The material base, technical equipment of any enterprise depends on the structure of fixed assets. They are an integral part of the production process, are used in the implementation of all types of economic activity: the provision of services, performance of work. Using OPF with maximum efficiency is possible with proper planning of their operation and timely modernization. For a comprehensive analysis of this asset, it is necessary to correctly reflect in all types of accounting for transactions with property of the enterprise.

Non-current assets

The first section of the main reporting document (balance sheet) contains information on the availability of intangible and fixed assets at the enterprise. This type of asset is the least liquid and expensive, therefore, its analysis is important for investment processes and investments. Fixed assets are characterized by a long service life, its minimum value is 12 months. During the production process, the assets do not change their initial physical form, the cost is transferred to the finished product in parts in the form of depreciation amounts. Fixed assets of the company have several types of sources of income.

- Purchase.

- Capital construction.

- Receiving at no cost.

- Receipt from the founder (owner) as a contribution to the authorized (share) capital.

- Transfer from parent organization to subsidiaries.

- Modernization of an existing facility.

- Acquisition under an exchange agreement.

In the production process, each object loses part of its physical and operational properties, and equipment becomes obsolete over time. Timely updating of non-current assets is carried out at the expense of own, borrowed, depreciation funds of the enterprise. Individual units, obsolete or worn out, the organization can eliminate or start a process such as the sale of fixed assets. Postings and precisely filled accounting registers in this case are of great importance. They affect the formation of the active part of the balance sheet and the taxation of the enterprise.

Structure

The composition of fixed assets depends on the type of fixed or additional activities of the organization. The structure of non-current assets should be optimal for production needs. With the diversion of part of the capital of the enterprise to non-functioning fixed assets, financial instability is possible due to lack of money supply. For accounting purposes, the following classification of production assets is used.

- Facilities (including transport lines).

- Buildings (domestic, industrial and administrative purposes).

- Machines and equipment (machine tools, production lines, etc.).

- Transport (cars for various purposes).

- Transmission devices (communications, power lines).

- Computing equipment and office equipment.

- Tools, household equipment (industrial and non-industrial purposes).

- Perennial plantings.

- Animals (livestock).

- Other facilities that meet the requirements of the law and the Tax Code.

There are several methods for assessing the value of fixed assets for which they are recognized in accordance with the transaction. Each type is determined by calculation and is reflected in accounting registers. The initial value appears in the balance sheet, which is calculated as the sum of the costs of the purchase, installation, delivery of the asset. It changes in the process of participation of non-current assets in production and in connection with the reduction of the operating life. This value is called the residual value, it is calculated as the difference between the value of the initial price (at which it is accounted for) and the amount of accrued depreciation. It is used in the process of write-off (liquidation), without it sale of fixed assets is impossible. Postings in this case are made with the participation of an additional analytical account. The replacement cost appears in registers when revaluing or upgrading an asset.

Accounting

PBU 6/01 regulates the control, movement, assessment and documentation of the asset "Fixed Assets". Account 01 is intended for grouping information on the status of non-current assets. It is balanced, synthetic, active. If necessary, and in accordance with the provisions of the adopted accounting policy of the company and on the basis of the tax legislation of the Russian Federation, analytical registers are opened for it, designed to detail the data. The account has an opening balance and a final debit balance, it is reflected in the balance sheet of the enterprise as a cost estimate for the availability of fixed assets. The receipt, appreciation of the asset is recorded in the debit, the credit of the account shows the disposal.

The movement of major non-current assets is reflected in account 01 in the presence of an approved unified form of the relevant document. This register always has a balance, the exception is the liquidation of the company, as a result of which all assets are sold or written off.

Documents

Fixed production assets purchased from a supplier for a fee or under an exchange agreement are credited to the account 08 on the basis of the supplier's invoice and TTN. In addition, all costs associated with the completion of the facility (assembly, installation, completion, preparation for work) are summed up by debit specified invoice. When registering, the full cost is transferred from loan 08 to account 01. This fact is documented by drawing up an act in the form OS / 1 and an inventory card of the OS / 6 object is drawn up. In the future, all operations associated with this unit of non-current assets will be reflected in this register, on the basis of which analytical records are kept. Inventory cards, in turn, are recorded in the inventory, OS / 10 form. When a unit of OS is transferred to workshops for repair or modernization, OS / 3 is applied, execution of an asset liquidation act - OS / 4, dismantling of a unit of equipment or its commissioning is executed in OS / 5 form. The distribution of assets in the shops of the enterprise with the obligatory indication of those responsible for operation is recorded in the OS / 13 inventory.

OS Posting Posting Table

No. | Debit | Credit | Business transaction (content) |

1 | 08 | 60 | Received OS from suppliers. |

2 | 08 | 76, 23, 60 | The amount of costs for the installation of the equipment received by the contracting organization, supplier, auxiliary workshops. |

3 | 01 | 08 | Capitalized OS at initial cost. |

4 | 60, 76 | 51, 55, 52 | The amount of debt to OS suppliers is listed. |

5 | 19 | 60, 76 | VAT paid. |

6 | 91/2 | 76, 60 | Negative differences (exchange rate) when buying OS for currency. |

Depreciation

In the process of production, operation, non-current assets wear out, lose some of their operational properties or become obsolete. Depreciation (amounts) is the estimated part of the value of the fixed asset, which is included in the cost of finished goods monthly. Depending on the type of asset, the enterprise independently determines the period of its operation (effective) and the method of calculating the amount of depreciation. The calculation process starts from the month following the date of registration (posting). The depreciation of fixed assets can be calculated according to the algorithm of the presented methods.

