfolds, half of the transaction will close at minus 15 points. Loss and fixed profit equalize each other, as a result of which the erroneous forecast closes without loss.

However, if the movement is in the predicted direction, then take profit set at the Fibonacci levels will allow you to take profit. significantly exceeding 15 points.

Technical analysis of financial markets does not give a 100% guarantee, as well as a fundamental one. It is assumed that the price hike when breaking the flag will be at least 70% of the size of the flagpole. However, this probability is reduced if the correction that occurs after the impulse. will be stretched in time. The longer it lasts, the weaker the pattern becomes. We can say that the flag figure formation cycle directly affects the mathematical expectation of this graphic model.

You should always remember that this is a breakdown structure: you can’t enter only because it looks right. You need to wait for the breakdown of the channel borders with the subsequent consolidation, only after that enter the deal.

An additional confirmation of movement along the trend will be an increase in volumes. Volume indicators are available in any trading terminals. Despite the fact that there are no true transaction volumes at Forex, tick volumes also do a good job of this. They show the number of price changes over a period of time. It is believed that the more ticks have occurred, the higher the volumes flow. And this is true, because for every change in price you need a certain amount.

Strategy with flag

How to use forex flag shape? For this, several strategies have been developed. One of them is called “Flag + ABC”. Its essence is as follows:

- After the occurrence of impulse movement, you need to wait until the price begins to move in the side channel.

- The first pullback movement after the impulse will be called wave “A”. The second wave, which will form the opposite boundary of the channel, will be called “B”. The third wave, which moves towards the pullback, will be “C”. It is she who will make it clear that the flag is formed.

- At the end of wave “C”, you can enter the trade in the direction of the initial impulse.

How can you understand that wave “C” is over? There are several ways to do this. The simplest is to draw a trend line from point “B” in the direction of wave “C”. A breakdown of this line will indicate the beginning of a new movement. In addition, divergence that occurs on indicators such as RSI, MACD can indicate the end of the wave.

Often the pullback reaches 38-61.8% of the impulse. This may indirectly indicate the end of wave “C”. However, if the correction is deeper, then you should think: is the resulting model worth referring to the flag? It is possible that the price forms one of the varieties of Gartley patterns.

The level for the first goal will be the external border of the consolidation channel. On it you need to set take profit. The second target will be at the level of 138% of the value of the initial impulse. The deal is already opened when the channel is broken. The rule of breaking the flag on the Forex is that the price goes beyond the limits of consolidation and begins a hike in the direction of the momentum that formed the flagpole. Or the price returns to a retest of the consolidation border level, and only after that a further price hike begins in the right direction. The main task of the trader is to wait for confirmation.

Where to put stop loss according to the strategy? Orders limiting losses in the event of an incorrect forecast on the Forex market are placed behind local minimums or maximums. If you give an order to complete a transaction after the end of wave “C”, you need to set a stop loss, then it must be placed lower (in the case of a bullish pattern) or higher (in the case of a bearish pattern) of the “C” point by several points. Their number will depend on the timeframe on which the graphic formation flag appeared. If this is a 4-hour chart, then 15-20 points on a four-digit basis will be sufficient, which corresponds to 150-200 points on a five-digit basis. On the hourly chart, stop loss can be set at 5-10 points from the extremum.

If, in the calculation of take profit and stop loss, it is based on the Fibonacci lines, then the order limiting losses can be placed below the Fibonacci line (in the case of the bull flag), to which the rollback has reached. That is, if the rollback has reached the level of 50%, then stop loss can be hidden behind the level of 61.8%. If the price has reached 61.8%, then the stop order must be set below 78.6%. However, if the rollback reached 78.6%, then most likely the figure of the flag will not be worked out.

Conclusion

Learning to trade is not an easy process. Many failed traders have come to the conclusion that Forex is a hoax or that technical analysis is not working. Indeed, many of the techniques used in the last century work with a small degree of probability. But this does not apply to the technical analysis flag figure. In most cases, it can serve as a reliable method of forecasting prices.