- Linear.

- Productive.

- Sum of years.

- Reduced balance.

- Non-linear.

Depreciation deductions cease from the first day of the next month after the date of its liquidation, write-off, or when starting a process such as the sale of fixed assets. Postings, documents, financial result for these cases will be different, but the procedure for calculating the residual value is the same. To account for depreciation deductions, account 02 is intended. Passive, synthetic, is not reflected in the balance sheet, the values of accrued depreciation are accumulated on credit, and their deduction on debit. The balance (balance) at the beginning and end of the period is reflected on the right side of the account (credit). The use of fixed assets takes a long time. This is one of their features. Depreciation of fixed assets is carried out on a monthly basis, while it is reflected in the corresponding calculation account, depending on the direction of use of the object.

Depreciation Postings

No. | Debit | Credit | Operation |

1 | 20 | 02 | Depreciation on assets used in the main production is accrued. |

2 | 23 | 02 | Ancillary equipment. |

3 | 25 | 02 | Depreciation of fixed assets in the structure of ODA, OXR. |

4 | 29th | 02 | Depreciation of operating systems used in service industries. |

5 | 91/2 | 02 | Depreciation of leased operating systems. |

6 | 02 | 01 | Charged to depreciation. |

Analytical (detailed) accounting is carried out for each unit of fixed assets separately.

Implementation

Non-current assets upon purchase are of high value, i.e. require large investments. The structure of production activities may vary in accordance with market conditions. This causes a simple equipment, a change in the main (registered) type of activity, the most difficult in this case, the company to compensate for its capital investment. Also, the main assets can be realized during the modernization of production or exchanged for another object of non-current funds. All actions with depreciable property are carried out on the basis of the order (order) of the head of the organization. The unit is inventoried, its residual value is calculated (the initial value is the amount of depreciation calculated for the entire period of operation), a special analytical account is opened, after which the fixed assets are sold.

Postings

No. | Debit | Credit | Bang. operation |

1 | 76, 62 | 91/1 | Invoice issued to buyer. |

2 | 01/09 (p) | 01 | Reflected on the disposal account the initial value of the property, plant and equipment. |

3 | 02 | 01/09 (c) | Charged to the amount of accrued depreciation. |

4 | 91/2 | 09/09 | Reflected the amount of residual value. |

5 | 91/2 | 23, 29, 60, 70, 10 | Reflected the costs of the implementation of the facility (dismantling, transportation, repair by forces of a third organization or its own auxiliary units) |

6 | 91/2 | 68 | Exposed VAT on the property being sold. |

7 | 50, 51, 55, 52 | 62 | Credited payment from the buyer of the asset. |

Each organization is guided by the provisions of its own accounting policy to open an analytical register for the sale of the asset "Fixed Assets". Account 01 serves to summarize information on all accounting objects. Its total value in the balance sheet is not decrypted, therefore, in the process of disposal (implementation), the subaccount may have the number 01/03 or 01/09. A prerequisite for taxation is the completion of all relevant documents: an act on the transfer and acceptance of an asset (OS / 01), appropriate changes are made to the inventory card (OS / 06). Documents signed by the head are transferred to the accounting department of the enterprise, on the basis of which there is a sale of fixed assets. Accounting entries are generated and reflected in the respective ledgers. The selling price of the non-current asset is fixed in the contract. The result of the sale may be a profit or loss, which is reflected in the account 91/2 in correspondence with 99.

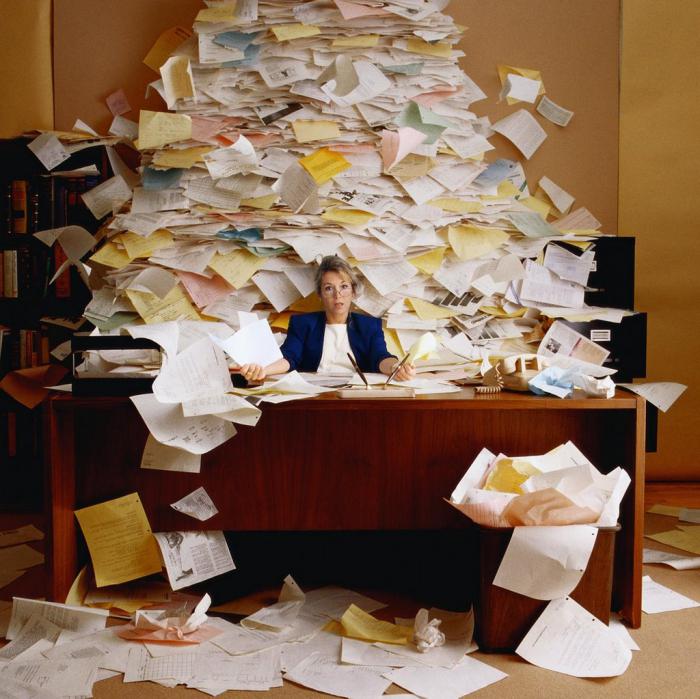

Automation

Modern programs for maintaining all types of accounting, including accounting, greatly simplify the process of filling in all registers. Automation allows not only to avoid many errors, but also to generate the necessary document in a short time. At the same time, data required to fill in the relevant details are entered into the program. A large amount of paper work is reduced, the depreciation process occurs automatically according to the specified parameters. Fixed assets of the organization are considered the most voluminous asset in terms of accounting, so the use of modern optimization methods is necessary.